Here’s your Monday rundown acroos crypto, AI, blockchain, and more!

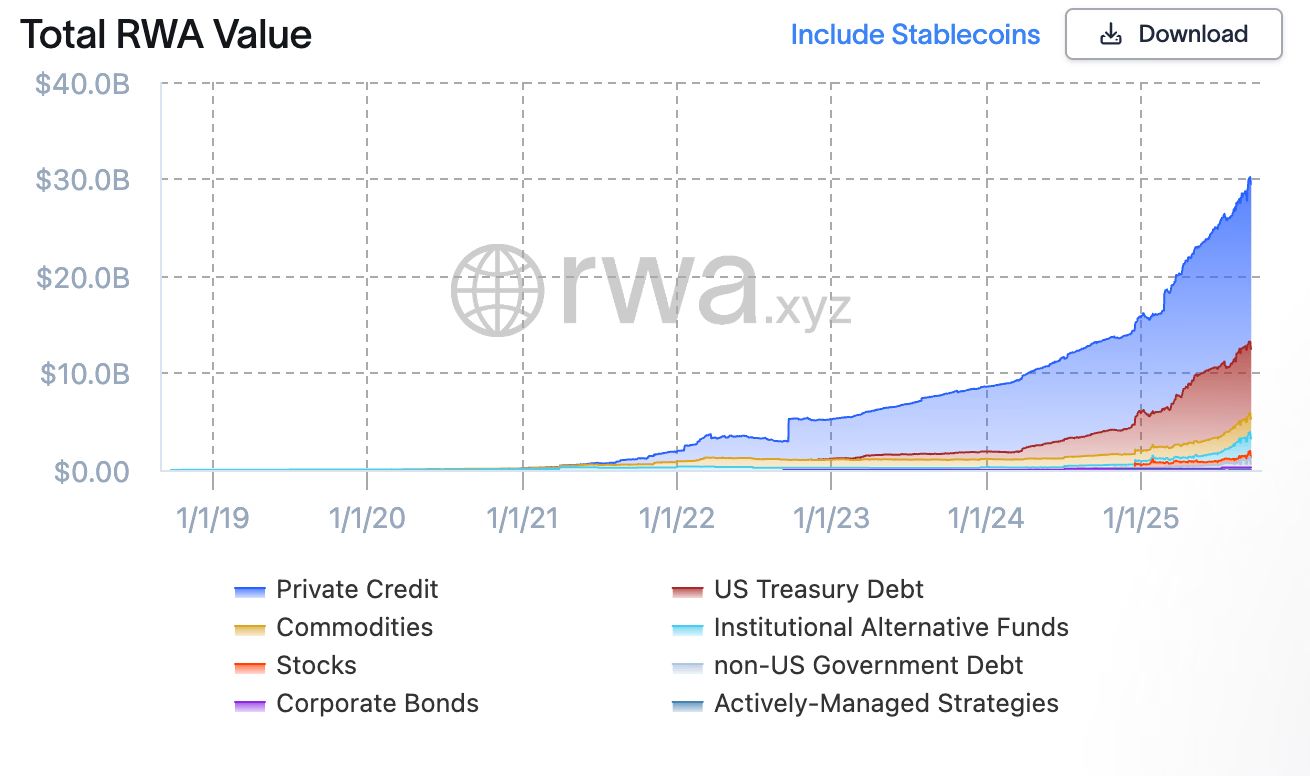

The week kicks off with big headlines. MetaMask is teasing a token launch while its new stablecoin, mUSD, hits $65M in supply in just one week. Arthur Hayes stirred backlash Monday morning for selling $5.1M in HYPE tokens to buy a Ferrari—then defended his move in a blog post. Meanwhile, Crypto.com faces heat after a Bloomberg investigation uncovered undisclosed past hacks, raising transparency concerns. Over on X, the platform vows legal action against banned crypto scammers bribing employees. And in other news, tokenized real-world assets have now topped $30B, led by Treasuries and private credit from institutions like BlackRock and Fidelity.

Let’s dive in →

Latest News

DeepMind AI Unlocks New Insights Into Century-Old Fluid Dynamics Puzzle

Google’s DeepMind has used artificial intelligence to uncover mathematically verified solutions to the Navier-Stokes equations, one of science’s most enduring unsolved problems. By identifying new patterns in fluid behavior, the breakthrough could reshape fields from aircraft design and climate modeling to astrophysics, while showcasing AI’s role as a partner in fundamental scientific discovery. Read more →

Rekt Drinks Hits 1 Million Cans Sold with MoonPay Collaboration

Web3 beverage startup Rekt Brands has sold its 1 millionth can of sparkling water, marked by a sold-out drop of its MoonPay-themed “Moon Crush” flavor. The milestone underscores the brand’s growing momentum through selective crypto partnerships, blending real-world consumer appeal with tokenized rewards and rapid market growth. Read more →

Trump and Xi Advance TikTok Talks, Plan South Korea Summit

President Trump and Chinese President Xi Jinping signaled progress on a TikTok deal during their first call in three months, agreeing to meet in South Korea in late October to discuss trade, fentanyl, and the Russia-Ukraine war. While Trump declared the TikTok agreement “well on its way,” key questions over ownership, algorithm control, and congressional approval remain unresolved. Read more →

FTX to Distribute Another $1.6 Billion to Creditors in Bankruptcy Payout

Collapsed crypto exchange FTX will begin its third round of repayments on Sept. 30, sending $1.6 billion to creditors across both retail and institutional classes. While many users are set to recover more than their original balances, some remain frustrated that payouts are in cash rather than crypto, which has since rebounded in value. Read more →

X Targets Bribery Scheme Tied to Crypto Scammers and Criminal Networks

X announced legal action against banned users, including crypto scammers, who attempted to bribe employees to restore suspended accounts, linking the scheme to a wider criminal network known as “The Com.” The company said it is working with law enforcement as authorities warn the group is growing more sophisticated in online fraud and money laundering. Read more →

Rabby and MetaMask Stir Hype With Token Teasers Amid Wallet Competition

Ethereum wallets Rabby and MetaMask are hinting at potential token launches as competition intensifies, with both platforms integrating features like in-app derivatives trading. The speculation follows renewed interest in wallet tokens after Trust Wallet’s rally, though past disappointments like Consensys’ Linea launch have left some traders cautious. Read more →

Bitmine Expands Ethereum Holdings With $69M Purchase

Tom Lee’s Bitmine acquired 15,427 ETH worth $69 million from Galaxy Digital, bringing its total Ethereum holdings to $8.66 billion. The move further cements Bitmine as one of the largest institutional holders of ETH.

Hypurr NFT Floor Surges to $100K Ahead of Official Launch

Hyperliquid’s unreleased Hypurr NFTs, awarded to the platform’s top traders, are trading for six figures on OTC markets, with recent sales topping $80,000. Speculation over future perks like token airdrops and fee reductions is fueling demand, despite the collection not yet being distributed to eligible users. Read more →

Grayscale Pushes Dogecoin ETF Forward With Revised Filing

Grayscale has submitted an updated S-1 to the SEC to convert its Dogecoin Trust into an ETF, proposing Coinbase as custodian and aiming to list the product on NYSE Arca under the ticker GDOG. At the same time, NYSE Arca filed to shift Grayscale’s Ethereum trusts under newly approved ETF standards, part of a broader wave of crypto fund activity following recent SEC approvals. Read more →

Remilia Unveils Milady Social Platform Aimed at “Chan Culture Diaspora”

NFT collective Remilia has launched RemiliaNET, a profile and achievement system that assigns users a public “social credit score,” with plans to expand it into RemiliaChat—a full-fledged social media rival to X. The project, rooted in Milady’s internet subculture, promises algorithm-driven feeds, tokenized rewards, and minimal moderation while seeking to reclaim online spaces for its community. Read more →

Tokenized Real-World Assets Cross $30B as Institutions Drive Growth

The on-chain tokenized real-world assets market has surpassed $30 billion, led by private credit and U.S. Treasuries, with institutional products from BlackRock, Fidelity, and others fueling adoption. Analysts say the sector is moving beyond experimentation, with tokenization poised to expand into infrastructure assets and potentially unlock new use cases for stablecoins and even Bitcoin. Read more →

Souce: rwa.xyz

Flora Growth Secures $401M to Rebrand as ZeroStack and Build $0G AI Treasury

Flora Growth Corp. announced a $401 million funding round, including a $22.9 million investment from DeFi Development Corp., to launch an AI-driven digital asset treasury anchored by the $0G token. The company will rebrand as ZeroStack, adopt $0G as its primary reserve asset, and expand its role in decentralized AI infrastructure after demonstrating breakthroughs in distributed model training. Read more →

BitGo Reveals Soaring Revenues Ahead of U.S. IPO

Crypto custody firm BitGo reported a near fourfold jump in revenue to $4.19 billion in the first half of 2025 as it filed for a U.S. IPO, aiming to list on the NYSE under the ticker BTGO. The filing comes amid a surge of successful crypto listings, growing institutional adoption, and renewed investor appetite for digital asset infrastructure. Read more →

BlackRock Leads Strong ETF Inflows for Bitcoin and Ethereum

U.S. spot Bitcoin ETFs logged $223 million in net inflows on Sept. 19, with BlackRock’s IBIT alone bringing in $246 million. U.S. spot Ethereum ETFs added $47.75 million, almost entirely driven by BlackRock’s ETHA, which saw $144 million in single-day inflows.

Coinbase CEO Sees Crypto Market Bill as Unstoppable Momentum

Coinbase CEO Brian Armstrong said he has “never been more bullish” on the Digital Asset Market Clarity Act after a week in Washington, where he observed strong bipartisan backing for the crypto market structure bill. Framing it as a “freight train leaving the station,” Armstrong argued the legislation will cement U.S. crypto innovation, prevent regulatory overreach, and give clarity on the roles of the SEC, CFTC, and other agencies. Read more →

Caliber Bets on Chainlink to Power On-Chain Business Operations

Arizona-based asset manager Caliber has added over $6.7 million worth of Chainlink (LINK) to its treasury, positioning the token as a core asset instead of Bitcoin or Ethereum. CEO Chris Loeffler said Chainlink’s institutional adoption and utility make it uniquely valuable, with plans to leverage its oracle network to automate valuations, improve transparency, and eventually integrate real-world asset data on-chain. Read more →

Circle Unveils Arc: A Blockchain Purpose-Built for Stablecoin Finance

Circle, the issuer of USDC, has launched Arc, a new Layer-1 blockchain designed to address limitations of existing networks by offering deterministic settlement, stable fee structures in USDC, and optional privacy features tailored for institutional use. Rolling out through 2026, Arc integrates Circle’s interoperability tools and compliance-focused design to position itself as an enterprise-grade hub for stablecoin-native financial applications. Read more →

SEC Filing Lays Out Three New 2x Leveraged Crypto ETFs Under Tidal Trust II

Tidal Trust II filed a post-effective amendment to register three leveraged funds—the Quantify 2X Daily All Cap Crypto ETF, Alt Season Crypto ETF, and AltAlt Season Crypto ETF—each seeking 200% of the daily performance of an actively managed crypto target portfolio via swaps, options, futures, and ETPs. The prospectus stresses these are short-term trading vehicles with significant risks from leverage, compounding, and volatility, and details eligibility criteria (initially BTC, ETH, SOL, and XRP), Cayman subsidiary use, rebalancing, and potential for total loss on severe down days. Read more →

Saylor Blames Bot Army for Strategy Stock Slump as Chanos Fires Back

Michael Saylor claims short sellers are funding bot networks to smear Strategy, the $97 billion Bitcoin treasury firm he co-founded, as its shares hit a five-month low despite relatively stable Bitcoin prices. Legendary short seller Jim Chanos, one of Strategy’s most vocal critics, dismissed the allegation and renewed his attacks on the company’s leveraged Bitcoin strategy, likening it to the excesses of the 2021 SPAC boom. Read more →

Pew Survey Finds Americans Torn Between AI’s Convenience and Human Costs

A new Pew Research survey of 5,000 U.S. adults shows that while 73% are open to AI assisting with daily tasks, most fear it will erode creativity and relationships, with half now “more concerned than excited” about the technology—up sharply from 37% in 2021. Younger Americans, despite greater exposure, express the most pessimism, and overall trust in AI companies continues to decline, fueling widespread calls for stronger regulation and clearer safeguards. Read more →

Source: Pew Research Center

Senate Democrats Push for Greater Role in Shaping Crypto Market Bill

A group of 12 Senate Democrats, including Kirsten Gillibrand and Cory Booker, urged Republicans to adopt a bipartisan authorship process for the Clarity Act, the GOP-led crypto market structure bill already passed by the House. Their call follows the release of a Democratic framework that emphasizes stronger CFTC oversight, clearer SEC boundaries, and stricter ethics rules for lawmakers, setting up a potential clash over how digital assets should be regulated. Read more →

Vitalik Buterin States Why Low-Risk DeFi Could Become Ethereum’s Core Revenue Engine

A new essay by Vitalik Buterin argues that low-risk decentralized finance—payments, savings, collateralized lending, and synthetic assets—may play the same role for Ethereum as search did for Google: a dependable revenue generator that sustains a broader ecosystem. With security risks reduced and stable applications emerging, low-risk DeFi now offers both economic alignment with Ethereum’s goals and global value in democratizing access to mainstream financial assets, positioning it as a cultural and financial cornerstone for the network’s future growth. Read more →

Tether CEO Hails USDT Adoption as Major Brands Accept USDT in Bolivia

Tether chief Paolo Ardoino announced that Toyota, BYD, and Yamaha now accept USDT payments in Bolivia, framing the stablecoin as a “digital dollar” for emerging markets. The move follows the Bolivian central bank’s report that crypto transactions hit $430 million in the past year—up 630% since the country lifted its crypto ban in 2024.

Binance Adds 0G to HODLer Airdrops, Lists Decentralized AI L1 on Sept. 22

Binance’s 42nd HODLer Airdrop features 0G (a decentralized AI L1), rewarding users who held BNB in Simple Earn and/or On-Chain Yields during Sept 15–17 (UTC) with 3,000,000 0G, ahead of spot listing on Sept 22, 2025 at 10:00 UTC (deposits open Sept 21 at 11:00 UTC; pairs: USDT, USDC, BNB, FDUSD, TRY; Seed Tag). Tokenomics note a 1B-genesis supply with 3.5% annual inflation (circulating 213,243,998 0G at listing, ~21.32%), plus 18.5M 0G earmarked for future marketing, and a 4% BNB holding cap for rewards. Read more →

$7B Bitcoin Fraud Trial in London Puts Spotlight on Crypto Crime Enforcement

UK prosecutors are set to begin trial against Chinese national Qian, accused of holding Bitcoin tied to a vast $7 billion fraud, in one of the largest crypto crime cases ever seen in the country. While the Crown Prosecution Service is avoiding direct fraud charges due to the activity’s roots in China, experts say focusing on unlawful possession and transfer of crypto could make a conviction more achievable, though civil recovery of the seized 61,000 BTC remains a formidable legal battle likely bound for the UK Supreme Court. Read more →

Cointelegraph’s Top 10 Bitcoin-Friendly Destinations for Global Crypto Travelers

From El Salvador’s Bitcoin Beach to Switzerland’s Crypto Valley, a growing number of countries now let tourists pay for hotels, dining, and activities directly in Bitcoin. Leading destinations like Portugal, Singapore, and Dubai offer tax perks, BTC ATMs, and crypto-friendly merchants, while emerging hotspots such as Bhutan showcase sustainable mining and expanding adoption—making 2025 a breakthrough year for Bitcoin tourism. Read more →

Source: Cointelegraph

Bloomberg: Teen Hacker Breached Crypto.com Employee Account, Exposing User Data

A Bloomberg investigation revealed that Crypto.com suffered a previously undisclosed breach when teenage hacker Noah Urban, part of the Scattered Spider group, and an accomplice phished their way into an employee account, exposing some user data but not customer funds. The incident, which occurred before Urban’s FBI arrest in 2023, raises fresh criticism—particularly from blockchain analyst ZachXBT—over Crypto.com’s history of security lapses and lack of transparency about such breaches. Read more →

EU Ministers Agree on Roadmap for Digital Euro, But Launch Still Years Away

EU finance ministers have struck a compromise with the ECB and European Commission to shape the rollout of a digital euro, positioning it as both a payments tool and a sovereignty move against U.S.-dominated networks. While legislation may be in place by 2026, issuance could take up to three more years amid political skepticism, banking concerns, and debates over privacy and financial stability risks. Read more →

DAT Fundraising Boom Cools as Market Shifts to Execution and Consolidation

Digital asset treasury (DAT) firms have raised more than $20 billion in 2025, but investors say the wave of mega-rounds has likely peaked, with future raises smaller and focused on scaling rather than formation. With many DATs now trading at or below net asset value, consolidation is expected, while liquidity challenges and NAV compression put pressure on weaker firms—setting the stage for M&A, structured capital strategies, and a pivot toward DeFi yields, stablecoins, and real-world asset products as the next VC focus. Read more →

South Korea Sees Record Surge in Crypto Crime Reports

South Korean crypto firms filed 36,684 suspicious transaction reports between January and August 2025—already exceeding the combined total of the previous two years, according to Yonhap News. The Korea Customs Service said ₩9.56 trillion ($6.8B) in virtual asset-related crimes have been referred to prosecutors since 2021, with over 90% tied to underground remittances. Read more →

Binance co-founder Changpeng “CZ” Zhao’s edtech project Giggle Academy has collected over $1.3 million in donations within 12 hours, largely from trading fees tied to the newly launched $GIGGLE memecoin. The funds will support Giggle Academy’s mission to provide free K–12 education—including finance, blockchain, and AI courses—to children in developing countries, with CZ aiming to reach up to a billion students worldwide. Read more →

Kaia and LINE NEXT to Launch Stablecoin-Powered Super-App on LINE Messenger

Kaia, formed by merging Kakao’s Klaytn and LINE’s Finschia networks, is teaming up with LINE NEXT to roll out Project Unify, a stablecoin-based super-app embedded in LINE Messenger, which serves nearly 200M users across Japan, Taiwan, and Thailand. Launching in beta later this year, the app will unify payments, remittances, DeFi services, and multi-currency stablecoin support, aiming to streamline fragmented Asian payment systems while complying with evolving regional regulations, including South Korea’s upcoming stablecoin framework. Read more →

Upbit Lists SUN on KRW and USDT Markets

Upbit announced it will list Sun (SUN), a Tron-based DeFi platform token, on both the KRW and USDT markets starting September 22, 2025, at 12:00 KST. SUN, which powers governance and staking across SunSwap, Stable Swap, and Sun DAO, will support deposits and withdrawals exclusively via the Tron network, with initial trading restrictions applied to ensure liquidity and compliance with Korea’s Travel Rule. Read more →

Metaplanet Expands Bitcoin Treasury to Over 25,000 BTC

Tokyo-listed Metaplanet disclosed the purchase of 5,419 BTC for $632.5 million at an average price of $116,724, bringing its total holdings to 25,555 BTC. The firm has now invested $2.71 billion in Bitcoin at an average acquisition cost of $106,065 per coin as of September 22, 2025.

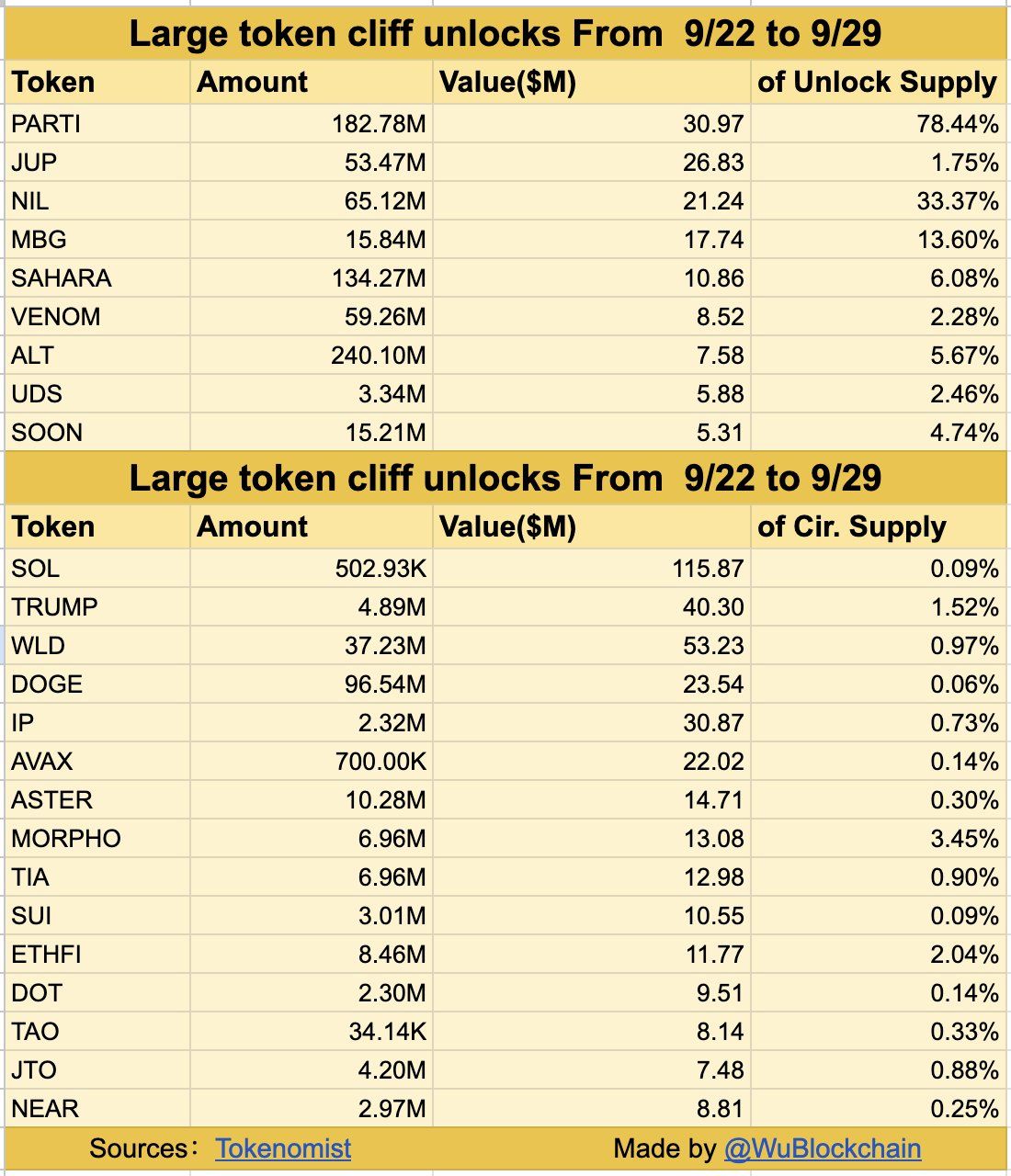

Over $517M in Token Unlocks Set for Coming Week

Tokenomist reports that more than $517 million worth of tokens will be unlocked in the next seven days, including major one-time events over $5M for PARTI, JUP, NIL, MBG, SAHARA, VENOM, ALT, UDS, and SOON. In addition, large daily linear unlocks above $1M are expected for SOL, WLD, TIA, DOGE, TAO, AVAX, SUI, DOT, NEAR, and others, potentially adding significant supply pressure to markets.

Source: Tokenomist, Wu Blockchain

Bitcoin Slips Below $114.5K as Post-Fed Rally Fades, Traders Weigh Next Moves

Bitcoin dipped to $114,467 late Sunday, down from last week’s $118K high, as enthusiasm over the Fed’s 25 bp rate cut gave way to caution over uncertain macroeconomic signals. Analysts describe sentiment as “nervous optimism,” with long-term holders steady, short-term traders restless, and catalysts such as ETF approvals or sovereign adoption still seen as potential sparks for the next rally. Read more →

Uniswap Tops $1T Annual Volume, Eyes Record Quarter

Uniswap’s trading activity has already surpassed $270 billion in Q3 2025, putting it on pace for its highest-ever quarterly volume, according to Token Terminal. CEO Hayden Adams also confirmed that the platform has crossed $1 trillion in annual trading volume for the first time, marking a major milestone for the decentralized exchange.

Crypto.com CEO Denies Allegations of Undisclosed Data Leak

Crypto.com chief Kris Marszalek dismissed reports of a hidden user data breach as “unfounded,” insisting the exchange informed regulators about a 2023 security incident. His response comes amid renewed scrutiny of exchange transparency following recent media claims of undisclosed vulnerabilities.

Perp DEX Sector Sees 10x Surge in Mindshare, Led by Emerging Protocols

Data from Dexu AI shows that perpetual decentralized exchanges (Perp DEXs) recorded a tenfold spike in mindshare in September, far outpacing other crypto sectors. The fastest-rising protocols over the past week include Aster, Lighter, Avantis, Extended, and Paradex.

Arthur Hayes Warns of Massive HYPE Token Unlock Overhang

In his article “HYPE’s Damocles Sword,” Arthur Hayes revealed he sold 96,600 HYPE, citing concerns over the upcoming 237.8M token unlock starting Nov. 29, 2025—worth $11.9B over two years, or about $500M monthly. With current buybacks covering just 17% of that supply, he warned of a $410M monthly overhang despite DATs like Sonnet raising nearly $900M in HYPE and cash combined. Read more →

Ronin Treasury to Buy Back $4.6M in RON, Cutting Supply by 1.3%

Starting Sept. 29, the Ronin Treasury will swap its ETH and USDC holdings for $4.6 million worth of RON, reducing the token’s circulating supply by 1.3% and boosting treasury reserves. The move comes as Ronin repositions itself as an Ethereum layer-2, aiming to realign its ecosystem with builders and users after years of decline following its 2022 bridge hack. Read more →

MetaMask’s mUSD Stablecoin Hits $65M Supply in First Week

MetaMask’s newly launched mUSD stablecoin has grown to a $65 million circulating supply just a week after launch, with 88% deployed on Linea and 12% on Ethereum, per Dune Analytics. Issued via Stripe’s Bridge platform and backed 1:1 by liquid dollar assets, mUSD enters a $279.8B stablecoin market as regulatory momentum builds under the U.S. GENIUS Act. Read more →

UAE Joins Global Crypto Tax Reporting Pact, Launches Industry Consultation

The UAE has signed on to the OECD’s Crypto-Asset Reporting Framework, committing to automatic tax information exchanges with global authorities starting in 2028 after firms comply with new rules by 2027. To shape the rollout, the Ministry of Finance has opened an eight-week consultation through November 8, seeking industry input as the country strengthens its standing as a crypto hub while aligning with international transparency standards. Read more →

$1.7B in Crypto Liquidations as Bitcoin Drops to $112.9K

Crypto markets faced $1.7 billion in liquidations over the past 24 hours, with $1.62 billion from long positions and more than $1 billion wiped out in just four hours, per Coinglass data. The selloff, triggered by Bitcoin’s 2.5% dip to $112,890 and Ethereum’s 6.2% slide, fueled forced closures for over 404,000 traders, underscoring waning momentum in the broader bull cycle. Read more →

B HODL Lists in London After Raising $20.7M for Bitcoin Treasury Strategy

B HODL Plc, a UK-based bitcoin treasury firm, debuted on the Aquis Stock Exchange after raising £15.3M ($20.7M) through new share issuance. Backed by CoinCorner (14.3%) and Blockstream CEO Adam Back (25.5%), the company aims to build a large BTC treasury and generate revenue via Lightning Network liquidity and routing fees. CEO Freddie New called the listing a “landmark moment,” making B HODL the UK’s first firm dedicated from inception to bitcoin accumulation. Read more →

Bitget Launches 25 U.S. Stock Perpetual Futures With Up to 25x Leverage

Bitget has introduced 25 USDT-margined perpetual futures contracts for major U.S. stocks, offering up to 25x leverage, low fees (≤0.06%), and 24/5 trading. The lineup includes Tesla, Apple, NVIDIA, Amazon, MicroStrategy, Coinbase, and more, marking the first stock index futures with aggregated price feeds for added transparency and safety. Read more →

China Tells Brokers to Halt RWA Tokenization in Hong Kong Amid Digital Asset Surge

China’s securities regulator has informally told some local brokerages to pause real-world asset (RWA) tokenization in Hong Kong, citing risk management concerns as enthusiasm for digital assets surges offshore. The move contrasts with Hong Kong’s push to become a crypto hub, where tokenization and stablecoin initiatives are booming despite Beijing’s cautious stance. Read more →

Midas and Axelar Launch Tokenized XRP Yield Product (mXRP)

Midas and Axelar have launched mXRP, a tokenized XRP product offering a 6–8% base yield paid in XRP, with potential returns above 10% when used in DeFi. Built on the XRPL EVM sidechain with Axelar interoperability, mXRP is positioned as a “perpetual buyer” of XRP, aiming to unlock dormant supply, fuel DeFi activity on XRPL, and become the highest-yielding XRP product on the market. Read more →

AgriFORCE Rebrands as AVAX One, Plans $550M Raise to Become First NASDAQ Avalanche-Focused Company

AgriFORCE Growing Systems (Nasdaq: AGRI) will rebrand as AVAX One and raise $550M to accumulate over $700M in AVAX tokens, making it the first NASDAQ-listed company dedicated to Avalanche exposure. Backed by leaders from Coinbase, SkyBridge, and Hivemind Capital, the firm aims to build the “Berkshire Hathaway of onchain finance,” combining AVAX accumulation with acquisitions of fintechs migrating to Avalanche. Read more →

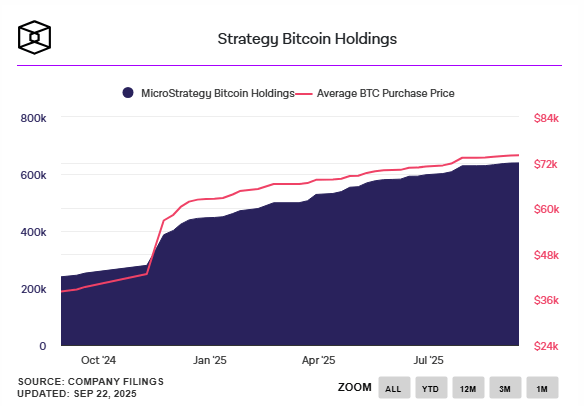

Strategy Adds $100M in Bitcoin, Holdings Top 639,800 BTC

Strategy (formerly MicroStrategy) purchased 850 BTC for $99.7M, raising its total holdings to 639,835 BTC worth ~$72B, acquired at an average of $73,971 per coin. The firm continues to fund acquisitions via stock and preferred share programs under its expanded $84B “42/42” plan, despite recent S&P 500 exclusion and growing scrutiny over valuation and treasury models. Read more →

Chart from The Block Data

Chart from The Block Data

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed