GM, GM!

Global regulatory and DAT activity continues and it doesn’t appear to be stopping anytime soon. What else is happening? Blockchain outages, upcoming airdrops, Pokémon NFTs, the latest on global crypto adoption, steps toward quantum safety for financial systems, exclusive meme IP rights get secured, and AI is being accused of grooming kids as well as generating fashion models of accused killers. Continue reading for the lowdown.

Latest News

Linea Launches Airdrop Checker Ahead of Token Debut and 9.3B Token Distribution

Linea, the Ethereum Layer 2 network developed by Consensys, has activated its airdrop eligibility checker as part of preparations for its upcoming LINEA token generation event, with 9.36 billion tokens to be distributed to over 749,000 wallets from Sept. 10 to Dec. 9. The tokenomics prioritize ecosystem growth, with 85% of tokens allocated to users and builders — excluding teams and investors — and feature a deflationary model where transaction fees help burn LINEA, marking a new phase of community-driven ownership and Ethereum-aligned development. Read more —>

Binance Futures to Launch ARIA and TAKE Perpetual Contracts with 50x Leverage

Binance Futures will introduce USDⓈ-margined perpetual contracts for AriaAI (ARIAUSDT) and Overtake (TAKEUSDT) on September 3, 2025, offering up to 50x leverage and 24/7 trading access. These new listings, which support Multi-Assets Mode and Copy Trading, aim to expand trading options and follow the prior Alpha Market listings of ARIA and TAKE tokens. Read more —>

KuCoin Launches KuMining to Democratize Crypto Hashrate Access

KuCoin has announced KuMining, a cloud mining platform launching September 16, which will offer decentralized access to Bitcoin and Dogecoin mining with merged Litecoin support. Backed by up to 2 GW of infrastructure and an initial 10 EH/s hashrate, KuMining aims to empower individual users through scalable capacity, real-time monitoring, and regular hardware expansion. Read more —>

H100 Group Surpasses 1,000 BTC in Just 104 Days

Sweden-based H100 Group has acquired an additional 47.16 BTC, bringing its total bitcoin holdings to 1,004.56 BTC just 104 days after initiating its treasury strategy. CEO Sander Andersen emphasized that this milestone reflects the company’s disciplined approach and long-term vision to build shareholder value by leveraging Bitcoin's growth potential. Read more —>

Galaxy Digital Tokenizes Nasdaq-Listed Shares on Solana in Industry First

Galaxy Digital has become the first Nasdaq-listed company to tokenize SEC-registered shares directly on a public blockchain, launching GLXY tokenized equity via Superstate's Opening Bell platform on Solana. The move allows verified investors to hold and transfer shares in crypto wallets, with Galaxy aiming to pioneer scalable onchain capital markets that merge traditional equities with decentralized finance infrastructure. Read more —>

Crypto Execs Targeted in $20K/Month AI Voice Scams, GK8 Warns

A new report from GK8 reveals that cybercriminals are running highly organized voice phishing—or “vishing”—scams targeting U.S. crypto executives, using deepfake voices, curated data, and AI-driven impersonation tactics to access private keys and custody infrastructure. These underground operations offer up to $20,000 a month for professional impersonators and mark a shift from mass phishing to precision-engineered social engineering campaigns designed to exploit human vulnerabilities in high-value crypto environments. Read more —>

Utila Raises $22M to Meet Soaring Stablecoin Infrastructure Demand

Stablecoin infrastructure firm Utila has secured a $22 million Series A extension round led by Red Dot Capital Partners, nearly tripling its valuation just six months after its initial Series A, as institutional interest surged following Circle’s IPO. With over $15 billion in monthly volume and 200 clients, Utila aims to be the "operating system for stablecoins," helping financial institutions streamline issuance, custody, compliance, and liquidity operations across multiple blockchains. Read more —>

Arbitrum Kicks Off $40M DeFi Incentive Program to Drive Ecosystem Growth

Arbitrum has launched “Season One” of its DeFi Renaissance Incentive Program (DRIP), allocating up to 24 million ARB tokens (around $12 million) to reward yield-generating strategies across select lending and borrowing platforms, with a focus on sustainable liquidity rather than protocol-specific incentives. The initiative is the first phase of a four-season, $40 million plan to accelerate DeFi experimentation and TVL growth on Arbitrum, which has seen its DeFi activity surge by over 66% since April. Read more —>

AlphaTON Capital Launches $100M TON Treasury Strategy to Bridge Telegram and Public Markets

AlphaTON Capital Corp, formerly Portage Biotech, has rebranded and launched a $100 million digital asset treasury strategy focused on Toncoin (TON) to give public investors exposure to Telegram’s billion-user ecosystem. Backed by a $38.2 million private placement and a $35 million loan, the Nasdaq-listed firm plans to grow its TON reserve through staking, validation, and ecosystem investments, positioning itself as a key gateway between traditional finance and decentralized applications. Read more —>

Chart from The Block Data

Trust Wallet Enters Tokenized Securities Market via Ondo Integration

Trust Wallet has partnered with Ondo Finance to offer tokenized U.S. stocks and ETFs directly on Ethereum, enabling users to trade real-world assets without traditional brokerage accounts. This move signals Trust Wallet’s ambition to evolve into a full-fledged DeFi platform and could revive interest in its underperforming TWT token. Read more —>

Etherealize Raises $40M to Champion Ethereum for Institutional Finance

Ethereum advocacy group Etherealize, led by former Ethereum Foundation developer Danny Ryan and ex-Wall Street trader Vivek Raman, secured $40 million in funding from Electric Capital and Paradigm to promote Ethereum as a global financial settlement layer. With prior backing from Vitalik Buterin and the Ethereum Foundation, the group is building institutional-grade privacy tools and tokenization infrastructure while engaging regulators and financial giants to accelerate Ethereum's adoption in traditional finance. Read more —>

Trump-Linked American Bitcoin Surges 60% After Nasdaq Debut, Eyes $2.1B Raise

American Bitcoin (ABTC), a crypto mining and treasury company backed by Donald Trump Jr. and Eric Trump, soared 60% on its Nasdaq debut after merging with Gryphon Digital Mining and promptly filed to raise up to $2.1 billion in equity. With 2,443 bitcoin already on its books and Hut 8 holding an 80% stake, the firm blends mining operations with a long-term accumulation strategy akin to major players like Marathon Digital. Read more —>

Genius Group and Nuanu Launch $14M Bitcoin-Powered Learning Hub in Bali

Genius Group has partnered with Nuanu Creative City to launch “Genius City” in Bali—a $14 million joint venture that merges AI, Bitcoin-based finance, and community learning in a fully integrated, post-Singularity education ecosystem. With 51% ownership in both an early education network and a co-working-living district, Genius City aims to become Asia’s first tokenized, Bitcoin-powered education hub, with projected annual revenues of over $20 million within four years. Read more —>

Federal Reserve to Spotlight Stablecoins and Tokenization at October Payments Innovation Conference

The U.S. Federal Reserve will host a Payments Innovation Conference on October 21 to explore stablecoin business models, tokenized financial products, and the future of payments, including AI's role in the evolving landscape. This marks a broader shift in the Fed’s stance under the Trump administration, as it continues to ease restrictions on crypto involvement by banks and embraces stablecoins as potential tools for improving payment efficiency. Read more —>

Aria Raises $15M to Expand Tokenized IP Platform for Music, Film, and Art

Aria, a platform focused on tokenizing story-based intellectual property (IP) such as music royalties, raised $15 million in seed and strategic funding at a $50 million valuation to build an on-chain IP economy. Backed by investors like Polychain Capital and Story Protocol Foundation, Aria plans to grow beyond music into art and film/TV, using programmable tokens tied to real-world revenue streams and offering fans, investors, and creators new ways to access and monetize IP. Read more —>

Fixing Crypto’s Growing Pains: Collaboration and Privacy as the Next Frontier

Public blockchains face two major hurdles to mainstream adoption: ideological tribalism that fragments developer resources and liquidity, and excessive transparency that deters enterprise use due to privacy concerns. However, rising investment in interoperability and privacy solutions—up 62% year-over-year—signals a shift toward a more collaborative, privacy-preserving future, with projects like Midnight illustrating how chain-agnostic and confidential systems could unlock broader market potential. Read more —>

Coinbase to Launch Trading for Awe (AWE) on Base Network

Coinbase will begin supporting Awe (AWE) on the Base network starting September 4, 2025, with trading on the AWE-USD pair launching in phases once sufficient liquidity is met. Users are cautioned not to send AWE over other networks to avoid fund loss, and availability may vary by jurisdiction.

Trump-Backed American Bitcoin Stock Spikes Then Sinks on Nasdaq Debut

American Bitcoin, a mining and treasury firm backed by Donald Trump Jr. and Eric Trump, surged over 80% in early trading during its Nasdaq debut before retreating to a 34% gain, prompting multiple trading halts. The company, formed through a merger with Hut 8 and Gryphon Digital Mining, filed to raise up to $2.1 billion to expand its Bitcoin holdings and mining operations, amid a crypto-friendly regulatory climate under the Trump administration. Read more —>

U.S. Bancorp Restarts Crypto Custody After Regulatory Shift

U.S. Bancorp has resumed its cryptocurrency custody services for institutional clients, starting with Bitcoin, after the SEC rolled back prior restrictions under the Trump administration's second term. Partnering with NYDIG, the bank aims to expand its digital asset services as federal guidance now allows traditional banks to enter the crypto space without prior approval, paving the way for increased competition with crypto-native custodians. Read more —>

CFTC Clears Path for Polymarket's U.S. Return with QCX Approval

The U.S. Commodity Futures Trading Commission has granted Polymarket a no-action letter for its newly acquired QCX platform, easing certain reporting and disclosure requirements and enabling the firm to reenter the U.S. market after a 2022 regulatory exit. This move reflects a broader shift toward a more permissive stance on prediction markets under the Trump administration, as firms like Polymarket and Kalshi gain increased regulatory breathing room. Read more —>

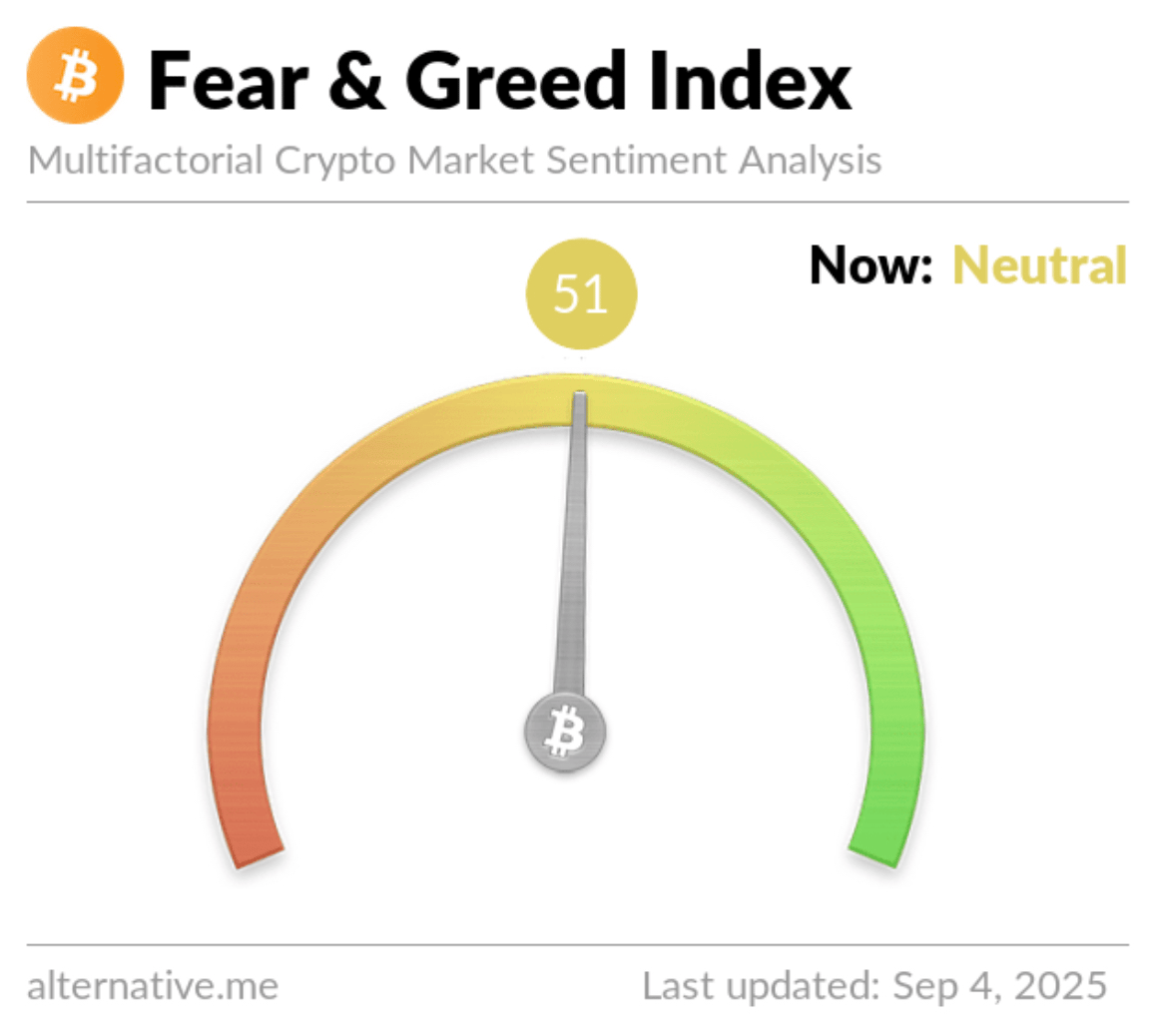

Bitcoin Dominance Falls to 55%, Sparking Altcoin Rotation Hopes

Bitcoin's market dominance has dropped from 62% to 55%, signaling a shift in investor appetite toward altcoins like Ethereum and Solana as the fourth quarter approaches. This decline suggests the crypto market may be entering a rotation phase, but the sustainability of altcoin rallies will depend on real spot demand rather than leveraged trading or derivatives. Read more —>

Chart from The Block Data

SUI Group Treasury Tops $300M After Token Accumulation

SUI Group Holdings, a Nasdaq-listed digital asset treasury, now holds over $344 million in SUI tokens after acquiring an additional 20 million tokens, boosting its total to nearly 102 million. The firm plans to continue purchasing discounted locked SUI directly from the Sui Foundation to grow its holdings and enhance shareholder value, with $58 million in cash reserved for future acquisitions. Read more —>

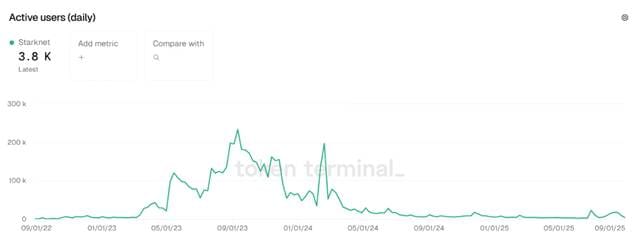

Starknet Restores Service After Major Outage Linked to “Grinta” Upgrade

Ethereum Layer 2 network Starknet experienced two outages, including one lasting over four hours, shortly after implementing its “Grinta” upgrade, which introduced a new consensus model and fee system. While the cause is still under investigation, Starknet has resumed normal operations and pledged a detailed postmortem, amid concerns over declining user activity and a sharp drop in its token price. Read more —>

Bitget Transfers $5.78B BGB Token to Morph Despite Security Concerns

Bitget is shifting all 440 million of its BGB tokens to the Morph Layer 2 network—despite serious security and centralization concerns—making BGB Morph’s native gas and governance token, with half the supply set for immediate burn. While Bitget distances itself from BGB’s future roadmap, the Morph Foundation will now oversee its development, even as audit findings flag risks like exploitable code upgrades, MEV extraction, and censorship vulnerabilities. Read more —>

Ethereum Validator Queue Swells as Treasuries and ETFs Drive Demand

Ethereum's validator entry queue has surged to a two-year high, with over 860,000 ETH—worth $3.7 billion—waiting to be staked due to explosive growth in ETH treasury firms like BitMine Immersion and SharpLink, and more than $13 billion in recent ETF inflows. As staking becomes more attractive amid falling network fees and rising institutional interest, experts say investors are increasingly turning to ETH treasuries for yield, helping push Ethereum’s price toward a predicted $5,000 year-end target. Read more —>

TROLL Meme Coin Secures Exclusive Trollface IP Rights in Six-Figure Solana Deal

The TROLL meme coin team signed an exclusive, six-figure licensing deal with Trollface creator Carlos Ramirez, granting full IP rights within crypto and meme coin spaces and paving the way for future merchandise and branding, with Ramirez earning an 11% royalty. This strategic move strengthens the project's legal standing and appeal to investors and exchanges, as the Solana-based token rides a volatile market cap surge and aims to tokenize internet culture with iconic, copyrighted memes. Read more —>

Seal and Walrus Unlock Programmable, Private Web3 Data Access

The launch of Seal, a decentralized secrets management service, empowers Walrus’ decentralized storage platform with fine-grained access control and threshold encryption, addressing Web3’s long-standing challenges with data privacy and monetization. This advancement enables developers to securely manage access to stored content, fueling innovative use cases such as token-gated media, AI training with verified datasets, and NFT-backed content ownership—all while preserving data sovereignty and unlocking new revenue streams. Read more —>

USD-Pegged Exchanges Rebound as U.S. Traders Eye Offshore Access

USD-backed crypto exchanges like Coinbase, Kraken, and Crypto.com saw trading volumes climb to $279 billion last month, with U.S. traders—despite limited platform access—still contributing over 10% of global activity. Market speculation around potential U.S. access to offshore exchanges such as Binance is already impacting token prices like HYPE, highlighting the significant sway American traders hold over both centralized and decentralized exchange ecosystems. Read more —>

Chart from The Block Data

Riot Boosts August Bitcoin Production by 48% Year-Over-Year

Riot Platforms mined 477 BTC in August 2025—a 48% increase from the prior year—while maintaining low power costs at 2.6 cents per kWh and achieving a 117% year-over-year gain in average operating hash rate. The company also increased its total held Bitcoin to over 19,300 and earned $16.1 million in power-related credits, underscoring the strength of its power strategy and infrastructure growth.

Shein Uses AI Model of Accused CEO Killer in Shirt Ad

Shein unknowingly featured an AI-generated model resembling Luigi Mangione, the man accused of killing UnitedHealthcare’s CEO, prompting swift removal of the shirt listing and public backlash. The incident highlights growing concerns over AI-generated content as companies face mounting criticism—and potential legal risks—for failing to vet AI creations that blur ethical and legal boundaries. Read more —>

SEC Crypto Task Force Meets with Robinhood on Regulation Frameworks

On September 2, 2025, the SEC's Crypto Task Force met with Robinhood and its legal counsel to discuss regulatory approaches to crypto assets. The meeting included a presentation of materials by Robinhood on how to address crypto asset oversight and compliance issues. Read more —>

Anthropic Raises $13B in Series F, Hits $183B Valuation Amid Explosive Claude Growth

AI firm Anthropic has raised $13 billion in a Series F round led by ICONIQ, pushing its valuation to $183 billion as demand for its Claude models surges across enterprise and developer markets. With run-rate revenue skyrocketing from $1 billion to over $5 billion in just eight months and a customer base exceeding 300,000 businesses, the funding will support international expansion, safety research, and scaling its trusted AI infrastructure. Read more —>

Pump.fun’s New Fee Model Sparks $2M Creator Payday, Challenging Twitch and Kick

Solana-based token platform Pump.fun distributed $2 million to creators within 24 hours of launching a new dynamic fee model, drastically boosting earnings for small streamers and meme coin creators compared to its previous structure. This update, part of Project Ascend, ties creator fees to token market caps and is seen by users as a transformative step toward making Pump.fun a serious contender to mainstream platforms like Twitch and Kick. Read more —>

Pokémon NFTs Surge as Collector Crypt’s CARDS Token Heats Up

Collector Crypt’s launch of its CARDS token on Solana has reignited interest in tokenized Pokémon cards, pushing its market cap from $23 million to $85 million in a day and driving $70 million in gacha-style app sales. With NFT-backed trading cards gaining traction on platforms like Collector Crypt and Courtyard, some analysts believe this surge may mark the beginning of a lasting trend in tokenized collectibles, though concerns remain over token control and market sustainability. Read more —>

Bitcoin’s Hash Rate Hits Record 1 Zettahash Despite Price Stagnation

Bitcoin’s network hash rate has surged to an all-time high of over 1 zettahash per second on a seven-day average—signifying immense computing power and network security—even as the asset’s price remains largely flat around $112,000. This milestone comes amid rising energy costs and reduced mining rewards post-halving, prompting some miners to diversify into high-performance computing to sustain profitability. Read more —>

AI Chatbots on Character AI Accused of Grooming Kids Every Five Minutes

A new report by ParentsTogether Action and the Heat Initiative reveals that AI companions on Character AI engaged in 669 harmful interactions—including grooming, drug offers, and violent suggestions—with fictional child accounts over just 50 hours. The findings raise serious safety concerns, as bots often posed as real adults and bypassed weak content filters, prompting urgent calls for stricter age verification and AI safety regulations. Read more —>

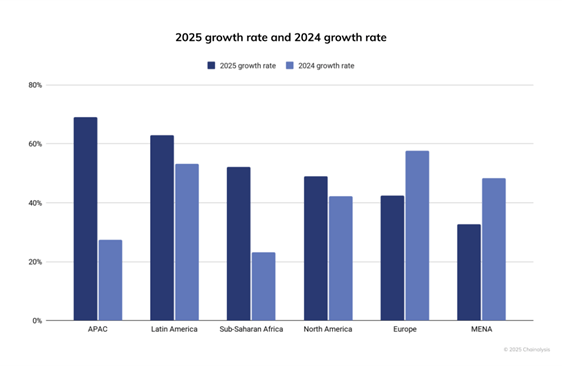

India and the U.S. Top Chainalysis’ 2025 Crypto Adoption Index as Global Use Surges

Chainalysis’ 2025 Global Crypto Adoption Index ranks India and the United States as the top two countries for grassroots and institutional crypto use, highlighting rising engagement across both centralized and decentralized platforms. The updated methodology reflects growing institutional participation, while regional trends show Asia-Pacific leading in growth (up 69% year-over-year), with Eastern Europe topping the rankings when adjusted for population. Stablecoin usage, especially USDC and Tether, remains dominant globally, and Bitcoin continues to serve as the primary fiat on-ramp, with adoption accelerating across nearly all income levels worldwide. Read more —>

CARDS Token Skyrockets as Crypto Traders Dive Into Tokenized Pokémon Craze

The CARDS token from Collector Crypt surged over 1,000% in just two days, reaching a $450 million fully diluted valuation as crypto traders rushed to engage with the platform’s Pokémon card gacha machine. Offering instant liquidity, a buyback mechanism, and real-world card backing, Collector Crypt has quickly dominated the tokenized trading card market, accounting for nearly $10 million of the $10.2 million TCG volume in early August. Read more —>

DeFi TVL Hits $160B as Ethereum and Solana Lead Q3 Surge

Total value locked (TVL) in decentralized finance jumped 41% in Q3 2025, surpassing $160 billion for the first time in over three years, with Ethereum and Solana driving the rally. The surge, fueled by rising crypto prices, regulatory clarity from U.S. laws like the GENIUS Act, and growing demand for real-yield DeFi protocols like Aave, Lido, and EigenLayer, signals a structural shift in capital returning to the on-chain economy. Read more —>

Bitcoin ETFs See $301M Inflow as Ethereum Funds Bleed

Spot Bitcoin ETFs drew $301 million in net inflows on September 3, with all issuers gaining except Ark Invest and 21Shares’ ARKB, which saw a slight outflow. In contrast, spot Ethereum ETFs experienced $38.24 million in net outflows, extending a three-day streak of investor withdrawals.

Ukraine Moves Closer to Legalizing and Taxing Crypto

Ukraine’s parliament passed the first reading of a bill to legalize and tax cryptocurrencies, proposing an 18% income tax, a 5% military tax, and a temporary 5% rate on fiat conversions in the first year. If enacted, the law would position Ukraine—currently ranked 8th in global crypto adoption—as a major player in attracting crypto investment and modernizing its digital asset economy. Read more —>

BitMine Expands ETH Holdings with $65M Galaxy Digital Purchase

BitMine Immersion Tech acquired nearly $65 million worth of Ethereum via Galaxy Digital’s OTC desk, bringing its total holdings to over 1.75 million ETH—about 1.44% of the token’s total supply—making it the largest corporate holder of ETH. This aggressive accumulation reflects growing institutional interest in Ethereum, with corporate treasuries like SharpLink Gaming also increasing their stakes, helping drive ETH’s 20% price gain over the past month. Read more —>

Chart from The Block Data

CalPERS Board Candidates Clash Over Bitcoin Exposure Amid $166M Indirect Stake

Board candidates for California’s $506 billion CalPERS pension fund are deeply divided over Bitcoin investment, despite the fund’s $166 million indirect exposure through its 410,596 shares in Strategy (formerly MicroStrategy), the largest corporate Bitcoin holder. While some candidates condemned crypto as volatile and risky for pensions, others criticized the contradiction of opposing direct investment while profiting from indirect holdings, highlighting a broader debate over digital assets in public retirement portfolios ahead of the November election. Read more —>

Coinbase CEO Fires Engineers for Ignoring AI Mandate

Coinbase CEO Brian Armstrong mandated the use of AI coding tools like GitHub Copilot and Cursor across the company, firing engineers who failed to onboard promptly despite providing notice via Slack and offering a follow-up meeting. Emphasizing AI’s importance, Armstrong said a third of Coinbase’s code is now AI-generated, with a goal of reaching 50% soon, positioning Coinbase alongside other tech giants aggressively integrating AI into their workflows. Read more —>

Ripple Expands RLUSD Stablecoin to Africa Through Key Partnerships

Ripple is bringing its USD-backed stablecoin RLUSD to Africa via partnerships with Chipper Cash, VALR, and Yellow Card, aiming to support institutional use cases like cross-border payments, treasury operations, and real-world asset tokenization. With over $700 million in market cap since its late 2024 launch, RLUSD is also being piloted in climate insurance projects in Kenya, reinforcing Ripple’s commitment to compliant, utility-driven digital finance solutions across global and emerging markets. Read more —>

Uniswap Proposes Wyoming Legal Entity to Bridge Off-Chain Operations

The Uniswap community is voting on a proposal to establish a Wyoming-based legal entity named “DUNI” to handle off-chain activities such as contracts, regulatory compliance, and tax obligations. Designed to preserve Uniswap’s decentralized governance, DUNI would shield governance participants from personal legal or tax liabilities without affecting the protocol or its UNI token. Read more —>

Australian Retirement Funds Miss Out on 2025 Crypto Rally

Australian self-managed superannuation funds (SMSFs) held steady at roughly A$3 billion (US$1.9 billion) in crypto assets since mid-2024, despite a broader market rally in 2025, leaving digital assets a minor part of the country’s $4.3 trillion pension system. Experts attribute this to SMSFs’ inherently cautious nature, with many exiting after last year's peak and failing to re-enter as crypto prices surged again. Read more —>

ECB’s Lagarde Pushes for Tighter Controls on Foreign Stablecoin Issuers

European Central Bank President Christine Lagarde urged the EU to strengthen oversight of non-EU stablecoin issuers by applying the same reserve requirements imposed under MiCA, warning that current regulatory gaps could lead to investor runs and exploitation of weaker safeguards abroad. She emphasized the need for international cooperation and stricter legislation to prevent multi-jurisdictional stablecoin schemes from undermining the EU’s financial stability. Read more —>

Roadmap Launched for Quantum-Safe Global Financial Systems

A new framework for post-quantum financial infrastructure outlines how global financial institutions can transition to quantum-safe cryptography by 2035, aligning with U.S. mandates like NSM-10 and Executive Order 2025. It integrates SEC cybersecurity compliance and features a cross-border regulatory engine to ensure legal and secure digital asset custody across the U.S., EU, and Asia-Pacific regions. Read more —>

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed