Good day, everyone!

Kickin’ off this busy Tuesday with controversial crypto remarks heard around the world, WLFI token launch aftermath and much needed clarity, digital asset news on regulatory and institutional progress, nondisclosure of promotional social media posts by crypto influencers exposed, and more.

Latest News

South Korea’s FSC Nominee Sparks Controversy Over Crypto Remarks

Lee Eok-won, nominee for chair of South Korea’s Financial Services Commission, triggered backlash by calling cryptocurrencies valueless and unsuitable for functions like storing value or enabling transactions. His stance drew criticism from local blockchain advocates who argued that crypto's digital utility provides real-world value, especially amid growing global adoption by institutions. While Lee remains skeptical of crypto investment for pensions and spot ETFs, he signaled support for developing a regulated stablecoin market aligned with broader global trends. Read more ->

Bank of China Stock Soars on Stablecoin License Speculation

Bank of China’s Hong Kong shares jumped 6.7% following reports that the bank may apply for a local stablecoin issuer license under Hong Kong’s newly launched regulatory framework. While official confirmation is pending, growing interest from major financial institutions and Chinese tech firms underscores the region’s appeal as a digital assets hub, even as regulators caution against speculative trading. Read more ->

CZ Charts the Future: Stablecoins, Tokenized Assets, and AI-Powered Crypto: Wu Blockchain

At the Hong Kong CryptoFi Forum, Binance founder Changpeng Zhao (CZ) outlined his strategic vision for the future of digital finance, highlighting stablecoins as tools for dollar globalization, the tokenization of real-world assets (RWAs), and the transformative potential of decentralized exchanges (DEXs) and AI-integrated crypto ecosystems. CZ emphasized regulatory, liquidity, and technical challenges facing RWA adoption but maintained that stablecoins have proven the viability of on-chain finance, while the DAT (Digital Asset Treasury) model offers a compliant bridge for traditional investors to gain crypto exposure. He also projected a future in which AI agents conduct microtransactions on blockchain rails, dramatically increasing crypto volume and ushering in new global economic efficiencies. Read more ->

Jason Fang to Lead Thai-Based Crypto Investment Venture DV8 Public

Sora Ventures founder Jason Fang has been named CEO of DV8 Public, a Thai-listed firm aiming to become a regional counterpart to MicroStrategy by building a crypto-focused public company. The initiative involves collaboration with partners from UTXO Management, Moon Inc, Nakamoto, and Asia Strategy, signaling broader institutional interest.

Futian Issues World’s First Ethereum-Based Public RWA Bond

Futian Investment Holdings has successfully issued the world’s first publicly offered RWA digital bond on the Ethereum blockchain, raising 500 million RMB in offshore bonds with a 2.62% coupon and two-year maturity. This landmark issuance marks a major step in integrating blockchain with traditional finance, reinforcing Hong Kong and Futian District’s role in driving digital innovation in capital markets. Read more ->

$WLFI Launches with 24.67B Tokens in Circulation and Emphasis on Transparency

World Liberty Financial’s $WLFI token debuted with approximately 24.67 billion tokens in circulation, allocated across ecosystem reserves, public sale participants, Alt5 Sigma’s treasury, and liquidity efforts. The majority of the remaining supply—over 75 billion tokens—will remain under vesting schedules or locked, reinforcing the project’s long-term vision and commitment to transparency. Read more ->

XRP ETF Approval Could Trigger $5B Inflows, Analysts Say Demand Is Underestimated

Analysts predict spot XRP ETFs could see over $5 billion in inflows within their first month, with ETF Store President Nate Geraci warning that investor demand is being significantly underestimated. As the SEC nears its decision deadline in October on XRP ETF applications, optimism is growing amid updated filings and bullish forecasts, despite recent price dips and whale profit-taking. Read more ->

BRC20 Launches BRC2.0 to Bring Ethereum-Style Smart Contracts to Bitcoin

The BRC20 protocol has introduced BRC2.0, integrating Ethereum Virtual Machine (EVM) capabilities into Bitcoin to enable smart contract functionality similar to Ethereum’s, using the Ordinals protocol to inscribe data on individual satoshis. Developers aim to offer users the programmability of Ethereum with the security of Bitcoin, marking a major step toward Turing-complete applications on the Bitcoin network. Read more ->

Myriad Surpasses $10M Volume as Prediction Markets Enter DeFi Spotlight

Prediction market protocol Myriad has surpassed $10 million in USDC trading volume and over 5.4 million predictions, positioning itself as a leader in transforming tradable information into a core component of decentralized finance. With a growing user base and plans for expansion, Myriad aims to redefine capital markets by making speculation and forecasting as accessible as trading stocks. Read more ->

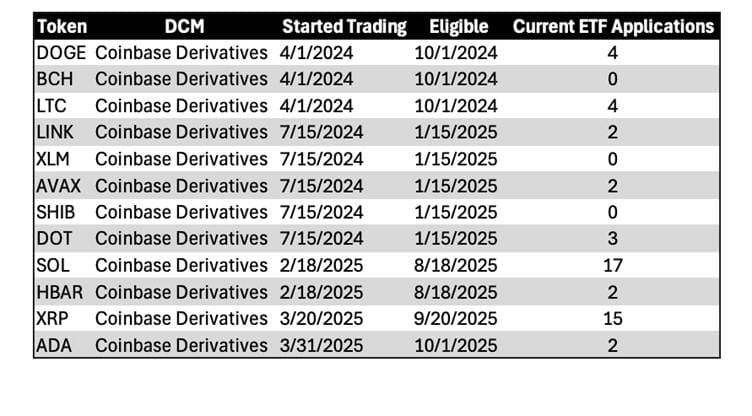

Only a Dozen Tokens Qualify for SEC’s Fast-Track ETF Path, Says Galaxy

According to Galaxy Digital, just 12 out of the top 100 cryptocurrencies beyond Bitcoin and Ethereum meet the SEC's proposed fast-track criteria for ETF approval, due to strict requirements around regulated futures trading and exchange surveillance. While exchanges push for a rule-based listing standard to replace the current case-by-case process, most crypto assets are unlikely to qualify soon, leaving capital to flow into alternative investment products in the meantime. Read more ->

Tokens listed on Coinbase derivates and that meet ETF fast-track requirements

Source: Galaxy Digital

Metaplanet Shareholders Approve $884M Plan to Sustain Bitcoin Strategy

Metaplanet shareholders have approved an $884 million capital raise involving new and preferred share issuances, as the company struggles with financing issues caused by a sharp drop in its stock price. Despite the funding challenges, Metaplanet continues to expand its Bitcoin holdings—now totaling 20,000 BTC—but analysts warn that failure to secure additional capital could derail its goal of owning 210,000 BTC by 2027. Read more ->

Binance Launches Medá to Advance Fintech Access in Mexico

Binance has launched Medá, a regulated Mexican fintech entity backed by over one billion pesos in investment, to enhance fiat-to-crypto access and drive digital financial inclusion across Latin America. Operating independently within Binance’s ecosystem, Medá aims to position Mexico as a fintech hub through regulatory compliance, financial education, and affordable transaction services. Read more ->

DeFi Protocols Adopt Safe Harbor to Empower White Hat Hackers

To bolster security amid rising crypto theft, 12 DeFi protocols managing a combined $20 billion in assets have adopted the Safe Harbor Agreement, which protects white hat hackers from prosecution when rescuing funds during active exploits. The framework, developed by the Security Alliance with legal input from top crypto firms, aims to encourage ethical hackers to intervene without legal risk, provided they return recovered funds within 72 hours. Read more ->

Banking Lobbyists Push for Stablecoin Rule Revisions as Congress Reconvenes

As Congress returns from recess, banking lobbyists are pressing lawmakers to revisit the GENIUS Act, targeting provisions that allow crypto firms like Coinbase and PayPal to offer yield-like “rewards” on stablecoins without traditional oversight. With banks warning of potential $6.6 trillion in lost deposits and reduced consumer lending, the lobbying effort aims to tighten regulations—though crypto advocates argue the so-called loopholes were intentional and lawmakers face a crowded legislative agenda. Read more ->

Trump-Backed WLFI Token Launches With $26B Valuation and 1,700% Gains

The Trump-endorsed World Liberty Financial token (WLFI) officially launched for trading, reaching a fully diluted valuation of over $26 billion and delivering early investors gains exceeding 1,700% from its presale price. Despite its explosive debut and listings on major exchanges, the token faced over $12 million in liquidations amid volatile trading, while political controversy grows over former President Trump’s financial windfall from the project. Read more ->

El Salvador Shifts Bitcoin Strategy Over Quantum Security Fears

El Salvador has moved its national Bitcoin reserve—worth over $686 million—into multiple addresses to reduce vulnerability to potential quantum computing threats, despite earlier IMF commitments to halt further BTC accumulation. While officials claim the move is a security upgrade rather than new purchases, it raises questions about the country's ongoing Bitcoin strategy amid global scrutiny and public disinterest. Read more ->

Crypto Edges Into Australia's A$4.3 Trillion Pension Market via SMSFs

Major exchanges like Coinbase and OKX are targeting Australia's self-managed superannuation funds (SMSFs) to introduce crypto into the country’s A$4.3 trillion ($2.8 trillion) pension system, with rising interest from both younger investors and Baby Boomers. While crypto exposure in SMSFs is still relatively small, its rapid growth is pushing regulators and mainstream funds to grapple with digital assets amid ongoing warnings about volatility and risk. Read more ->

RAK Properties to Accept Bitcoin and Crypto for UAE Real Estate Deals

RAK Properties, a major real estate developer in the UAE's Ras Al Khaimah emirate, will begin accepting Bitcoin, Ether, and Tether for international property purchases, partnering with Hubpay to convert crypto into local currency. This move highlights the UAE's growing embrace of digital assets, as the nation positions itself as a global crypto hub with favorable regulations and increasing adoption. Read more ->

ZachXBT Exposes Over 100 Crypto Influencers for Undisclosed Paid Promotions

Blockchain investigator ZachXBT published evidence showing that over 100 crypto influencers accepted payments to promote tokens without properly disclosing the posts as advertisements. His findings, based on leaked pricing spreadsheets and on-chain payment records, highlight growing concerns around deceptive marketing practices and lack of transparency in crypto influencer culture. Read more ->

EU Warns Tokenized Stocks May Mislead Retail Investors

Natasha Cazenave, executive director of the European Securities and Markets Authority (ESMA), cautioned that tokenized stocks often give investors a false impression of ownership, as they typically lack fundamental shareholder rights like voting and dividends. While the technology offers benefits like fractional trading and 24/7 access, ESMA warns that poor transparency and regulatory gaps could confuse retail investors and harm market integrity. Read more ->

WLFI Falls After Launch as Governance Weighs Buyback-and-Burn Plan

World Liberty Financial’s WLFI token dropped from $0.33 to around $0.245 during its first day of trading, as token holders began voting on a proposal to use liquidity fees for buybacks and permanent token burns. While analysts acknowledge the plan could support WLFI's value by reducing supply, they warn its impact may be limited given the token’s high valuation, low utility, and upcoming token unlocks. Read more ->

Source: CoinGecko

South Korea Joins Global Crypto Data-Sharing Network to Curb Tax Evasion

South Korea will begin sharing virtual asset transaction data with tax authorities in 48 countries under the OECD’s Crypto-Asset Reporting Framework (CARF), allowing global exchanges of user data to begin with 2026 transaction records. While this initiative aims to combat offshore tax evasion, officials emphasize that data sharing is separate from domestic taxation policies, which remain suspended until 2027. Read more ->

StarkNet Faces Outages on Ethereum Layer 2 Network

StarkNet, an Ethereum Layer 2 scaling solution, experienced service disruptions, marking rare interruptions for the network. The cause of the outages have not yet been publicly disclosed.

Ethereum to Retire Holesky Testnet After Fusaka Upgrade

Ethereum will shut down its largest testnet, Holesky, two weeks after the upcoming Fusaka upgrade, which aims to improve rollup efficiency by better distributing data storage across validators. The decision follows mounting issues with Holesky’s validator queues and the launch of newer, more efficient testnets like Hoodi and Sepolia to support development and testing going forward. Read more ->

Record Chinese Margin Debt Sparks Risk-On Sentiment, But Crypto Traders Stay Cautious

Margin trading in China’s stock market hit a record 2.28 trillion yuan ($320 billion), signaling strong risk appetite among investors and potentially influencing global markets, including crypto. However, despite moderately bullish funding rates in top cryptocurrencies, traders remain wary due to ongoing economic headwinds and deflationary pressures. Read more ->

Bunni DEX Exploited for $8.4M, Halts Smart Contract Operations

Decentralized exchange Bunni suffered an $8.4 million exploit targeting its smart contracts on Ethereum and Unichain, prompting the platform to suspend all contract activity as it investigates. The attacker transferred much of the stolen funds to Ethereum via Across Protocol, while Bunni confirmed the breach impacted two specific liquidity pools. Read more ->

Hyperliquid Surpasses $100M Monthly Revenue Amid Soaring Perpetual Trading Volume

Hyperliquid hit a record $106 million in revenue for August, driven by nearly $400 billion in perpetual trading volume and capturing 70% of the decentralized perpetuals market share. While its growth is powered by its custom Layer-1 chain and low fees, the platform faces ongoing scrutiny after manipulation incidents prompted new safeguards to protect traders. Read more ->

Revolut’s $75B Valuation Signals Crypto’s Rise in Mainstream Finance

Revolut’s valuation surged to $75 billion following a secondary share sale, fueled in part by a 300% revenue jump in its crypto and trading division, underscoring how digital assets are central to the neobank’s rapid ascent. With the launch of its own crypto exchange and growing global user base, Revolut is bridging fintech and crypto, positioning itself alongside major financial institutions and hinting at a future U.S. public listing with crypto at its core. Read more->

Venus Protocol Exploited for $27M in Suspected Smart Contract Attack

Venus Protocol on BNB Chain suffered a suspected exploit that drained $27 million in assets after its Core Pool Comptroller contract was reportedly redirected to a malicious address targeting tokens like vUSDC and vETH. While the stolen funds remain unmoved, the incident has raised concerns about smart contract vulnerabilities in one of the chain’s largest DeFi platforms. Read more->

EU Eyes Tokenization Proposals in December to Modernize Capital Markets

The European Commission plans to introduce proposals in December under its Savings and Investment Union initiative that focus on the tokenization of real-world financial instruments using blockchain technology, rather than pursuing a "MiCA 2.0" revision. Adviser Peter Kerstens emphasized that distributed ledger technology could unify the EU’s fragmented capital markets and transform traditional finance, as regulatory frameworks are updated to accommodate increasing interest from banks and securities firms. Read more ->

RUSI: Ukraine Risks $10B Crypto Crime Loss Without Stronger Regulation

Ukraine has lost at least $10 billion to crypto-related crimes and tax shortfalls, according to a report by the Royal United Services Institute, which warns that the country’s lax regulatory environment leaves it vulnerable to money laundering, Russian sanctions evasion, and budget erosion. While Ukraine passed a virtual asset law in 2022, it remains unenforced due to missing tax legislation, and experts caution that without urgent alignment with EU and FATF standards, Ukraine could become an entrenched crypto crime hub, undermining both its security and financial stability. Read more ->

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed