Gm! Happy Saturday!

Regulators around the globe are still hard at work in the kitchen. Most of the proposed regulations appear favorable to the crypto industry. We’ll continue to let ‘em cook! Meanwhile, Michael Saylor’s Strategy didn’t make the S&P 500 index rebalancing cut, U.S. job growth didn’t meet expectations, Tesla proposes $1T compensation package for Elon Musk, Trump-linked crypto business-making moves continue, and a lot more happening in the crypto, blockchain, and AI space.

Check out what else is going on down below!

Latest News

Elliptic Launches New Tool to Track Stablecoin Crime

Blockchain analytics firm Elliptic has introduced a tool designed to monitor illicit activity in stablecoins, as tokens like USDT and USDC increasingly enter mainstream finance. The system will provide regulators and institutions with enhanced visibility into risks such as money laundering and fraud. Read more →

Bullish Secures MiCA License in Germany

Crypto exchange Bullish’s European arm has obtained a MiCA license from German regulators, giving it the green light to operate under the EU’s new crypto framework. The license positions Bullish to expand services across the bloc as regulatory clarity takes shape. Read more →

U.S. Job Growth Slumps as Unemployment Hits Four-Year High

The U.S. economy added just 22,000 non-farm jobs in August, far below expectations of 76,500 and marking one of the weakest gains since late 2021. The unemployment rate climbed to 4.3%, its highest level in nearly four years. Read more →

Monero Attackers’ Qubic AI Model Fails Basic Math

The group behind a 51% attack on Monero released an AI model under the Qubic brand, but users quickly found it unable to handle even simple arithmetic. Despite grand claims, the release has been met with skepticism about its utility and the attackers’ broader motives.

Read more →

Bybit Launches B2B Unit for Institutional Adoption

Exchange Bybit has established a new business-to-business division aimed at driving institutional adoption of digital assets. The initiative will focus on building infrastructure, liquidity solutions, and enterprise-grade services for corporate clients. Read more →

Wildcat Labs Raises $3.5M in Seed Round

Decentralized finance startup Wildcat Labs secured $3.5 million in funding led by Robot Ventures. The firm aims to expand its development of permissionless credit infrastructure for DeFi markets. Read more →

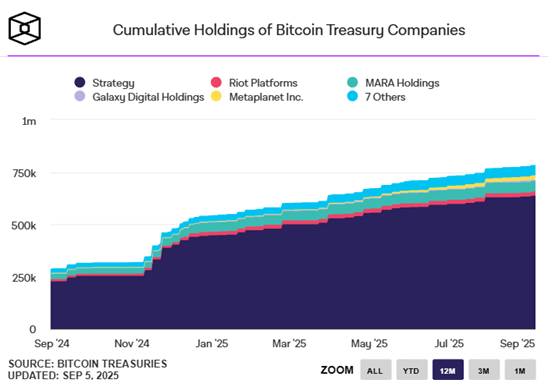

MARA Bitcoin Holdings Grow to 52,477 BTC

African crypto firm MARA disclosed that it now holds 52,477 BTC, strengthening its position as a significant Bitcoin treasury player. The company has been steadily building reserves as part of its long-term strategy. Read more →

Chart from The Block Data

SEC and CFTC Push for Regulatory Harmony

The SEC and CFTC issued a joint statement pledging closer cooperation on crypto oversight and other market regulations. Both agencies will co-host a roundtable on September 29 to advance harmonization efforts. Read more →

Inside Tesla’s $1 Trillion Pay Plan for Elon Musk

Tesla is considering a record-setting $1 trillion compensation package for CEO Elon Musk, contingent on milestones including massive vehicle deliveries and market cap growth. The plan underscores Musk’s outsized role in the company’s future but faces scrutiny from investors. Read more →

UK Crypto Investor Claims Banks Froze His Accounts

James Wynn, a British crypto investor, alleges that his UK bank accounts were frozen without explanation, leaving him unable to access funds. The case highlights rising tensions between traditional banking institutions and crypto users. Read more →

Trump Media Buys $105M in Cronos Tokens

Trump Media & Technology Group closed a $105 million purchase of Cronos tokens in a deal with Crypto.com. The acquisition adds a large crypto position to the company’s balance sheet as it seeks to expand in digital finance. Read more →

CFTC and SEC Call for Bold Market Reforms Inspired by Crypto

In a policy statement, CFTC Commissioner Caroline Pham highlighted how innovations from crypto and decentralized finance could guide U.S. market modernization. She pointed to proposals for 24/7 markets, event contracts, perpetual contracts, and portfolio margining, while also suggesting the use of innovation exemptions to responsibly test new financial products under regulatory oversight. Read more →

Covalent Reports August Growth Across Speed and Scale

Covalent’s August recap highlighted continued progress on its CXT-powered onchain data network, citing improvements in transaction speed, scale, and ecosystem adoption. The update also detailed how its “onchain flywheel” is positioning Covalent as a key infrastructure player. Read more →

CBDC Debate Rekindled as U.S. Congress Returns

Lawmakers are revisiting the contentious issue of a U.S. central bank digital currency (CBDC), with strong divides between supporters who see benefits for payments and critics who fear surveillance and state overreach. The debate comes as other major economies advance their CBDC pilots. Read more →

SharpLink Considers Staking Part of $3.6B Ethereum Treasury on Linea

Sports betting technology firm SharpLink is exploring staking a portion of its $3.6 billion Ethereum holdings on Linea to generate yield. CEO Matt Feinberg noted the strategy could boost returns while strengthening the company’s blockchain engagement. Read more →

Justin Sun Pledges to Buy $20M in Trump-Linked Assets After WLFI Ban

After World Liberty Financial blocked his wallet, Tron founder Justin Sun declared he would purchase $20M in Trump-affiliated assets regardless, framing the move as both a personal commitment and a political stance. The dispute underscores the tensions between Sun and regulated platforms. Read more →

SWIFT Exec Says Banks Will Integrate Best Public Blockchain Innovations

A senior SWIFT executive argued that traditional banks will adopt and internalize the strongest features of public chains, from tokenization to settlement efficiencies. He suggested that while crypto-native platforms may fade, their innovations will live on in mainstream finance.

Read more →

Trump-Linked Firm Enters Top 25 Bitcoin Treasuries

American Bitcoin Corp, reportedly tied to the Trump family, has joined the top 25 corporate Bitcoin treasuries, surpassing The Smarter Web Company in holdings. The move highlights growing institutional and politically connected interest in Bitcoin, raising questions about how mainstream finance and politics may further intertwine with crypto adoption. Read more →

Gold Prices Hit Record High After Weak U.S. Jobs Report

Spot gold surged to new record highs above $3,577.33 per ounce and U.S. Gold Futures for December reached $3,637 following disappointing U.S. job data that showed slowing employment growth and rising unemployment. Investors turned to the metal as a safe haven amid growing economic uncertainty. Read more →

Kyle Samani Expected to Lead Solana’s Treasury Committee

Multicoin Capital co-founder Kyle Samani is expected to become chairman of Solana’s treasury, overseeing strategy for the ecosystem’s capital reserves. His leadership could influence Solana’s long-term positioning in DeFi and institutional adoption.

Read more →

Hyperliquid Eyes USDH Stablecoin in Next Network Upgrade

Decentralized exchange Hyperliquid is preparing to introduce USDH, a native stablecoin, as part of its upcoming network upgrade. The project aims to strengthen liquidity and improve user experience on its Layer 1 blockchain, though details of the rollout are still under discussion. Read more →

Sora Ventures Plans $1B Bitcoin Fund for Asia

A Taiwan-based venture capital firm Sora Ventures is setting up a $1 billion Bitcoin fund to promote corporate treasury adoption of BTC across Asia. The fund reflects growing regional interest in Bitcoin as a reserve asset following similar moves in Japan.

Read more →

U.S. Treasury Secretary Calls for Major Fed Overhaul

Treasury Secretary Scott Bessent has urged sweeping changes to the Federal Reserve, citing a need for greater transparency and accountability in monetary policy. His comments mark one of the boldest calls for reform of the Fed in recent years. Read more →

Sol Strategies Wins Nasdaq Listing Approval

Digital asset investment firm Sol Strategies announced that it has received approval to list on the Nasdaq Global Select Market. The move positions the firm to broaden investor access to structured crypto products under a regulated exchange framework. Read more →

President Lukashenko Pushes for Clear Crypto Framework in Belarus

Belarusian President Alexander Lukashenko renewed his call for wider crypto adoption, urging the development of a clear and transparent regulatory framework. He positioned digital assets as key to strengthening the nation’s financial sovereignty, even as international sanctions complicate its economic outlook. Read more →

Tron Surpasses Ethereum in 30-Day Fee Revenue

For the first time, Tron’s network fee revenue outpaced Ethereum’s over a 30-day period by 28%, highlighting its strength in stablecoin transfers and retail activity. Over the past 30 days, Tron generated $56.7 million in fees from 267 million transactions, surpassing Ethereum’s $44.3 million from 49 million transactions, according to Nansen. Read more →

EU Hits Google With $3.45B Fine Over Adtech Abuses

The European Commission fined Google €2.95 billion ($3.45B) for anti-competitive practices in its adtech business, ruling that the company favored its own AdX exchange to the detriment of rivals and publishers. While Google plans to appeal, regulators warned of stronger remedies — including potential divestitures — if conflicts of interest aren’t resolved, underscoring growing transatlantic tensions over digital market regulation.

Read more →

Polymarket Sees Record Surge in New Market Creation

Prediction platform Polymarket reached an all-time high in new markets created, signaling robust user engagement. The surge comes as the company explores a U.S. relaunch under clearer regulatory guidance. Read more →

Chart from The Block Data

Hyperliquid’s Stablecoin Proposal Sparks Scrutiny

Hyperliquid has invited community proposals on launching its planned USDH stablecoin, but some critics warn of potential risks and foul play. Questions around governance and transparency remain as the project evaluates its next steps. Read more →

Kazakhstan to Accept Stablecoins for Regulatory Fees

Kazakhstan’s financial regulators announced they will begin accepting USD-backed stablecoins for official regulatory fee payments. The move reflects the country’s ongoing efforts to integrate digital assets into its financial system. Read more →

StablecoinX Expands ENA Accumulation With $530M Raise

StablecoinX announced a $530 million PIPE financing round, bringing its total fundraising to $895 million as part of a multi-year strategy to accumulate over 3 billion ENA tokens. The deal includes a $310 million buyback program by an Ethena Foundation subsidiary, representing ~13% of ENA’s circulating supply, with purchase pacing tied to token price levels and downside moves.

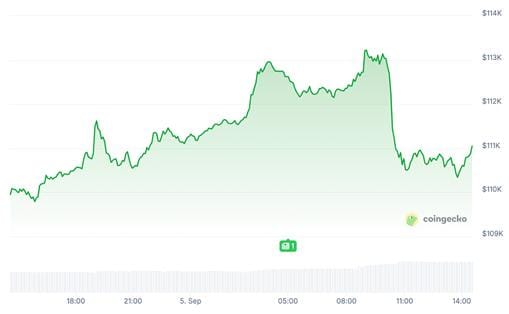

Crypto Markets Stall After Weak U.S. Jobs Report

Crypto prices traded sideways following a disappointing U.S. jobs report that showed sluggish employment growth. The muted performance reflects broader macroeconomic uncertainty weighing on risk assets. Read more →

BTC Chart

Source: CoinGecko

Senate Bill Update Narrows Scope of Crypto Securities Rules

A revised Senate Banking Committee market structure bill excludes staking, airdrops, and pre-enactment tokens from securities status unless linked to fraud, according to Eleanor Terrett. It also exempts DePIN projects, preserves protections for DeFi, self-custody, and developers, and creates a formal SEC–CFTC coordination framework to oversee digital assets.

Saylor’s Strategy Overlooked by S&P 500 as Robinhood Joins Instead

Michael Saylor’s MicroStrategy (MSTR) was passed over for inclusion in the S&P 500 despite meeting eligibility criteria, prompting a nearly 3% drop in its stock after hours. In a surprise move, Robinhood (HOOD) secured inclusion and saw its stock climb 7% off-hours.

Read more →

Lighter DeFi Platform’s TVL Climbs Over $350M Ahead of Public Launch

Lighter, a decentralized perpetuals exchange emerging from private beta, saw its total value locked surge past $350 million as of September 3, rising around 90% since early August. Although no official public launch date has been announced, the platform is currently accessible via invite codes tied to user activity. Read more →

Robinhood, AppLovin, and Emcor to Join S&P 500 in Major Index Shuffle

S&P Dow Jones Indices announced multiple changes effective September 22, 2025, with Robinhood, AppLovin, and Emcor Group entering the S&P 500, replacing MarketAxess, Caesars Entertainment, and Enphase Energy. The quarterly rebalance also moves Uber into the S&P 100 while reshuffling dozens of companies across the S&P MidCap 400 and SmallCap 600 to better reflect market capitalization ranges. Read more →

WLFI Blacklists 272 Wallets Amid Security Crackdown

WLFI reported blocking 272 wallet addresses in recent days to curb theft and aid recovery, with most linked to phishing schemes and others frozen after user compromise reports. The firm stressed that blacklisting decisions rely strictly on on-chain security signals, not standard trading activity.

Small Businesses Quietly Fuel Bitcoin’s 2025 Bull Run

River reports that its business clients have reinvested an average of 22% of profits into Bitcoin, with firms across real estate, hospitality, finance, and even nonprofits accumulating 84,000 BTC this year—roughly a quarter of institutional and corporate holdings. Analysts say regulatory clarity, better accounting standards, and the 2025 bull market have made adoption easier, especially for smaller companies with fewer barriers than large corporations. Read more →

Source: River

Tether Eyes Gold Mining as Profits Fuel Commodity Push

Tether, the $168 billion stablecoin giant, is exploring investments across the gold supply chain after posting $5.7 billion in first-half profits, with CEO Paolo Ardoino calling the metal “natural bitcoin.” The company has already built an $8.7 billion bullion position and invested over $200 million in gold royalty firms, though its unconventional entry into the conservative mining sector has raised skepticism. Read more →

Ethereum and Bitcoin ETFs Face Heavy Outflows

On September 5, Ethereum spot ETFs recorded $447 million in net outflows, marking the second-largest withdrawal on record. Bitcoin spot ETFs also saw pressure with $160 million in outflows, as none of the twelve funds reported net inflows.

AI-Crypto Projects Stall Despite Tech Hype from OpenAI and Nvidia

AI-powered crypto projects have raised over $516 million in 2025, but their combined market cap has shrunk more than 50% since December’s $70 billion peak, leaving them a small $30 billion niche in the $4 trillion crypto market. Analysts say most ventures either lack real use cases or lean on “AI” branding for hype, with adoption expected only when higher-level services emerge—though supporters believe today’s quiet phase could mirror DeFi’s early cycle before its breakout. Read more →

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed