Gm! Ready start a brand-new week?

Well On & Off Chain is and we have you covered! Let’s go!

Latest News

IMF Pushes Back on Reports of El Salvador Buying More Bitcoin

The International Monetary Fund clarified that El Salvador is not currently purchasing additional Bitcoin, despite speculation tied to its ongoing adoption of the cryptocurrency. The IMF reiterated its concerns over Bitcoin’s volatility and potential risks to financial stability. Read more →

Allied Gaming & Entertainment’s Stock Price Doubles After Crypto Treasury Bet

Shares of a little-known esports company, Allied Gaming & Entertainment, surged more than 100% after it disclosed plans to hold Bitcoin and Ethereum in its treasury. The move mirrors strategies of larger firms like Strategy, sparking investor enthusiasm.

Read more →

Ethena Expands to Avalanche With USDe and sUSDe Launch

Stablecoin protocol Ethena has deployed its USDe and yield-bearing sUSDe tokens on Avalanche, marking a significant cross-chain expansion. The rollout aims to broaden liquidity and enhance accessibility for DeFi users. Read more →

Polymarket and Kalshi Reportedly Eye Multi-Billion Valuations

Prediction market Polymarket is weighing a financing round at a valuation between $9–10 billion, according to reports. Meanwhile, rival Kalshi is said to be close to raising funds at a $5 billion valuation, underscoring investor appetite for the sector. Read more →

Meme Coin Dev Gets Slapped, Token Pumps 2,000%

A Pump.fun livestreamer was slapped by fitness influencer Bradley Martyn after trying to grab his hat, sparking viral attention that sent their Solana meme coin Bagwork soaring more than 2,000%. The duo earned nearly $50,000 in creator fees that day and have leaned into daily viral stunts, though critics warn the antics encourage dangerous behavior in a platform already known for extreme content. Read more →

Solana Rallies as Galaxy Digital Makes $700 Million Purchase

Solana’s price surged again following news that Galaxy Digital acquired $700 million worth of the cryptocurrency. The investment highlights growing institutional interest in Solana’s ecosystem. Read more →

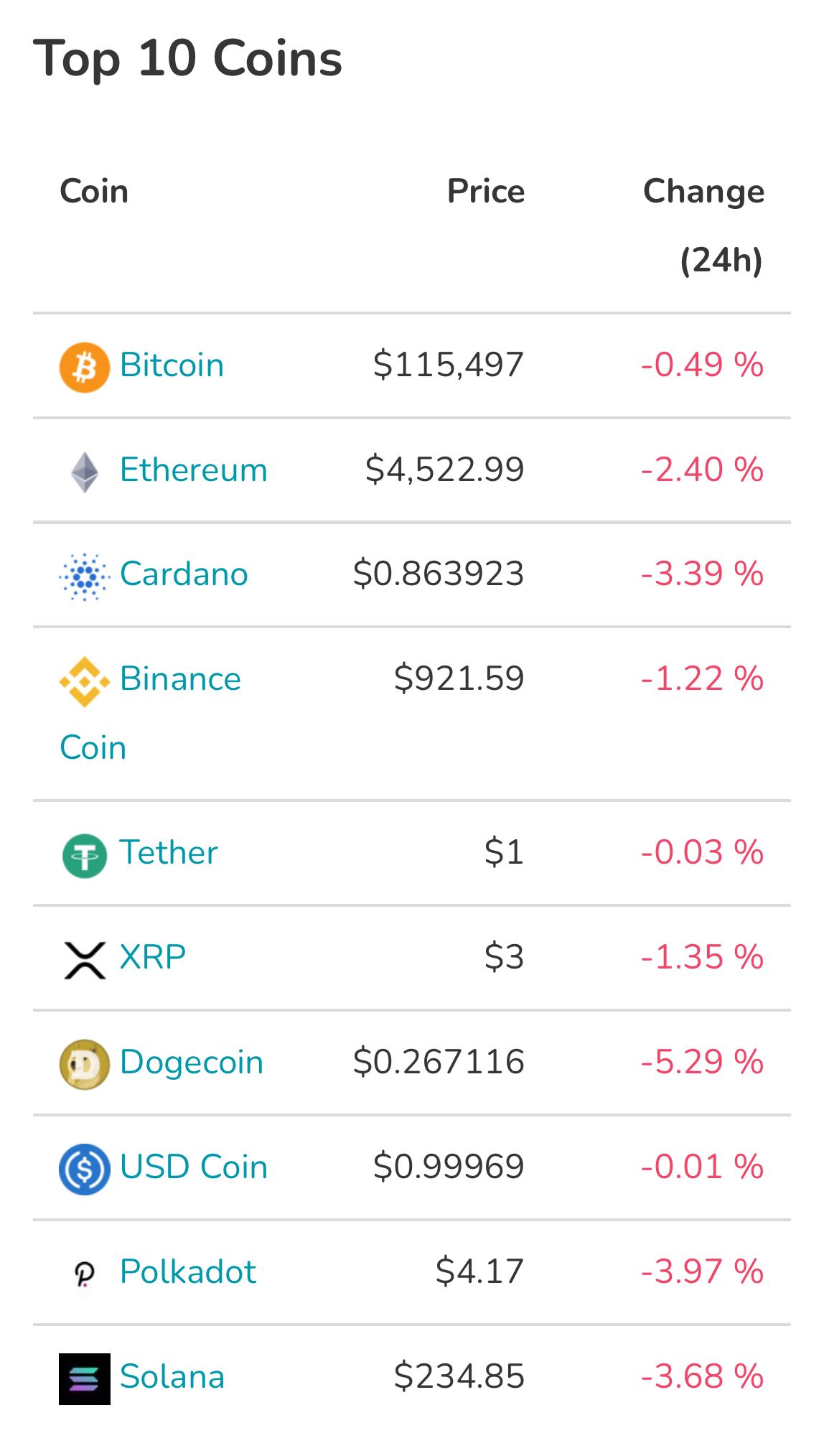

Dogecoin and BNB Jump as Bitcoin and Ethereum Hit Monthly Highs

Bitcoin and Ethereum both reached their highest prices in a month, lifting the broader crypto market. Dogecoin and Binance Coin (BNB) were among the altcoins posting notable gains. Read more →

Japan Prepares Major Crypto Tax Overhaul With Flat 20% Rate

Japan is set to replace its harsh crypto tax regime—currently as high as 55%—with a flat 20% tax on digital asset gains starting in 2026, pending parliamentary approval. The reforms aim to align crypto with equities, introduce insider trading rules, and allow loss carry-forwards, signaling a shift from strict regulation toward fostering Web3 innovation. Read more →

Tether Outlines Distinct Roles for USDT and USA₮

Tether CTO Paolo Ardoino explained that USDT functions as a “digital dollar” for nearly 500 million people in emerging markets, offering access to money for the unbanked and underserved. In contrast, USA₮ is tailored for the U.S., designed to comply with domestic regulations while targeting financial inclusion within American communities.

Chainlink Surpasses $100B TVS, Driven by Aave and Institutional Partnerships

Chainlink’s total value secured (TVS) has crossed $100 billion, fueled largely by Aave v3, which accounts for over 70% of the figure. Institutional deals with ICE and the U.S. Department of Commerce, growing whale adoption, and new integrations like SolvBTC and Polymarket highlight the oracle network’s expanding role, though reliance on Aave poses concentration risks. Read more →

Treasury Firms Hold $2.8B in Solana, Led by Sharps, DeFi Development, and Upexi

According to SSR data, 17 treasury companies collectively hold over 11.7 million SOL—worth about $2.8 billion—representing 2.04% of Solana’s total supply. Sharps Technology, DeFi Development, and Upexi stand out as the largest holders, each with at least 2 million SOL or more.

Bitcoin and Ethereum ETFs Extend Multi-Day Inflow Streaks

On September 12, U.S. Bitcoin spot ETFs logged $642 million in net inflows, marking five straight days of positive momentum. U.S. Ethereum spot ETFs followed with $406 million in inflows, their fourth consecutive day of gains.

Vitalik Buterin Warns Against “Naive AI Governance”

Vitalik Buterin argued that relying on a single AI to allocate funding is flawed, as it can be easily exploited with jailbreaks. Instead, he supports an “info finance” model that uses open markets, human spot-checks, and model diversity to create stronger incentives for accountability and robustness.

Prenetics Adds Bitcoin to Treasury With Daily Purchase Plan

Healthcare firm Prenetics, listed on NASDAQ, has disclosed holdings of 228 BTC and a strategy of buying 1 Bitcoin per day. The company joins a growing number of publicly traded firms steadily accumulating crypto for their corporate treasuries. Read more →

Twerk From Home Wants to Be the UFC of Exotic Dancing—With Crypto in the Mix

Startup Twerk From Home (TFH) is launching livestreamed twerking tournaments with cash prizes, audience voting, and sportsbook betting, aiming to professionalize exotic dance the way UFC legitimized MMA. Founder Joe Mahavuthivanij says crypto payments and gambling integration are key to overcoming industry stigmas and banking challenges, though critics note the contest currently functions more as a popularity vote than a judged sport. Read more →

Derive Co-Founder Pushes for 50% Token Supply Expansion

A Derive co-founder has proposed increasing the DRV token supply by 50%, a move that would dilute existing holders by roughly one-third. The plan has sparked debate within the community over its fairness and long-term impact. Read more →

Analyst Sees Strong Odds of US Strategic Bitcoin Reserve

Galaxy’s Alex Thorn argued that there is a “strong chance” the US government could establish a strategic Bitcoin reserve in 2025. He pointed to shifting political attitudes and increasing institutional adoption as drivers of the possibility. Read more →

Ethereum Foundation Outlines Privacy Roadmap

The Ethereum Foundation unveiled an ambitious plan for end-to-end privacy, covering private reads, writes, and proofs on the blockchain. The initiative aims to advance user confidentiality without compromising decentralization or scalability. Read more →

Arthur Hayes Exits Memecoins for Yield-Driven DeFi Bets

BitMEX co-founder Arthur Hayes announced he is leaving behind memecoins in favor of high-yield decentralized finance protocols. He has thrown support behind EtherFi, Ethena, and Hyperliquid, projecting returns as high as 130x, while still keeping Bitcoin in his portfolio. Read more →

Shibarium Bridge Loses $2.4M in Sophisticated Exploit

The Shibarium network’s cross-chain bridge suffered a flash-loan attack that drained $2.4 million. The exploit highlights ongoing security risks facing emerging layer-2 solutions and their DeFi ecosystems. Read more →

Coinbase Publishes Transparency Guide for Token Listings

Coinbase CEO Brian Armstrong announced a new “Guide to the Digital Asset Listing Process,” aimed at clarifying how tokens are evaluated for the exchange. He highlighted that applications are free, merit-based, and reviewed under uniform standards, with timelines varying from a few hours to several months based on complexity.

Monero Faces 18-Block Reorg, Raising Double-Spend Concerns

Monero (XMR) experienced an 18-block chain reorganization, prompting warnings for users to wait beyond the standard 10 confirmations when accepting payments. Security experts, including SlowMist’s Yu Xian, cautioned that neglecting reorg risks leaves the community vulnerable to double-spending, describing it as a looming “Damocles’ sword.”

Stablecoins Could Lose Tickers as Exchanges Abstract “USD” Backend

Helius CEO Mert Mumtaz predicted that US dollar stablecoins will eventually drop their individual tickers, with exchanges converting them invisibly so users only see “USD.” Tether co-founder Reeve Collins added that AI-driven agents will further simplify stablecoin use by automatically managing portfolios and yield-bearing tokens. Read more →

Solana Asset Manager SOL Strategies Debuts on Nasdaq

SOL Strategies, a Solana-focused asset management firm, has officially listed on Nasdaq. CEO John Carter said the company benefits from being “underestimated,” allowing it to carve out an edge as traditional markets embrace digital assets. Read more →

Capital Group Expands Bitcoin Exposure to $6 Billion

Investment giant Capital Group has grown its Bitcoin position to nearly $6 billion, largely through treasury stock gains. The move signals deepening institutional confidence in Bitcoin as a portfolio asset. Read more →

IRS Expands Surveillance of Crypto Investors

A Decrypt investigation revealed that the IRS is widening its surveillance of crypto activity, relying on blockchain analytics firms to track users. The agency’s approach raises questions about privacy and the boundaries of financial oversight. Read more →

Yala’s YU Stablecoin Struggles After Attack-Induced Depeg

The Bitcoin-backed YU stablecoin from Yala has struggled to maintain its peg following an exploit. Developers are working to stabilize the token, but investor confidence remains shaken. Read more →

Pump.fun Token Hits $3B Market Cap, Rivaling Kick and Rumble

Pump.fun’s token surged past a $3 billion market cap, with co-founder Alon Cohen claiming the platform is “nibbling the lunch” of rivals Rumble and Kick. The milestone underscores growing demand for crypto-powered social and streaming platforms.

Read more →

$500K Relief Fund Launched for Players of Failed Crypto Games

As blockchain games continue to shut down, a new $500,000 fund aims to help affected players recover some of their lost assets. Splinterlands, one of the longest-running crypto games, is leading the initiative. Read more →

Pakistan Opens Licensing Path for Crypto Firms

Pakistan’s crypto regulator is inviting firms to apply for licenses to serve its estimated 40 million potential users. The move could bring greater oversight and legitimacy to one of the world’s largest untapped crypto markets. Read more →

Native Markets Clinches USDH Ticker in Landmark Hyperliquid Vote

Native Markets secured the USDH stablecoin ticker after Hyperliquid validators backed its proposal, edging out rivals like Ethena and Paxos in one of the year’s most closely watched governance contests. The firm plans a phased rollout, starting with capped trial mints and redeems before opening a USDH/USDC order book, while pledging transparent reserves and shared yield to strengthen Hyperliquid’s ecosystem. Read more →

Galaxy Digital Builds $300M Solana Position

Galaxy Digital has accumulated a $300 million position in Solana, further cementing its bullish stance on the network. The move highlights institutional confidence in Solana’s role within the broader crypto ecosystem. Read more →

Bithumb to Temporarily Suspend Services for System Upgrade

Korean exchange Bithumb announced a scheduled service suspension to conduct system upgrades. The downtime will affect deposits, withdrawals, and trading, with users advised to complete transactions beforehand. Read more →

Binance Ends Support for OM Token on Select Networks

Binance said it will cease support for deposits and withdrawals of MANTRA (OM) on certain networks starting September 26, 2025. The change does not affect OM trading on the platform. Read more →

OKX Expands Into Australia’s Super Fund Market

Crypto exchange OKX announced its entry into Australia’s $1 trillion self-managed superannuation fund sector. The move aims to give retirement investors regulated access to digital assets. Read more →

Over $790M in Token Unlocks Set for Coming Week

Tokenomist reports that more than $790 million worth of tokens are scheduled to unlock in the next seven days. Major events include single unlocks above $5 million for assets like OP, ARB, and SEI, alongside daily linear unlocks topping $1 million for SOL, DOGE, AVAX, and others.

Arthur Hayes Predicts Bitcoin Could Surpass $200K, Rejects Four-Year Cycle Theory

BitMEX co-founder Arthur Hayes argued that global liquidity injections by central banks will drive Bitcoin well beyond traditional four-year cycle expectations. He forecasted BTC could reach $150K–$200K by the end of the 2020s, citing money printing and macroeconomic tailwinds as key catalysts.

Nemo Protocol Exploited via Debt Token Program

Nemo Protocol suffered an exploit tied to its debt token program, though full details on the attack remain under investigation. The incident highlights ongoing vulnerabilities in emerging DeFi platforms. Read more →

Ethereum Stablecoin Supply Hits Record $166B

The total supply of stablecoins on Ethereum has reached a record $166 billion. The milestone underscores Ethereum’s dominant role in stablecoin liquidity despite competition from other blockchains. Read more →

Monero Gains 7% Despite Chain Reorg

Monero’s price jumped more than 7% just hours after the network experienced an 18-block reorganization. The rally suggests resilient market sentiment despite renewed concerns over network security. Read more →

Forward Industries Expands Into Solana DeFi

Forward Industries announced new ventures targeting Solana-based DeFi protocols. The initiative reflects growing institutional interest in Solana’s ecosystem. Read more →

Monero’s Largest Reorg Wipes 36 Minutes of Transactions

Monero experienced its largest-ever blockchain reorganization, erasing 36 minutes of transaction history. Developers urged caution, recommending longer confirmation times to mitigate double-spend risks. Read more →

Polkadot DAO Votes to Cap DOT Supply

Polkadot’s community approved a governance proposal to cap the total supply of DOT tokens. The move aims to introduce greater predictability for investors and align long-term tokenomics. Read more →

London Stock Exchange Launches Blockchain Platform for Private Funds

The London Stock Exchange Group rolled out a blockchain-based platform designed to streamline access to private funds. The launch marks a major step in integrating distributed ledger technology into traditional finance. Read more →

Upbit Lists Boundless (ZKC) With Multiple Trading Pairs

Upbit announced the listing of Boundless (ZKC), which will be available on KRW, BTC, and USDT markets. The exchange also published guidelines for minimum order pricing.

Read more →

Hyperscale Data Unveils $100M Bitcoin Treasury Strategy

Hyperscale Data is committing $100 million to a Bitcoin treasury reserve as part of its shift toward becoming a pure-play AI and digital asset company. The firm said the strategy will align with its broader digital transformation. Read more →

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed