Oh look! You’re back for some more! Well here goes…..

For starters, lets agree that it's Tom Lee's world and we're just investing in it. Yes? No? Anyways, there’s lots of news on Ethereum, token generation events (TGEs) coming down the pipe line, and the latest on a recent supply chain attack. And of course we have more.

Source: alternative.me

Latest News

Tom Lee Questions the Future of Bitcoin’s Four-Year Cycle

In a discussion with Mario Nawfal, Tom Lee of Bitmine explained that Bitcoin’s historic four-year price cycle stems from its halving events but may now be losing relevance. With institutional investors replacing retail as the main market drivers, Lee argues that the market could break from its traditional cycle and long-standing correlation with equities, reshaping how crypto’s trajectory is understood.

Forward Industries lines up $1.65B to launch Solana treasury; Multicoin’s Kyle Samani to chair

Forward Industries (NASDAQ: FORD) announced $1.65 billion in cash and stablecoin commitments for a PIPE to build an institutional Solana-focused treasury strategy led by Galaxy Digital, Jump Crypto, and Multicoin Capital. Cantor is lead placement agent, Galaxy Investment Banking is co-placement agent, and upon closing Kyle Samani is expected to become board chair with Galaxy’s Chris Ferraro and Jump Crypto’s Saurabh Sharma as observers. Read more →

Report: Galaxy, Jump, Multicoin back $1.65B Solana treasury plan at Forward Industries

A report says Forward Industries secured $1.65 billion in commitments led by Galaxy Digital, Jump Crypto, and Multicoin Capital to execute a Solana-centered treasury strategy, with Multicoin’s Kyle Samani poised to take the chair. The initiative aims to position the small-cap public company as a major institutional participant in the Solana ecosystem. Read more →

Report: Bybit’s India app and website blocked amid regulatory action, then restored

The exchange’s app and website in India were reportedly rendered inaccessible following government blocking orders, disrupting local user access. Bybit’s mobile app has since been fully restored for users in India on both the App Store and Google Play, marking a significant return of accessibility. Meanwhile, the Bybit website is being brought back online in phases and is expected to be fully available within the next 3–4 days. Read more →

Grayscale moves to launch a spot Chainlink ETF in the U.S.

Grayscale filed an S-1 for “Grayscale Chainlink Trust (LINK)” with plans to list on NYSE Arca under the ticker GLNK, pending approval of generic listing standards and other regulatory steps. The trust would hold LINK and initially accept cash creations/redemptions, with Coinbase entities named as prime broker and custodian. Read more →

Strategy.com says it bought 1,955 BTC, lifting total holdings to 638,460 BTC

The company announced a fresh 1,955-BTC purchase, claiming aggregate bitcoin reserves now stand at 638,460 BTC. The release positions the buy as part of its ongoing treasury accumulation strategy. Read more →

U.S. spot Ethereum ETFs see $788M outflow over four days as risk appetite fades

From Sept. 2–5, U.S. spot ETH ETFs booked ~$787.6M in net outflows—including a single-day $446.8M exodus—while Bitcoin ETFs saw about $250.3M in net inflows over the same stretch. Analysts point to staking limitations for ETFs and a broader risk-off tone as drivers of the rotation. Read more →

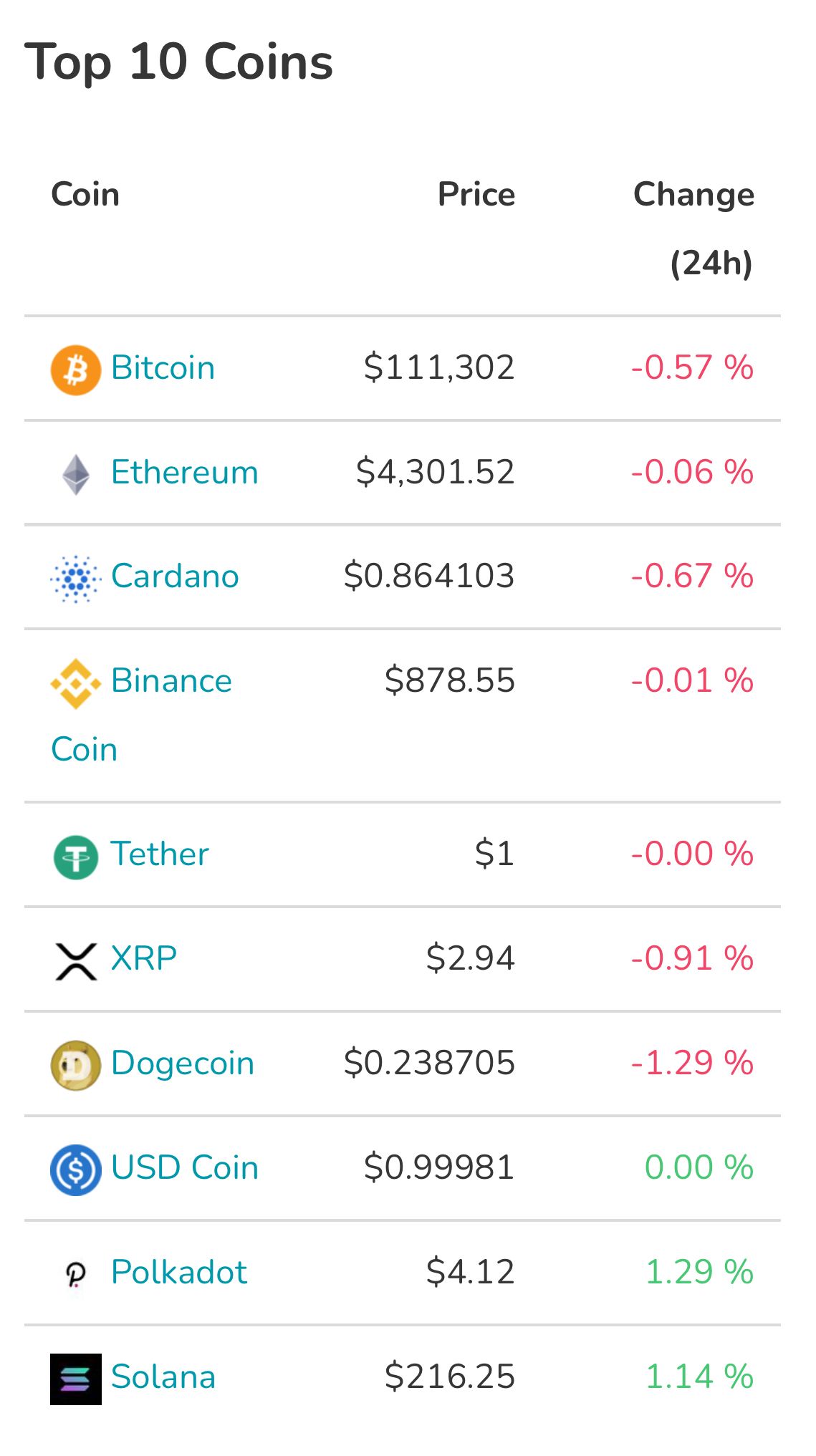

Source: CoinGecko

Bitcoin search interest hits 11-month low as gold powers to record highs

Google Trends data show U.S. search interest for “Bitcoin” at its weakest since October 2024, even as gold is up ~38% year-to-date versus Bitcoin’s ~18%. Strategists say a favorable macro turn could catalyze rotation from bullion back into BTC. Read more →

U.S. Google Trends data for "Bitcoin."

Image: Google

Nasdaq files to allow trading of tokenized securities on its main U.S. market

Nasdaq proposed rule changes to trade listed stocks and ETPs in traditional or tokenized form; if approved, it would be the first U.S. exchange to do so, with initial token-settled trades targeted by late Q3 2026 pending DTC readiness. The plan argues tokenized instruments must confer the same material rights as traditional shares to be treated equivalently on the order book. Read more →

CoinShares charts U.S. move via merger plan with Vine Hill SPAC and Odysseus Holdings

The Jersey-based firm unveiled a joint merger plan to shift its listing from Nasdaq Stockholm to a U.S. exchange (targeting Nasdaq) and raise about $50M in a private placement; illustrative ownership shows CoinShares holders at ~91.6% post-deal (assuming full SPAC redemptions). Key shareholders representing ~87.7% have entered a support agreement, with completion subject to shareholder, court, and listing approvals. Read more →

Eightco raises $250M, adds $20M from Bitmine to build first Worldcoin treasury

Eightco Holdings (OCTO) announced a $250 million private placement, plus a $20 million strategic investment from Bitmine, to adopt Worldcoin (WLD) as its primary treasury reserve while potentially holding cash and ETH as secondary assets. The move formalizes a dedicated WLD treasury strategy alongside the company’s core operations. Read more →

Lion Group pivots treasury from SOL and SUI into Hyperliquid’s HYPE after custody milestone

Lion Group Holding said it will reallocate treasury assets from Solana and Sui to Hyperliquid’s HYPE token, citing a recent U.S. institutional custody milestone. The shift is framed as aligning the firm’s balance sheet with emerging market structure in perps-focused liquidity. Read more →

Binance adds Linea (LINEA) to HODLer Airdrops with retroactive BNB Simple Earn eligibility

Binance announced a new HODLer Airdrops campaign featuring Linea (LINEA), allowing users with qualifying BNB Simple Earn subscriptions to earn retroactive rewards. Availability remains subject to regional restrictions and product eligibility. Read more →

Rectitude inks $32.6M standby equity deal to launch Bitcoin treasury strategy

Rectitude Holdings said it entered a $32.6 million standby equity purchase agreement to fund a new Bitcoin-focused treasury program. The Singapore-based safety equipment supplier framed the shift as a capital allocation initiative alongside its core business. Read more →

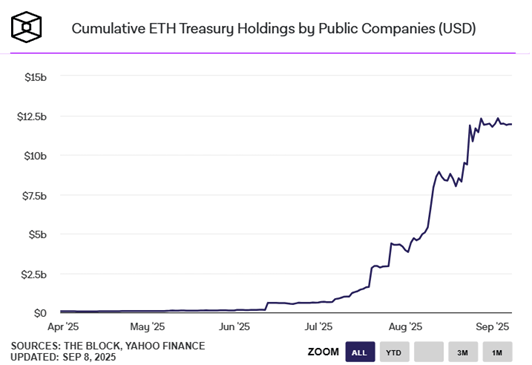

The Block: Bitmine says crypto + cash holdings top $9.2B; ETH stash hits 2.1M

Bitmine Immersion disclosed that combined crypto and cash reserves surpassed $9.2 billion, including approximately 2.1 million ETH in its treasury. The update underscores the firm’s evolution into a large institutional ETH holder. Read more →

Chart from The Block Data

Worldcoin jumps 25% on $250M treasury deal and user growth momentum

WLD rallied about 25%, extending weekly gains near 50%, following Eightco’s $250 million financing tied to a WLD treasury plan and fresh adoption metrics. CoinDesk also notes new contributors to Worldcoin’s MPC network, signaling expanding infrastructure participation. Read more →

Forward Industries soars on $1.65B Solana treasury pivot, then pares gains

Shares of Forward Industries spiked after unveiling a $1.65 billion PIPE to execute a Solana-first treasury strategy backed by crypto heavyweights, before cooling intraday. The company says advisory, trading, and staking support will come from established firms in the ecosystem. Read more →

Source: CoinGecko

easyJet founder unveils ‘easyBitcoin’ trading app via brand deal with Uphold

Stelios Haji-Ioannou is launching a Bitcoin trading app under the easyGroup umbrella, aiming to “bring Bitcoin to the people” through a licensing partnership with Uphold. The release adds crypto to a stable of 350+ “easy” brands spanning multiple consumer sectors. Read more →

Singapore court blocks Do Kwon from reclaiming $15.1M luxury penthouse deposit

The High Court ruled Terraform Labs’ founder cannot recover a down payment on a premium Ardmore property after failing to complete the purchase amid criminal proceedings. The decision underscores the legal fallout still trailing the collapsed Terra ecosystem. Read more →

Justin Sun–backed USDD stablecoin launches natively on Ethereum

USDD, previously centered on the Tron ecosystem, is now live on Ethereum, broadening its footprint across major chains. The launch adds another dollar-pegged option to Ethereum’s stablecoin stack. Read more →

MegaETH teams with Ethena to roll out USDm, using reserve yield to subsidize fees

MegaETH unveiled USDm, a native stablecoin designed with Ethena so that reserve yield can fund the network’s sequencer and keep transaction costs low. The design aims to couple stablecoin economics with L1/L2 performance incentives. Read more →

Upbit parent Dunamu files ‘GIWA’ trademarks amid chatter of a new blockchain

CoinDesk reports Dunamu has lodged trademark applications for “GIWA,” and a website with a countdown suggests an announcement timed to the Upbit Developer Conference. The filings have stoked speculation that Upbit’s owner may be preparing to launch its own network. Read more →

Ethzilla nears $500M ETH balance sheet as CEO shifts, Cumberland backs financing

Ethzilla disclosed its Ethereum holdings are approaching $500 million while securing a financing deal from market maker Cumberland. The announcement coincided with a leadership change as the company transitions to a new CEO. Read more →

SEC approves Cboe BZX rule change to list and trade Hashdex Nasdaq Crypto Index ETF

The SEC signed off on Cboe BZX’s request to list and trade shares of the Hashdex Nasdaq Crypto Index US ETF under Rule 14.11(e)(4). The order outlines surveillance and reporting requirements designed to mitigate manipulation and enhance market integrity. Read more →

CoinShares to list in U.S. via $1.2B Nasdaq SPAC deal with Vine Hill and Odysseus

CoinShares announced a plan to merge with Vine Hill Capital and Odysseus Holdings in a $1.2 billion transaction, shifting its listing from Stockholm to Nasdaq. The move aims to expand the European asset manager’s footprint with U.S. investors while raising ~$50M in fresh capital. Read more →

Wildcat Finance says Kinto default poses no contagion risk

Decentralized lending protocol Wildcat confirmed that a default linked to Kinto will not spill over into other outstanding loans. The protocol emphasized its risk management framework and isolation of exposures. Read more →

Enso and Reservoir unveil OneStable, a cross-chain stablecoin minting protocol

Enso and Reservoir launched OneStable, a protocol enabling users to mint stablecoins across chains with unified liquidity and collateralization. The project is pitched as a way to streamline fragmented stablecoin liquidity in DeFi. Read more →

Kazakhstan president signals creation of national crypto reserve

Kazakhstan’s President Kassym-Jomart Tokayev said the country plans to establish a sovereign crypto reserve to diversify holdings beyond gold and foreign currency. The initiative is positioned as part of broader efforts to modernize financial infrastructure and embrace digital assets. Read more →

Why AI keeps making things up—and how researchers are trying to fix it

A Decrypt explainer unpacks the problem of AI “hallucinations,” where systems generate false or misleading content, and explores potential fixes including retrieval-based approaches, training improvements, and stricter evaluation. The piece stresses that while progress is underway, hallucinations remain a persistent challenge in AI deployment. Read more →

Coinbase adds SPX6900 and Flock to trading lineup

Coinbase announced it will list SPX6900 (SPX) on Ethereum and Flock (FLOCK) on Base, with trading pairs against USD launching in phases starting September 9, 2025 on or after 9AM PT. Availability may be limited in certain jurisdictions due to regional restrictions.

OpenSea unveils mobile app, $1M NFT Flagship Collection, and final pre-TGE rewards push

OpenSea announced a reimagined mobile trading app with AI-powered portfolio tools, positioning itself as an all-in-one platform for NFTs and tokens across chains. The company also launched a $1 million Flagship Collection of historic and emerging NFTs, while kicking off the final phase of its pre-TGE rewards program ahead of the $SEA token generation event in early October. Read more →

NPM supply chain attack plants crypto-stealing malware in core JavaScript libraries

Researchers discovered malicious code hidden in widely used NPM packages, allowing attackers to siphon crypto assets from developers and users. The incident highlights ongoing vulnerabilities in open-source software supply chains and their growing impact on Web3. Read more →

Solana project Aqua accused of $4.65M rug pull

Onchain investigator ZachXBT reported that Solana-based project Aqua allegedly executed a rug pull involving 21,770 SOL (~$4.65M). The funds were split across wallets and funneled into instant exchanges, while Aqua’s team disabled replies on its social media posts. Read more →

Aster sets September 17 launch for ASTER token TGE with 704M airdrop

Decentralized perps exchange Aster, a competitor to Hyperliquid backed by YZi Labs, will hold its Token Generation Event on September 17, 2025. The rollout includes an airdrop of 704 million ASTER tokens and marks the start of the second phase of its Aster Genesis program.

Athena Bitcoin accused of targeting elderly in ATM scam, DC AG alleges

The Washington, D.C. Attorney General filed a lawsuit against ATM operator Athena Bitcoin, claiming the company knowingly facilitated scams that drained seniors of funds by charging high fees and failing to prevent fraud. Victims were allegedly coached to deposit cash into Athena’s kiosks, converting it to Bitcoin for scammers. Read more →

Cantor launches Bitcoin fund with gold-based insurance

Cantor Fitzgerald introduced a new Bitcoin fund designed with built-in insurance using gold reserves to help offset potential losses. The offering targets institutional investors looking for downside protection while gaining exposure to BTC. Read more →

China’s export growth slows sharply as global demand weakens

China’s exports rose just 3.2% in August, below forecasts of 6.8%, signaling cooling demand from key markets. The slowdown adds pressure on Beijing to shore up growth as trade headwinds weigh on the world’s second-largest economy. Read more →

Sharplink’s Ethereum and Linea treasury move draws muted investor response

Sharplink Interactive shifted part of its corporate treasury into Ethereum and Linea assets, but the market reaction remained subdued. Analysts suggest investors remain cautious on smaller firms pursuing token allocation strategies. Read more →

CleanCore stock surges after $285M Dogecoin treasury purchase

Shares of CleanCore spiked after the company revealed it had bought 285.4 million DOGE to begin a Dogecoin-focused treasury strategy. The move mirrors other corporates adopting crypto as part of balance sheet diversification. Read more →

SwissBorg suffers $40M hack targeting Solana holdings

Crypto platform SwissBorg confirmed it was hacked, losing over $40 million in Solana-based assets. The company is investigating the breach and has paused affected services while reassuring users its wider operations remain secure. Read more →

Putin advisor claims U.S. seeks to erase debt with crypto and gold

A senior Kremlin advisor alleged that Washington is leveraging crypto and gold markets to gradually reduce its massive sovereign debt load. The comments reflect Moscow’s increasing focus on alternatives to the dollar in global trade. Read more →

Near-telepathic wearable lets users silently command devices

Researchers unveiled a wearable interface that allows nearly silent communication with devices, interpreting subtle facial and neural signals. The prototype points to a future where people can interact with technology seamlessly without speech or touch. Read more →

Kalshi hits $875M August volume as rivalry with Polymarket heats up

Event contracts platform Kalshi reported $875 million in trading volume for August, boosted by its recent funding round. The surge underscores intensifying competition with crypto-native rival Polymarket in prediction markets. Read more →

SEC to host crypto task force roundtable on surveillance and privacy

The U.S. SEC announced it will convene a roundtable with its Crypto Assets and Cyber Unit to discuss financial surveillance, data privacy, and enforcement challenges. The initiative aims to balance investor protection with evolving digital asset technologies. Read more →

California man sentenced in DOJ crypto fraud crackdown

A California resident received a prison sentence for orchestrating a multi-million-dollar crypto scam, part of a broader DOJ crackdown on digital asset fraud. Authorities said the case reflects their stepped-up enforcement against schemes exploiting retail investors. Read more →

Upbit launches GIWA, an Ethereum Layer 2 built on OP Stack

South Korea’s largest exchange, Upbit, unveiled GIWA (Global Infrastructure for Web3 Access), a Layer 2 blockchain built on OP Stack. Designed to ease Web3 adoption, GIWA offers 1-second block times, full EVM compatibility, and seamless migration for Solidity contracts and developer tools. Read more →

U.S. sanctions Myanmar and Cambodian entities over trafficking-linked crypto scams

The U.S. Treasury sanctioned 9 Myanmar and 10 Cambodian entities accused of forcing trafficking victims to run crypto investment scams. Officials said the groups used debt bondage, violence, and sexual exploitation to coerce victims, contributing to scams that cost U.S. citizens over $10 billion in 2024. Read more →

U.S. lawmakers push Treasury to study Bitcoin use for federal reserves

A group of U.S. lawmakers introduced a bipartisan bill directing the Treasury to assess the feasibility and security of holding Bitcoin in government reserves. The report would examine potential benefits, risks, and how BTC could complement traditional assets like gold. Read more →

Ark Invest ups Bitmine stake, trims Robinhood holdings

Cathie Wood’s Ark Invest disclosed fresh purchases of crypto mining firm Bitmine shares while reducing exposure to Robinhood. The shift signals stronger conviction in institutional-scale crypto infrastructure plays over retail brokerage platforms. Read more →

Bitcoin ETFs see $368M inflow as Ethereum products log sixth day of outflows

On September 8, U.S. spot Bitcoin ETFs recorded $368 million in net inflows, with all 12 funds posting gains. In contrast, spot Ethereum ETFs saw $96.69 million in outflows, extending their losing streak to six straight days.

VanEck’s CEO voices strong support for Hyperliquid

VanEck’s CEO Jan van Eck praised Hyperliquid’s technology, governance, and rollout, calling the firm “bullish” and confirming that VanEck has been an owner for months. He emphasized VanEck’s commitment to contributing research and collaborating with HyperEVM builders, while cautioning that the firm won’t be a partner if “pushed around easily.”

Jack Ma’s Ant Digital explores blockchain to tokenize China’s energy sector

Ant Digital, the fintech arm of Jack Ma’s Ant Group, is developing blockchain-based tools to tokenize China’s energy resources, aiming to modernize trading and enhance transparency. The initiative highlights growing interest in applying tokenization to real-world assets in critical industries. Read more →

Binance lists Ethena’s USDe with trading pairs, rewards, and $0 listing fee

Binance has listed Ethena USDe (USDe) with trading pairs USDe/USDC and USDe/USDT, opening trading on September 9, 2025, at 12:00 UTC and enabling withdrawals the next day. USDe holders on Binance will be eligible for regular reward distributions, with September rewards paid in a lump sum and weekly disbursements thereafter. Read more →

Ripple partners with Spain’s BBVA to offer crypto custody for digital assets

Ripple has teamed up with Spanish banking giant BBVA to provide digital asset custody services via its Metaco subsidiary. The move marks a significant step for Ripple in expanding its enterprise crypto infrastructure in the European banking sector. Read more →

Gemini secures Nasdaq as strategic investor ahead of international expansion

Crypto exchange Gemini, founded by the Winklevoss twins, has reportedly brought Nasdaq on board as a strategic investor in its holding company. The move comes as Gemini ramps up international growth following regulatory challenges in the U.S. Read more →

Ledger CTO: NPM attack targeting crypto libraries was contained with minimal impact

Ledger’s CTO said a recent NPM supply chain attack aimed at Web3 libraries caused almost no user losses, with the threat identified and neutralized early. The malware was designed to drain crypto wallets via injected JavaScript in compromised dependencies. Read more →

Upbit to list CleanCore (CLCORE) and open KRW trading on September 10

Upbit announced the listing of CleanCore (CLCORE), with trading against KRW beginning September 10, 2025. Deposits open September 9, following the company’s Dogecoin treasury strategy reveal. Read more →

Ex-Standard Chartered exec says stablecoins must offer yield to stay competitive

The former head of tokenization at Standard Chartered argued that stablecoins will need to provide yield-bearing features to compete with traditional and crypto-native alternatives. Without incentives, he noted, stablecoins risk losing market share to higher-return assets. Read more →

Hyperliquid Opens Bidding War to Issue USDH Stablecoin, Draws Paxos, Frax, and Others

Hyperliquid is launching a native stablecoin, USDH, and has invited top issuers—including Paxos, Frax, Agora, and Native Markets—to submit proposals via a public, onchain RFP. The winner will be selected by validator vote, competing for control over ~$5.6B in user funds that could generate over $220M/year in Treasury yield. Frax leads in yield-sharing, while questions of fairness and preselection have emerged from rival bidders. Read more →

CFTC considers recognizing MiCA-aligned foreign crypto platforms under U.S. rules

Acting CFTC Chair Caroline Pham said the agency is reviewing whether crypto exchanges operating under strong foreign frameworks like the EU’s MiCA could qualify under U.S. cross-border regulations. This builds on the CFTC’s reaffirmation of its Foreign Boards of Trade (FBOTs) policy, allowing some non-U.S. platforms to serve U.S. users without full domestic registration.

WLD and MYX surge in derivatives trading, overtaking DOGE and XRP

WLD and MYX each posted over $10 billion in contract trading volume in 24 hours, ranking 4th and 5th globally—ahead of DOGE and XRP, per Laevitas data. MYX short liquidations totaled $42M on Sept. 8 and $31M on Sept. 9, accounting for significant portions of daily market-wide liquidations. Read more →

SharpLink activates $1.5B buyback, cites $3.6B staked ETH and zero debt

SharpLink began executing its $1.5 billion share buyback by repurchasing around 1 million $SBET shares. The company holds $3.6 billion in staked ETH, generating revenue, and reports no outstanding debt. Read more →

Ethereum core devs earn 50–60% below market, says Protocol Guild

According to the Protocol Guild, Ethereum core developers are earning 50–60% less than comparable roles in the broader market. The group is pushing for sustainable, long-term funding solutions to retain critical contributors who maintain and upgrade the network. Read more →

Senate Democrats unveil new framework for U.S. crypto market oversight

Senate Democrats released a proposed framework aimed at overhauling U.S. crypto market structure, focusing on clear regulatory authority, consumer protections, and stablecoin oversight. The plan emphasizes the need for comprehensive rules to address fraud, systemic risk, and technological innovation. Read more →

Binance partners with Singapore Gulf Bank for instant USD transfers

Binance has teamed up with Singapore Gulf Bank (SGB) to offer retail users instant USD on- and off-ramps via Binance Bahrain. The integration allows users to link SGB accounts for seamless, compliant fiat-to-crypto conversions.

Caliber begins Chainlink accumulation as part of digital asset treasury strategy

Caliber (NASDAQ: CWD) completed its first purchase of Chainlink (LINK) tokens as part of a new treasury initiative focused on long-term appreciation and staking yield. The company plans to gradually build a LINK position using its ELOC, cash reserves, and equity securities—marking the first Nasdaq-listed firm to adopt LINK as a treasury reserve asset. Read more →

Cboe to launch 10-year “continuous” Bitcoin and Ether futures in bid to regulate perps

Cboe Global Markets plans to introduce long-dated perpetual-style futures for Bitcoin and Ether on November 10, pending regulatory approval. The new “continuous futures” contracts aim to replicate offshore perpetuals within a U.S.-regulated framework, offering 10-year terms, daily price adjustments, and clearing through Cboe’s own infrastructure. Read more →

Ethereum trade router Barter acquires Copium to boost solver performance

Barter, a leading Ethereum “solver” responsible for routing over $19B in trades, has acquired the codebase of rival Copium to enhance price execution and defend against MEV. The deal, which excludes Copium’s team, aims to improve Barter’s competitiveness on platforms like CoW Swap, where solvers race to offer optimal trade outcomes in return for a cut of price improvements. Read more →

Coinbase acqui-hires Sensible founders to fuel 'everything exchange' strategy

Coinbase has acquired the founders of Sensible, a DeFi yield platform, to strengthen its onchain consumer strategy and advance its broader "everything exchange" vision. The hire marks Coinbase's seventh deal of 2025, reinforcing its push to offer users a one-stop platform for trading, borrowing, staking, and more onchain. Read more →

Quai Network integrates with Wormhole for cross-chain transfers and multichain dApps

Quai Network is teaming up with Wormhole to enable native transfers of its QUAI and QI tokens across 40+ blockchains, including Ethereum, Solana, and Base, using the NTT standard. The move enhances liquidity access and supports multichain dApps, reinforcing Quai’s position as a scalable, PoW-based energy-driven monetary system. Read more →

Dominari Holdings celebrates American Bitcoin’s Nasdaq debut, touts $170M stake

Dominari Holdings congratulated American Bitcoin (ABTC) on its Nasdaq listing and revealed it holds over 23 million shares, valued at approximately $171 million as of September 5, 2025. CEO Anthony Hayes called the listing a major milestone and affirmed Dominari’s continued support as ABTC pursues its post-IPO growth strategy. Read more →

Covalent integrates Sonic for real-time onchain data via GoldRush APIs

Covalent has integrated Sonic into its sub-second Data Co-Processor, enabling instant access to indexed and verifiable onchain data through GoldRush’s Streaming and Foundational APIs. With 400k TPS, sub-second finality, and up to 90% fee rebates to dApps, the integration delivers faster, high-throughput data for developers and institutions.

Solana, XRP rally as crypto market cap tops $4 trillion

Solana and XRP led gains as the global crypto market cap surged past $4 trillion, with SOL rising 9% and XRP climbing 7% in 24 hours. Analysts attribute the rally to renewed investor interest in Layer 1 assets and increased institutional inflows. Read more →

DOJ files forfeiture case for $5M in Bitcoin stolen via SIM swap attacks

The U.S. Department of Justice filed a civil forfeiture complaint for over $5 million in Bitcoin tied to SIM swap attacks that targeted crypto users. The DOJ claims the attackers stole login credentials and transferred funds from victims’ exchange accounts. Read more →

$CARDS token surges amid $150M trading frenzy for randomized Pokémon-style cards

Collector Crypt, a Web3 game platform, has driven over $150 million in randomized digital card trades modeled after Pokémon-style mechanics. Its native token, $CARDS, surged as traders flocked to speculate on rare items within the platform’s unique loot box ecosystem. Read more →

Vietnam launches five-year crypto trading pilot with strict local controls

Vietnam has approved a five-year trial for crypto trading, allowing only Vietnamese firms to operate platforms and issue digital assets—exclusively in dong and to foreign investors. The move marks a major regulatory shift in a country with over 17 million crypto holders, as the government tests formal market structures while preparing for broader digital asset legislation in 2026. Read more →

Apple Unveils iPhone Air: Ultra-Thin, AI-Enhanced, and Built for the Future

Apple introduced the iPhone Air, its thinnest and most power-efficient iPhone yet, featuring a 5.6mm titanium design, 6.5-inch 120Hz Super Retina XDR display, and the new A19 Pro, N1, and C1X chips. With a 48MP Fusion camera, 18MP AI-driven Center Stage front camera, eSIM-only design, and remarkable all-day battery life, iPhone Air marks a leap in design and performance, launching September 19 in four finishes. Read more →

Source: Apple.com

House of Doge and Bitstamp by Robinhood partner to host official Dogecoin treasury

House of Doge has selected Bitstamp by Robinhood as the trading and custody platform for the Official Dogecoin Treasury, established with CleanCore (NYSE: ZONE) to enhance transparency and long-term ecosystem stability. The move positions Bitstamp as a foundational layer for future yield-bearing DOGE utilities, reinforcing Dogecoin’s evolution beyond meme status toward structured financial integration. Read more →

Canadian Solana treasury firm SOL Strategies debuts on Nasdaq

SOL Strategies, a Canadian firm managing a Solana-based crypto treasury, has officially listed on the Nasdaq under the ticker SSTR, becoming one of the first Solana-native asset managers to enter U.S. public markets. The firm aims to bridge institutional capital with Solana’s ecosystem by offering transparent, regulated treasury strategies. Read more →

QMMM stock skyrockets 800% after unveiling crypto treasury strategy

Shares of QMMM, a Nasdaq-listed firm, soared over 800% after announcing plans to adopt a crypto treasury strategy focused on Bitcoin, Ethereum, and Solana. The move follows a broader trend of small-cap companies leveraging crypto asset allocations to attract investor interest. Read more →

Chart from The Block Data

Eric Trump’s board role reduced at WLFI crypto treasury firm Alt 5 Sigma

Eric Trump will take on a limited advisory position at WLFI’s crypto treasury company Alt 5 Sigma, stepping back from a previously anticipated board role. The company clarified that the change reflects a narrower scope of involvement amid increased attention on its Bitcoin and tokenized asset strategy. Read more →

AI accelerates arrival of quantum 'Q Day,' raising urgency for encryption overhaul

A new study reveals that AI models are dramatically simplifying the analysis of complex quantum systems, helping to advance hardware, applications, and potentially hastening the arrival of "Q Day"—when quantum computers can break current encryption. As AI boosts quantum simulation accuracy and speeds up hardware development, experts warn industries must shift to post-quantum cryptography before RSA and elliptic-curve protections become obsolete, possibly as early as 2030. Read more →

Harvard’s PDGrapher AI tool identifies gene-drug combos to reverse neurodegenerative disease

Harvard Medical School unveiled PDGrapher, an AI model that predicts and explains gene-drug pairings capable of restoring diseased cells—offering new hope for treating Parkinson’s, Alzheimer’s, and rare conditions. Unlike traditional tools, PDGrapher provides both therapeutic forecasts and mechanistic insights, marking a major leap in precision medicine and AI-driven biotech discovery. Read more →

STORY token hits all-time high as Heritage Distilling refines IP-based crypto treasury strategy

The native token of the Story Protocol, STORY, surged to a new all-time high after Heritage Distilling, a treasury company, reaffirmed its crypto strategy centered on intellectual property tokenization. The move reflects growing interest in using tokenized IP as a treasury asset amid broader institutional experimentation in the digital asset space. Read more →

MetaPlanet to raise ¥212.9B via overseas share sale to expand Bitcoin strategy

Japan-listed MetaPlanet announced plans to issue 385 million new shares at ¥553 each in an overseas offering, aiming to raise ¥212.9 billion (~$1.45B). The funds will be used to buy Bitcoin and support BTC income strategies, including options trading, boosting its total share count to roughly 1.14 billion. Read more →

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed