GM and Happy Hump Day! 🐫

We’re halfway through the week, and the crypto headlines are on fire! Fitell Corp just secured a $100M credit facility to build Australia’s first Solana-based digital asset treasury, while DeFi Development Corp raised its stock buyback cap to the same $100M mark. Uniswap is nearing $1 trillion in annual volume, but frustration is brewing among UNI holders. On the regulatory front, CFTC’s Caroline Pham is eyeing stablecoins as collateral in U.S. derivatives markets—a potential first. Meanwhile, Swarm is tokenizing top equities like Apple and Tesla for 24/7 on-chain, trading against stablecoins. And Coinbase is expanding stablecoin support with AUDD and XSGD listings. Not to be outdone, BNB Chain is looking to slash gas fees and speed up block times to compete with Solana and Base.

Scroll down for more news and details!👇

Latest News

Fitell Launches Australia’s First Solana Treasury with $100M Financing Line

Nasdaq-listed Fitell Corporation has secured a $100 million convertible credit facility to accumulate Solana (SOL) as part of a broader strategy to become Australia's first Solana-based digital asset treasury, with plans to rebrand as Solana Australia Corporation. The firm aims to deploy the capital into structured products and on-chain liquidity to generate yield beyond staking, positioning itself at the forefront of the digital treasury movement akin to emerging crypto ETFs. Read more →

Raiku Raises $13.5M to Bring Predictable Execution to Solana Blockchain

Raiku has secured $13.5 million in funding led by Pantera Capital and Jump Crypto to build infrastructure that ensures “guaranteed” Solana transactions, targeting one of the network’s core pain points: congestion-induced unreliability. Its architecture includes a parallel execution layer and validator-aligned blockspace reservations, aiming to support high-speed, institutional-grade use cases like market making, data oracles, and liquidity provisioning. Read more →

Trump Administration Vetting Josh Sterling for CFTC Chair Role

The White House is considering Josh Sterling, a former director of the CFTC’s Market Participants Division, as a leading contender for CFTC Chair following the stalled nomination of Brian Quintenz. Bloomberg reports that Mike Selig and Tyler Williams are also under review as potential nominees.

UNI Holders Criticize Absence of Revenue Share as Uniswap Volume Surges

Uniswap is approaching $1 trillion in annual trading volume, but UNI token holders are upset that the gains aren’t being shared—there are no payouts, buybacks, or clear economic benefits tied to token ownership. Critics argue that while liquidity providers, fees, and third parties benefit, UNI remains largely a governance token, with revenue‐sharing ideas stalled due to regulatory risk concerns. Read more →

FTX Trust Sues Genesis Digital Assets for $1.15B Claim Over Fraudulent Transfers

The FTX Recovery Trust has filed a lawsuit against Genesis Digital, its founders, and affiliates alleging that over $1.15 billion was fraudulently transferred from FTX to Genesis while FTX was insolvent. The suit claims that funds from FTX customer deposits were improperly routed via Alameda Research, inflated valuation deals, and other red flags including lack of audited records and unfavorable terms, as part of a broader effort to recover losses from FTX’s collapse. Read more →

Swarm to List Tokenized Stocks on Plasma Mainnet, Offering 24/7 Access

Swarm is launching nine tokenized equities—like Apple, Microsoft, Tesla, Nvidia, and Coinbase—on the Plasma blockchain, allowing users to trade shares on‐chain using stablecoins around the clock. These tokenized stocks are issued under EU regulatory frameworks (Prospectus Regulation), giving holders legal rights to the underlying securities, and are part of a wider expansion in tokenized real‑world assets (RWAs), which have roughly doubled in value this year. Read more →

NYSE Arca Moves Grayscale Ethereum ETFs to Generic Listing Standard

NYSE Arca has filed a proposed rule change to shift the Grayscale Ethereum Trust ETF and the Grayscale Ethereum Mini Trust ETF from “non‑generic” listing status to listing under the generic listing standards of Rule 8.201‑E. This change means the ETFs could trade without needing separate Commission approval orders each time, streamlining listing procedures and aligning them with other commodity‑based trust shares. Read more →

ShapeShift Agrees to Pay $750,000 for Sanctions Violations

The now‑defunct crypto exchange ShapeShift will pay a $750,000 settlement to the U.S. Treasury for allowing users in sanctioned jurisdictions like Cuba, Iran, Sudan, and Syria to execute transactions, without proper sanctions compliance. Officials said the exchange had processed over $12.5 million in crypto flows from those jurisdictions between late 2016 and 2018 and lacked screening systems until after receiving a subpoena. Read more →

CZ Denies Plans for YZi Labs to Raise External Capital Amid Mixed Messaging

Binance co-founder Changpeng “CZ” Zhao publicly denied claims that YZi Labs, formerly Binance Labs, is preparing to raise outside capital, directly contradicting recent comments attributed to co-founder Ella Zhang suggesting a $10 billion fund might be opened to external investors. Zhao emphasized that YZi operates independently, has not solicited outside funding since rebranding, and criticized traditional media for misrepresenting the firm’s intentions and his legal history.

Pro-Bitcoin Democrat Ian Calderon Enters California Governor’s Race

Former state lawmaker Ian Calderon has launched his campaign for California governor, positioning himself as a forward-thinking, crypto-friendly Democrat. Highlighting generational shifts, Calderon emphasized Bitcoin as a savings tool and criticized legacy policymakers for applying outdated solutions to modern challenges.

Ever‑Rising Base Activity Fueled by User Airdrop Speculation

Base, Coinbase’s Ethereum Layer‑2 chain, has just passed 90 million weekly transactions for the first time ever, driven largely by speculation about an upcoming native token airdrop and greater engagement from existing users rather than new ones. At the same time, total value locked (TVL) on Base hit about $5.1 billion in early September, though active address counts are falling — suggesting current users are doing more, but fewer people are joining. Read more →

Base TVL and Transactions

Source DeFiLlama

$1.25B Bitcoin Futures Liquidation Seen as Market Reset, Not Meltdown

Roughly $1.25 billion in Bitcoin futures positions were liquidated, triggering a drop in open interest but signaling a reset rather than a bearish reversal, according to analysts. With key support near $112,000 holding, traders are cautiously optimistic for upside if macro conditions remain favorable. Read more →

Fartcoin Sinks 28% in a Week as Prediction Markets Turn Bearish

Fartcoin plunged 28% over the past week, with Myriad prediction markets giving it less than a 20% chance of reaching a new all-time high by the end of 2025. The downturn underscores declining user confidence and fading meme token momentum in a cooling speculative market. Read more →

Source: CoinGecko

CFTC Proposes Allowing Stablecoins as Collateral in U.S. Derivatives Markets

Acting CFTC Chair Caroline D. Pham has launched an initiative to permit stablecoins as tokenized collateral in U.S. derivatives markets—marking a potential regulatory first. Originating from the February 2025 Crypto CEO Forum, the proposal is now open for public comment on issues such as valuation, custody, and settlement, with feedback due by October 20.

Samsung Joins Forces with DeSci Protocol to Bring AI to Healthcare Devices

Samsung has partnered with decentralized science (DeSci) protocol Galeon to integrate AI into its ultrasound devices, linking them with Galeon’s electronic health record (EHR) platform. The approach keeps raw patient data off‑chain and anonymized while putting algorithm operations on-chain to preserve traceability and privacy. Read more →

Tether Seeks $15–$20B Raise to Achieve $500 Billion Valuation

Tether is reportedly in early discussions to raise $15–$20 billion via private placement, potentially valuing the stablecoin issuer at around $500 billion. Cantor Fitzgerald is advising the deal, which would represent about a 3% stake if fully subscribed. Read more →

USDe Deposits on Binance Soar as Ethena TVL Tops $16B

Deposits of Ethena’s stablecoin USDe on Binance have surged past $734 million following a 12% APR offer, helping drive Ethena’s total value locked (TVL) above $16 billion. Meanwhile, the ENA token’s price lags behind the rapid liquidity inflows. Read more →

Source: CoinGecko

FINRA Grants tZero Approval to Trade Tokenized Corporate Debt

FINRA has approved tZero, a tokenization firm, to list and trade tokenized corporate debt securities. The decision marks a regulatory milestone by bridging traditional fixed income markets and blockchain-based securities. Read more →

OranjeBTC to List on Brazil’s B3, Aiming to Be Top Public Bitcoin Treasury

OranjeBTC is preparing for a listing on Brazil’s B3 exchange, positioning itself to become the country’s largest publicly traded Bitcoin treasury company. The move aims to attract both institutional and retail investors in Brazil’s growing crypto market. Read more →

Robot Swarms Offer Novel Take on Blockchain Oracle Problem

A new preprint study proposes Swarm Oracle, a network of autonomous robots that can collectively sense environmental data and reach consensus using Byzantine fault‑tolerant protocols—with self‑healing via reputation scoring—to act as decentralized oracles for blockchains. The approach avoids relying on centralized data providers and could be useful for real‑world use cases like disaster insurance, environmental monitoring, or DePIN systems, though practical deployment challenges (scaling, communication, adversarial mimicry) remain. Read more →

BNB Chain Validators Propose Gas Fee Cut and Faster Blocks to Boost Trading Activity

In a bid to stay competitive with fast, low-cost chains like Solana and Base, BNB Chain validators have proposed halving gas fees to 0.05 Gwei and shortening block times to 450ms. The move aims to sustain BNB Smart Chain’s dominance in trading activity—where gas costs matter most—while ensuring staking yields remain attractive and infrastructure remains under capacity.

Bitcoin and Ethereum ETFs See $245M in Combined Outflows in Single Day

On September 23, U.S. spot Bitcoin ETFs recorded $104 million in net outflows, led by Fidelity’s FBTC, which alone lost $75.55 million. U.S. spot Ethereum ETFs fared worse, seeing $141 million in total outflows, with none of the nine funds reporting any inflows.

OpenAI, Oracle & SoftBank Expand “Stargate” with Five New U.S. AI Data Center Sites

OpenAI, in partnership with Oracle and SoftBank, announced five new sites for its Stargate AI infrastructure project across the U.S., expanding its total footprint to approximately 7 gigawatts. The initiative, expected to cost over $400 billion, aims to meet surging global demand for advanced AI compute. Read more →

Cloudflare & Coinbase Launch x402 Foundation to Standardize Internet Payments

Cloudflare and Coinbase have unveiled the x402 Foundation to develop a new internet-native payment protocol that enables seamless machine-to-machine transactions. The goal is to create a standardized, geography-agnostic system for autonomous payments across online services. Read more →

Kraken Donates $2M to Pro‑Trump PAC, Citing Crypto & Privacy Causes

Kraken co-CEO Arjun Sethi announced $2 million in donations to pro-Trump crypto advocacy groups—$1 million to the Freedom Fund PAC and another to America First Digital—positioning the exchange as a defender of “financial freedom” and constitutional rights in the digital age. The move marks a shift from passive lobbying to ideological alignment, as Kraken joins industry peers like the Winklevoss twins in backing Republican efforts to protect self-custody, privacy tools, and decentralized infrastructure.

ReserveOne Files to List on Nasdaq, Proposes SEC Merger Plan

Tokenization firm ReserveOne has filed with the SEC to pursue a Nasdaq listing and is planning a corporate merger to facilitate public market entry. The move positions ReserveOne to expand its on-chain finance offerings under increased institutional visibility. Read more →

Upbit Lists FLUID for Trading Across KRW, BTC, and USDT Pairs

Upbit has added support for FLUID trading in KRW, BTC, and USDT markets, with trading launched on September 24 and Ethereum as the supported network for deposits and withdrawals. FLUID, a DeFi lending and trading protocol aimed at maximizing capital efficiency through unified liquidity layers, is now tradable with initial restrictions on order types and price limits during launch. Read more →

Binance Lists Plasma (XPL), Launches Retroactive Airdrop for BNB Holders

Binance has announced Plasma (XPL) as the 44th HODLer Airdrops project, offering retroactive token rewards to users who subscribed BNB to Simple Earn or On-Chain Yields between Sept. 10–13. XPL, a Layer 1 blockchain focused on low-cost stablecoin payments, will begin spot trading on Binance on Sept. 25 with 18% of its genesis supply in circulation. Read more →

SharpLink CEO Says On‑Chain Settlement Is Key to Transforming Global Finance

SharpLink CEO Joseph Chalom told attendees at Korea Blockchain Week that moving the $700 trillion traditional finance market on-chain represents the “greatest risk reduction” in financial history. He emphasized that success for digital asset treasuries will come from active participation in DeFi protocols and infrastructure—not just crypto accumulation. Read more →

Uniswap Labs Launches Compact v1 to Tackle Fragmented Cross‑Chain Liquidity

Uniswap Labs introduced Compact v1, an ERC-6909–based system designed to streamline token interactions across chains and enable composable, cross-chain liquidity. The initiative is part of Uniswap’s effort to reduce inefficiencies in decentralized exchange infrastructure. Read more →

Bitmine’s Tom Lee Calls Ethereum a “Truly Neutral” Institutional Asset

Tom Lee of Bitmine reaffirmed his support for Ethereum, describing it as a neutral, credible asset for institutions seeking programmable infrastructure and on-chain treasury tools. The firm continues accumulating ETH alongside Bitcoin in its long-term holdings. Read more →

Chart from The Block Data

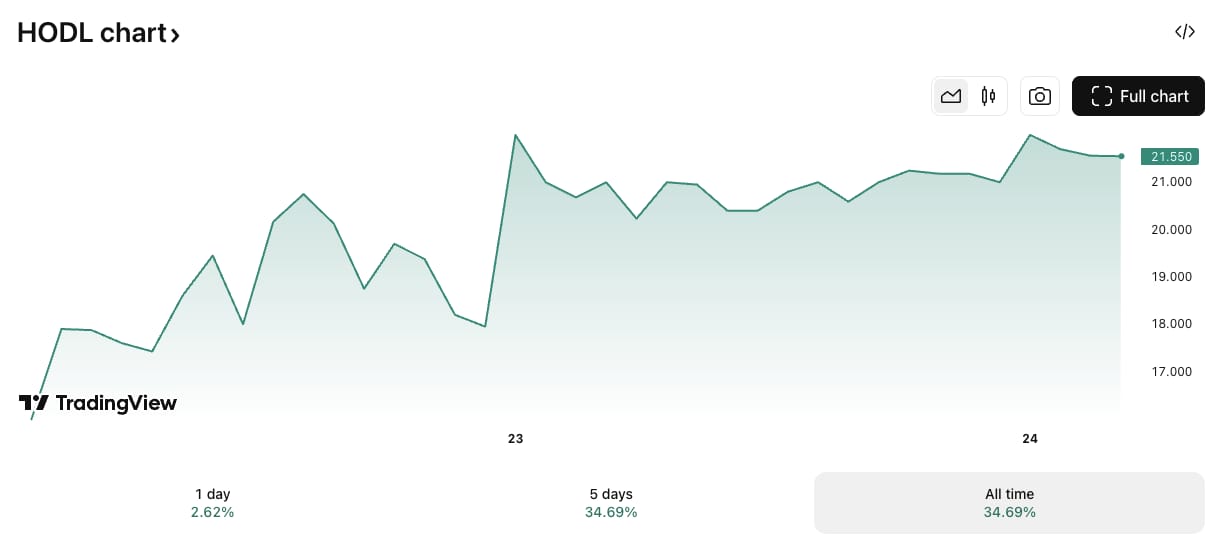

B HODL Adds 100 BTC to Treasury in Bitcoin Accumulation Strategy

UK-listed B HODL Plc has purchased 100 BTC for $11.3 million at an average price of $113,227 per coin, officially kicking off its long-term bitcoin treasury and Lightning Network strategy. Recently listed on London’s Aquis Exchange, the firm is backed by CoinCorner and Blockstream’s Adam Back, and aims to generate revenue through scalable Lightning node operations. Read more →

HODL/GBP Price Chart

Source: TradingView

Hyperliquid Launches USDH Stablecoin Following Native Markets’ Winning Bid

Hyperliquid has launched USDH, a natively issued dollar-pegged stablecoin, after Native Markets won a validator-led selection process over contenders like Paxos and Frax. Backed by cash and U.S. Treasuries, USDH debuted with a USDH/USDC pair and is designed to reinforce Hyperliquid’s control over liquidity, fees, and long-term exchange dynamics. Read more →

North Korean Hackers Steal $1.2M from Seedify Bridge in Latest Exploit

Hackers tied to North Korea exploited the Seedify bridge, draining approximately $1.2 million in crypto assets through a vulnerability in the bridge’s contract. Seedify is currently investigating the breach and coordinating recovery efforts with affected users and security firms. Read more →

Trust Wallet Integrates Aster to Offer Perps Trading With Up to 100x Leverage

Trust Wallet has partnered with decentralized exchange Aster to enable perpetuals trading directly within the wallet interface. The integration supports up to 100x leverage, expanding Trust Wallet’s trading capabilities beyond spot markets.

Franklin Templeton Expands Benji Tokenization Platform to BNB Chain

Franklin Templeton has extended its Benji technology stack to BNB Chain to broaden access to tokenized investment products for both institutions and retail investors, leveraging BNB’s low-cost and high-throughput infrastructure. This move is part of a trend where major asset managers bring traditional products on‑chain while maintaining compliance and security. Read more →

Solana DAT DeFi Development Boosts Share Buyback to $100M

DeFi Development Corp, a Solana‑focused digital asset treasury company, has raised its stock repurchase authorization from $1 million to $100 million, signaling strong confidence in its business model. The expanded buyback aligns with its strategy of compounding SOL accumulation and rewarding shareholders. Read more →

Flare Launches FXRP to Enable XRP in DeFi Ecosystem

Flare Network has introduced FXRP, a wrapped version of XRP that allows XRP holders to deploy their assets in DeFi use cases like lending, staking, and borrowing. This step aims to unlock XRP’s utility beyond payments and integrate it deeper into smart contract ecosystems. Read more →

CZ Outlines Vision for RWA, DeSci & On‑Chain Assets at BNB Anniversary Q&A

At BNB Chain’s fifth anniversary event, Binance founder CZ shared deep views on the future of real-world asset tokenization, institutional finance, and decentralized science (DeSci), emphasizing regulatory fit and product-market alignment. He argued that while tokenizing institutions and assets is compelling, success hinges on compliance clarity, on-chain liquidity, and patient capital rather than hype or early first-mover advantage. Read more →

Coinbase to Launch AUDD and XSGD Stablecoins on Platform

Coinbase will list the Australian dollar‑backed stablecoin AUDD and Singapore dollar‑backed XSGD starting on September 29, enabling users to convert AUD and SGD 1:1 into crypto assets and expanding its fiat‑stablecoin ramp offerings. The listings are part of Coinbase’s strategy to localize crypto access and cater to Southeast Asian on‑ramp demand. Read more →

Amplify ETFs Files for Solana and XRP Monthly Option Income ETFs

Amplify ETFs has filed for two new funds: the Amplify Solana and Amplify XRP Monthly Option Income ETFs, both designed to offer investors exposure to SOL and XRP price returns while generating income via covered call strategies. The move follows strong interest in Amplify's Bitcoin and Ethereum option income ETFs and reflects growing demand for crypto‑themed income products. Read more →

Kalshi Surpasses Polymarket in Sports Betting Volume

Kalshi has surpassed Polymarket in trading volume, with U.S. sports betting—especially NFL and college football—making up over 70% of activity. Its regulated status and Robinhood partnership give it an edge, though Polymarket may regain ground with upcoming compliance measures. Read more →

GSR Files ETF to Aggregate Digital Asset Treasury Firms

GSR has proposed a new ETF targeting companies that hold crypto on their balance sheets, aiming to institutionalize the digital asset treasury (DAT) strategy. The fund would bundle equities of such companies and could attract investors seeking diversified exposure to this increasingly popular model. Read more →

Coinbase Leads $14.6M Round into Bastion’s Enterprise Stablecoin Platform

Coinbase Ventures led a $14.6 million financing round for Bastion, a startup building compliant, white‑label stablecoin infrastructure and issuance tools for institutions. The funding round also included participation from Sony, Samsung, Andreessen Horowitz, and Hashed. Read more →

Trump Aides’ Involvement in UAE Chips & Crypto Deals Draws Ethics Scrutiny

Senators Elizabeth Warren and Elissa Slotkin have called for investigations into two Trump-era deals involving UAE royalty—one to import AI chips and another to fund a crypto firm tied to Trump advisers—questioning whether government officials violated ethics rules. The moves center on Steve Witkoff’s simultaneous roles in advocating chips access and holding a financial interest in the crypto company benefiting, and the questionable involvement of David Sacks in related negotiations. Read more →

PWEASE Meme Coin Rockets After VP Vance Posts Meme

A Solana-based meme token PWEASE jumped about 65% in one hour after U.S. Vice President JD Vance shared a meme referencing the token on social media. The surge was short‑lived: it later retraced some gains and now trades with a market cap in the low millions. Read more →

Myriad Launches Revenue Share Program for Predictors & Builders

Prediction market protocol Myriad has introduced a revenue-sharing program that rewards both predictors who bring volume and builders who contribute infrastructure. Users will receive a portion of protocol fees (1% for volume via affiliate links) as incentives. Read more →

Chinese EV Firm’s Stock Surges, Then Slumps After $1B Crypto Plan

EV charging firm Jiuzi Holdings saw its stock spike 47% after announcing plans to invest up to $1 billion in Bitcoin, Ethereum, and BNB—but the rally quickly reversed, with shares closing down nearly 10%. Despite the bold move, the company holds under $1 million in cash and has yet to detail how it will fund the crypto purchases. Read more →

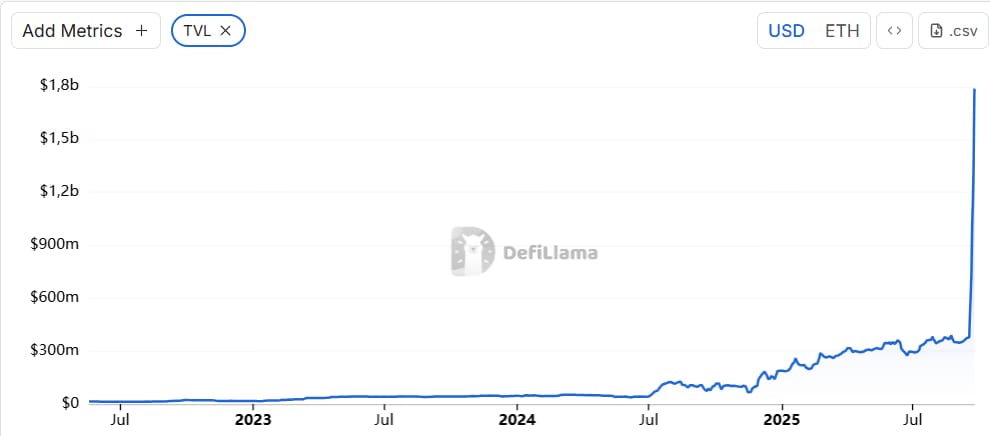

Aster Token Hits New Highs as DEX Emerges with Layer‑1 Ambitions

ASTER reached an all-time high on the back of explosive trading on Aster DEX—reportedly processing over $23.1B in daily trades, doubling Hyperliquid’s volume. The platform also recently boosted its TVL over 5x in a week and is laying plans to evolve into a full-fledged Layer‑1 environment. Read more →

Aster TVL

Source DeFiLlama

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed