Institutions Shift Toward Ethereum, Boosting Altcoin Market Momentum

It’s been a busy 24 hours in crypto and tech, starting with El Salvador adding 8 BTC to its national holdings, now totaling over 6,243 BTC. Meanwhile, the Altcoin Season Index has surged from 29 to 47, as the total altcoin market cap climbs to $1.55 trillion, fueled in part by rising institutional interest in Ethereum. Spot ETH ETFs posted record $2.18 billion inflows last week, outpacing Bitcoin’s $2.39 billion, while ETH perpetual open interest has jumped to $28 billion, indicating a strong wave of bullish positioning. Whale traders are making bold moves as well, such as wallet 0x1b…72D6 acquiring 45 CryptoPunks in minutes, sending the floor price up over 15%.

Institutions continue to shift toward crypto and high-growth tech, with the Ohio Public Employees Retirement System increasing its stakes in Palantir and MicroStrategy while trimming its Lyft position. The trend reflects broader investor confidence in Bitcoin- and Ethereum-heavy strategies, highlighted by firms like Strategy (formerly MicroStrategy), which now hold large reserves of BTC despite growing concerns over market volatility and funding risks. Meanwhile, Block Inc. will officially join the S&P 500 on July 23, sending its stock up 10% as its crypto ventures like Bitkey and Cash App gain recognition. Ethereum also made headlines with its upcoming Fusaka upgrade set for November and the release of “The Torch” NFT to celebrate its 10-year anniversary.

In broader tech and policy, AI developments are reshaping multiple industries. Netflix used AI-driven VFX to dramatically reduce production time on “The Eternaut,” while OpenAI CEO Sam Altman announced plans to deploy over one million GPUs by year- end.

Jack Dorsey's new offline messaging app, Bitchat, also drew attention for offering censorship-resistant communication via Bluetooth mesh networks, proving particularly useful in disaster zones and areas with limited connectivity. Meanwhile, Bedrock Robotics raised $80 million to automate heavy construction equipment, aiming to ease U.S. labor shortages and improve worksite safety.

Regulatory developments remain top of mind globally. In Spain, BBVA became the first traditional bank to launch a fully integrated retail crypto platform under the EU’s MiCA framework. In the U.S., banking groups are pushing back against crypto firms like Circle and Ripple seeking federal banking charters, while Thailand’s SEC is collecting feedback on relaxing ICO investor requirements. Stateside, over 25 U.S. states are exploring or advancing Bitcoin reserve legislation, with New Hampshire and Texas leading the way. On the global stage, Conflux Network is launching yuan-pegged stablecoins in partnership with Chinese firms, aiming to service Belt and Road countries amid growing demand for sovereign-backed digital currencies.

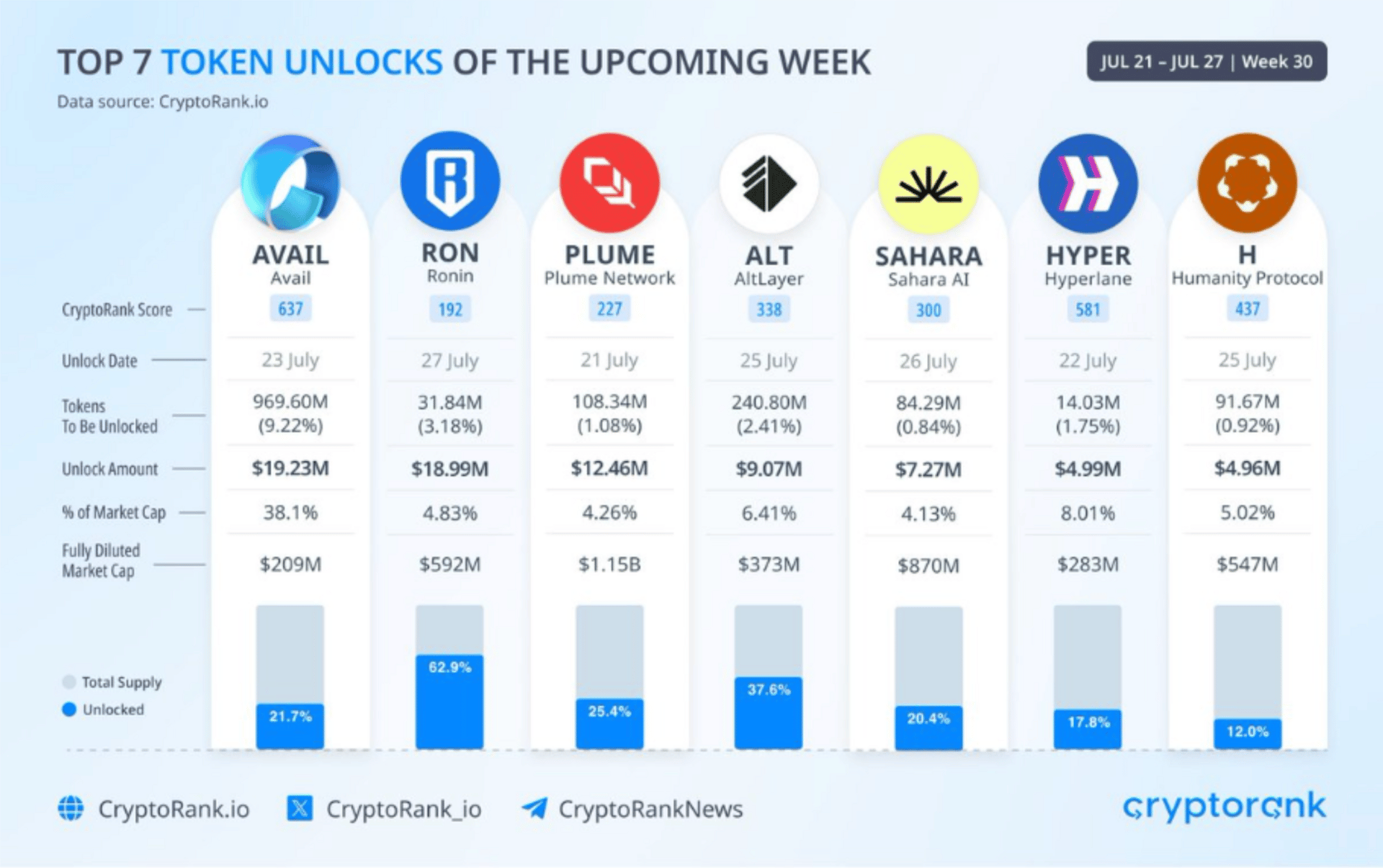

All of this comes amid rising token unlock activity for AVAIL, SOL, DOGE, TRUMP, TAO, SUI, SEI, WLD, AVAX, and other tokens; with over $442 million set to hit the market in the coming week.

All of this comes amid rising token unlock activity for AVAIL, SOL, DOGE, TRUMP, TAO, SUI, SEI, WLD, AVAX, and other tokens; with over $442 million set to hit the market in the coming week.

Share this newsletter with two friends and get a personal shout-out here 🗣

Must be subscribed