It’s already Wednesday. Time is flying!

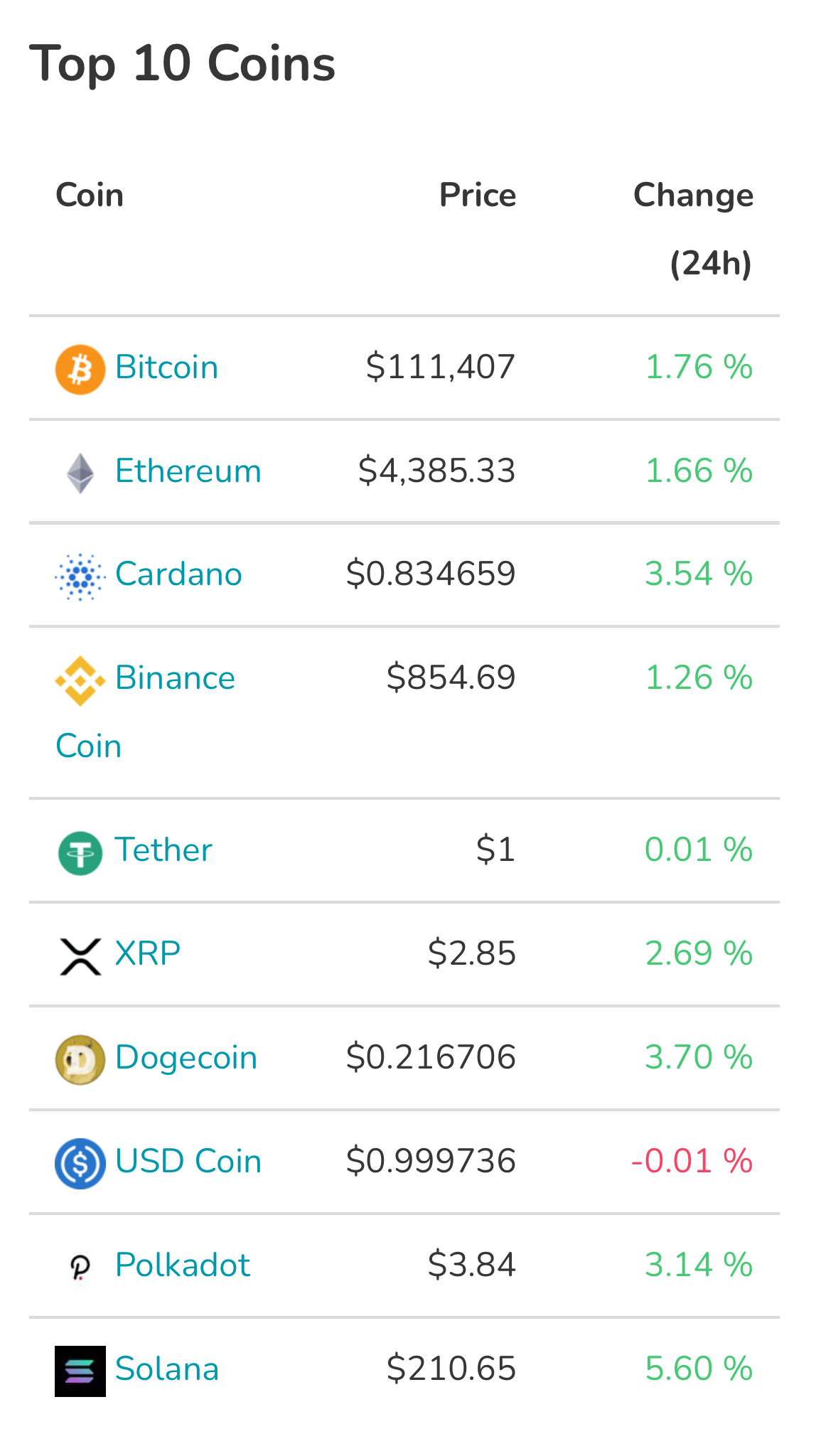

Lots of news on DATs accumulating crypto for their treasuries, crypto IPOs, the growing momentum of DeFi and RWAs, and Trump’s expedited ruling request to the Supreme Court on key tariffs. Shall we begin?

Latest News

Philippines Eyes Blockchain to Boost Budget Transparency

The Philippine government is considering two separate Senate proposals to place its national budget on a blockchain-based system, aiming to improve transparency, reduce corruption, and enable real-time tracking of public spending. Spearheaded by Senators Mark Villar and Bam Aquino—with the latter advocating for Polygon-based infrastructure—the initiatives would create tamper-proof records of disbursements and potentially position the Philippines as a leader in blockchain-based governance, despite political and technical hurdles. Read more —>

Coincheck to Acquire France’s Aplo in Global Expansion Push

Japanese crypto exchange Coincheck plans to acquire French institutional brokerage Aplo in October, marking its first European acquisition as it expands beyond Japan. The deal aims to boost Coincheck’s international presence, enhance institutional offerings, and aligns with broader consolidation trends in the crypto industry, with Aplo’s full team remaining onboard and its MiCA licensing efforts continuing. Read more —>

Bitget Upgrades BGB Token to Morph Blockchain for Governance and Gas

Bitget is transforming its BGB exchange token into the native asset on Ethereum Layer 2 network Morph, where it will function as both a gas token and governance mechanism while maintaining its exchange utility. As part of the move, Bitget transferred $2.3 billion worth of BGB to the Morph Foundation—half of which was burned—while Morph aims to capitalize on Bitget's vast user base and integrate BGB into consumer-focused decentralized applications. Read more —>

Mu Digital Aims to Onboard Asia’s $20T Credit Market to DeFi

Mu Digital, led by ex-investment bankers, is building a decentralized finance platform to unlock Asia’s institutional credit markets for everyday Web3 users by offering liquid, composable yield products backed by real-world assets. Backed by the Cointelegraph Accelerator, the team aims to tokenize sovereign, corporate, and private credit into permissionless DeFi primitives—bringing sustainable yield, broader access, and deeper liquidity to the onchain economy. Read more —>

Crypto.com and Underdog Launch Sports Prediction Markets in 16 States

Crypto.com Derivatives North America has partnered with fantasy sports platform Underdog to launch federally compliant sports prediction markets across 16 U.S. states, focusing on areas like California and Texas where traditional sports betting is not yet legalized. The new platform will allow users to trade on real-time outcomes of major sports events via the Underdog app, expanding access to prediction markets amid ongoing regulatory debates. Read more —>

Strategy Inc. Adds 4,048 BTC, Total Holdings Reach 636,505 BTC

Strategy Inc. has acquired an additional 4,048 Bitcoin, bringing its total holdings to 636,505 BTC, according to a Form 8-K filed with the U.S. Securities and Exchange Commission on September 2, 2025. The acquisition underscores Strategy’s continued commitment to its Bitcoin treasury strategy, making it one of the largest corporate holders of the digital asset globally. Read more —>

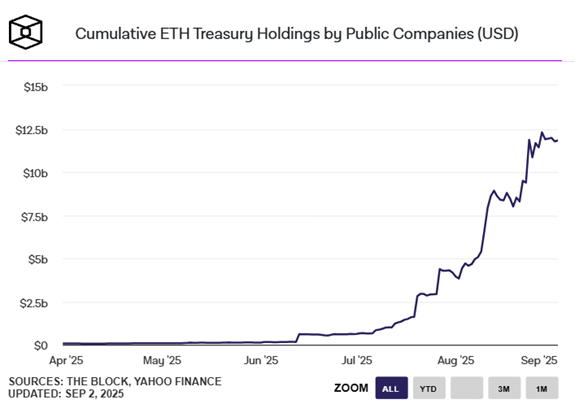

SharpLink Grows ETH Holdings to 837K, Earns 2,318 ETH in Staking Rewards

SharpLink Gaming has increased its Ether holdings to 837,230 ETH, now valued at over $3.6 billion, after purchasing 39,008 ETH at an average price of $4,531 during the week ending August 31, 2025. The company also reported total staking rewards of 2,318 ETH since launching its treasury strategy in June and raised $46.6 million through its At-the-Market facility that week. Read more —>

Winklevoss Twins' Gemini Files for IPO, Eyes Nasdaq Listing Under 'GEMI'

Crypto platform Gemini has announced plans to go public with an initial offering of 16.67 million Class A shares, priced between $17 and $19, and aims to list on the Nasdaq under the ticker "GEMI." The offering, led by Goldman Sachs and Citigroup, is pending SEC approval and market conditions, with additional shares available for over-allotment. Read more —>

Yunfeng Financial Buys $44M in ETH as Part of Web3 Strategy

Yunfeng Financial Group has purchased 10,000 ETH for $44 million using internal funds, marking a strategic move to integrate Web3, real-world asset tokenization, and AI into its financial services. The company sees Ethereum as key infrastructure for future innovation and plans to explore ETH’s role in insurance and digital finance while closely monitoring market and regulatory developments. Read more —>

CEA Industries Expands BNB Holdings to 388,888 tokens, Eyes 1% Supply by Year-End

CEA Industries has boosted its Binance Coin (BNB) holdings to 388,888 tokens worth $330 million as it works toward acquiring 1% of BNB’s total supply by the end of 2025. The company’s focused strategy aims to capitalize on BNB’s rising ecosystem momentum and deflationary model, potentially scaling its treasury to over $1.25 billion through future warrant exercises. Read more —>

Avalon Labs Brings Bitcoin Lending to Rootstock in BTCFi Expansion

Avalon Labs has launched its Bitcoin-collateralized lending platform on Rootstock, aiming to become the network’s largest lending market while advancing Bitcoin DeFi (BTCFi) infrastructure. The integration strengthens Rootstock’s growing ecosystem and may help Avalon recover from past TVL declines, signaling renewed momentum for both platforms. Read more —>

BNB Whale Loses $13.5M in North Korea-Linked Phishing Scam

A Binance Smart Chain whale lost $13.5 million in tokens after falling for a phishing attack likely linked to North Korea’s Lazarus Group, though Venus Protocol—where the funds were held—remains uncompromised. Security firms and partners including Binance, PeckShield, and ZeroShadow are working with the victim to recover the funds, but recovery remains uncertain. Read more —>

The Ether Machine Nears 500K ETH with $654M August Raise

The Ether Machine secured a $654 million investment in August—150,000 ETH from Ethereum advocate Jeffrey Berns—bringing its total holdings to nearly 500,000 ETH and solidifying its position as the third-largest ETH treasury. With over $2.5 billion in committed capital and plans for another $500 million fundraising round led by Citibank, the company is accelerating toward its upcoming Nasdaq listing. Read more —>

Source: The Block Data

ETHZilla Plans to Deploy $100M in ETH to EtherFi, Expands DeFi Treasury Strategy

ETHZilla announced it will deploy $100 million to EtherFi’s liquid restaking protocol, marking its first step into DeFi to enhance on-chain yields while supporting Ethereum’s security. With 102,246 ETH accumulated at an average price of $3,948.72, the company aims to lead institutional treasury innovation by integrating decentralized finance into its long-term asset strategy. Read more —>

Strategy Qualifies for S&P 500, Eyes September Inclusion

Strategy (formerly MicroStrategy) has met all criteria for potential inclusion in the S&P 500 following a record-breaking Q2, with $10 billion in net income and significant gains from its bitcoin holdings. If selected during the September rebalancing, Strategy would become the first bitcoin-treasury company in the index—highlighting the growing convergence between digital assets and traditional equities. Read more —>

Strategy Increases Annual Dividend on $STRC Preferred Shares to 10%

Strategy (MSTR) has raised the annual dividend rate on its $STRC variable rate Series A preferred stock from 9% to 10%, enhancing yield for shareholders amid its record earnings and growing bitcoin-backed balance sheet. The move signals the company’s confidence in its financial position and aims to attract more institutional capital.

CleanCore and Dogecoin Foundation Launch First-Ever Official DOGE Treasury with $175M Raise

CleanCore Solutions (NYSE: ZONE) has secured $175 million through a private placement backed by over 80 institutional and crypto-native investors to establish the first Dogecoin treasury officially supported by the Dogecoin Foundation and House of Doge. With Alex Spiro as Chairman and DOGE set as the company’s primary reserve asset, the initiative aims to drive institutional adoption, enhance Dogecoin utility, and set a precedent for foundation-aligned digital asset treasuries in public markets. Read more —>

Asia Backs BNB, Wall Street Bets on SOL: Wu Blockchain

Digital Asset Treasury (DAT) companies are increasingly allocating corporate capital into cryptocurrencies, with BNB treasuries gaining traction in Asia through Binance-aligned funding, while U.S. firms and investment banks are structuring Solana-focused DATs using Wall Street mechanisms like PIPEs and reverse mergers. Despite shared strategies of leveraging public vehicles for crypto exposure, the two camps differ in capital sources, execution styles, and ecosystem priorities—raising investor scrutiny over transparency, custody, and dilution risks. Read more —>

Ethena Nears Profit-Sharing Milestone as USDe Supply Hits $12B

Ethena’s USDe stablecoin has surged to $12.43 billion in supply, overtaking competitors like DAI and positioning the protocol as the fifth-largest in DeFi, with $61 million in August revenue. With two of three key milestones now met, Ethena is prioritizing integration on top centralized exchanges to activate its highly anticipated fee switch—unlocking profit-sharing for ENA token holders—as it continues to offer high yields despite mounting scrutiny over its unconventional collateral strategy. Read more —>

SonicStrategy Secures $40M Investment to Bolster Nasdaq Uplisting Plans

SonicStrategy has secured a $40 million USD investment from Sonic Labs in the form of convertible debt funded in Sonic tokens, marking a strategic move toward a planned Nasdaq Capital Markets listing. The deal strengthens SonicStrategy’s treasury and validator operations, while aligning long-term interests between the public-facing company and the foundation behind the Sonic blockchain, with all converted equity subject to a three-year lock-up. Read more —>

B3 Launches XRPL Gamechain to Bring Crypto Gaming to the XRP Ledger

B3 Network is expanding its crypto gaming platform from Ethereum’s Base to the XRP Ledger with the launch of XRPL Gamechain, aiming to drive on-chain engagement through casual mobile games and XRP-based rewards. In collaboration with XRPL Commons, B3’s Xcade arcade will offer weekly game updates, tournaments, and incentives to grow active participation and create new utility for XRP beyond simple token holding. Read more —>

Metaplanet Wins Shareholder Approval for $3.8B Bitcoin War Chest Expansion

Metaplanet Inc., Japan’s leading Bitcoin treasury company, has received shareholder approval to issue up to ¥555 billion ($3.8 billion) in preferred shares to fund its goal of increasing its Bitcoin holdings fivefold to 100,000 by the close of 2026, and hold 210,000 tokens by the end of 2027. The move comes amid a steep stock price correction and marks a shift toward new capital-raising strategies, with Eric Trump making an appearance at the shareholder meeting as both a strategic adviser and promoter of the Trump-linked WLFI token. Read more —>

Linea Unveils ‘Ignition’ Program with 1B Token Liquidity Incentives

Linea has launched its “Ignition” incentive program, distributing 1 billion LINEA tokens to boost liquidity on Etherex, Aave, and Euler. The initiative leverages Brevis’ zero-knowledge tech—Coprocessor and Pico ZKVM—for fully trustless, off-chain reward calculations verified on-chain through succinct proofs.

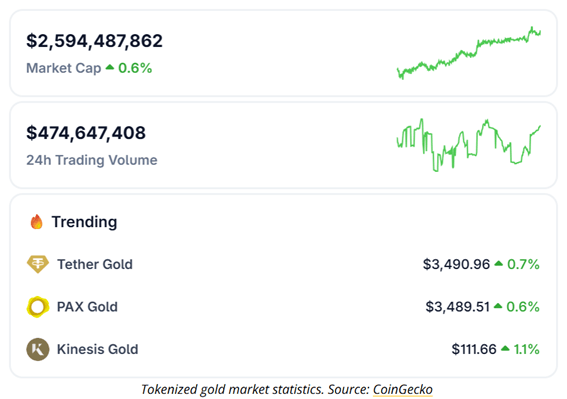

$1.6B SmartGold-Chintai Deal Brings Tokenized Gold to U.S. IRAs

SmartGold and Chintai have partnered to tokenize $1.6 billion in vaulted gold, enabling U.S. investors to hold and leverage gold-backed assets in self-directed IRAs while preserving tax advantages. The tokens, backed one-to-one with physical bullion, can be used as collateral in DeFi protocols like Morpho and Kamino, reflecting growing demand for tokenized real-world assets amid rising gold prices and economic uncertainty. Read more —>

Kraken Brings Tokenized U.S. Stocks to Ethereum via xStocks

Kraken has partnered with tokenization firm Backed to launch tokenized U.S. equities and ETFs on Ethereum through the xStocks platform, enabling 24/7 trading of major stocks like Apple and Tesla for non-U.S. users. While xStocks recently surpassed $500 million in transaction volume onchain, analysts say its real value lies in validating tokenized equities as a growing use case within decentralized finance. Read more —>

Ondo Global Markets to Launch With 100+ Tokenized Equities on Ethereum

Ondo Global Markets is set to launch on Sept. 3, 2025, offering more than 100 tokenized U.S. stocks and ETFs directly on Ethereum. This expansion allows global investors 24/7 access to traditional equities through blockchain-based assets, enhancing capital efficiency and composability within the DeFi ecosystem.

Figure and Gemini Target Nearly $900M in Crypto IPO Surge

Crypto firms Figure and Gemini are aiming to raise a combined $887 million through upcoming IPOs, with Figure seeking $526 million and Gemini up to $361 million, signaling renewed momentum in the digital asset public listing space. While Figure reports strong growth and profitability tied to its Provenance blockchain platform, Gemini’s IPO follows deepening losses, but could position it as the third U.S.-listed crypto exchange after Coinbase and Bullish. Read more —>

Project Ascend Unveils Dynamic Fees to Supercharge Pump.fun Ecosystem

Pump.fun has launched Project Ascend, a major upgrade featuring Dynamic Fees V1, a tiered fee model that boosts creator earnings and accelerates community growth without harming traders. By tying Creator Fees to a coin's market cap and streamlining application processes, the platform aims to 100x engagement, attract top talent, and establish itself as the go-to hub for creators and startups on Solana.

From Lightsaber to Ledger: Why Belief Is the Next Asset Class According to Loxley Fernandes

The upcoming auction of Darth Vader’s lightsaber—expected to sell for up to $3 million—highlights how prediction markets can transform cultural events into tradeable financial assets, allowing anyone to profit from their knowledge or convictions. As platforms like Myriad create liquid markets for information, the financialization of belief signals a broader shift where data, sentiment, and speculation become core components of the next generation of finance. Read more —>

Crypto Gains as Trump Tariff Ruling and Fed Cut Bets Shake Markets

Cryptocurrency markets saw modest gains Tuesday as Bitcoin, XRP, and Solana rallied on investor optimism around a possible Fed rate cut in September and legal uncertainty following a court decision that invalidated parts of Trump’s tariff regime. Despite rising liquidation volumes and ETF outflows, the broader risk-on sentiment and speculation over macro policy shifts kept crypto assets buoyant, with total market cap reaching $3.9 trillion. Read more —>

Improbable Launches Somnia Blockchain and SOMI Token After Raising $270M

SoftBank-backed Improbable has launched the mainnet for its high-speed Layer 1 blockchain, Somnia, and its native SOMI token, following a testnet that handled over 10 billion transactions and attracted 118 million wallet addresses. Purpose-built for large-scale DeFi, gaming, and social applications, Somnia enters the market with backing from $270 million in combined capital and more than 70 ecosystem partners, signaling Improbable’s full pivot into real-time metaverse infrastructure. Read more —>

BitMine Now Controls $8.1B in Ethereum, Aiming for 5% Supply

BitMine Immersion Technologies has acquired 153,000 ETH worth $655 million, boosting its total Ethereum holdings to 1.86 million ETH—roughly 1.5% of the total supply—as it works toward owning 5% of all ETH in circulation. Backed by Fundstrat’s Tom Lee, the Las Vegas-based firm is positioning Ethereum as the foundational asset for future financial rails and AI infrastructure, outpacing even the Ethereum Foundation in ETH ownership. Read more —>

Source: CoinGecko

Trump Vows to Appeal Tariff Ruling, Calls It Economic Emergency

Former President Donald Trump labeled a recent federal court decision overturning key tariffs as "an emergency" and warned of severe economic consequences if the ruling stands. He pledged to file an appeal as early as Wednesday, arguing the decision threatens U.S. economic stability.

Coinbase Unveils Hybrid Futures Index Combining Big Tech and Crypto ETFs

Coinbase announced the launch of its Mag7 + Crypto Equity Index Futures, offering traders exposure to a mix of top tech stocks—including Apple, Tesla, and Nvidia—alongside BlackRock’s Bitcoin and Ethereum ETFs and Coinbase shares, each weighted equally. The move marks Coinbase’s first diversified index product on its U.S. derivatives platform and aims to boost trading activity amid a slowdown in spot volumes, with trading set to begin on September 22. Read more —>

Venus Protocol Votes to Liquidate Hacker, Recover $13.5M After Phishing Attack

Following a phishing attack that enabled a hacker to steal $13.5 million from a Venus Protocol user, the DeFi platform's stakeholders swiftly voted to liquidate the attacker’s position and return the stolen funds. The move reflects a growing trend in decentralized finance where protocols intervene through governance to reverse malicious exploits and protect user assets. Read more —>

Pudgy Penguins’ Mobile Game “Pudgy Party” Tops App Store Rankings

Pudgy Penguins’ new mobile game Pudgy Party shot to the top of Apple’s iOS racing game charts just three days after its launch, marking another milestone in the NFT brand’s mainstream expansion. With physical toys in major retailers, a book deal, and a high-value NFT collection, Pudgy Penguins continues to blend digital and physical IP, while its associated PENGU token now holds a $2.3 billion fully diluted valuation. Read more —>

Kevin Spacey’s Film Comeback Tied to Accused Crypto Scammer

Kevin Spacey’s new sci-fi film The Portal of Force, unveiled at the Venice Film Festival, was directed by Spacey and written by Vladimir Okhotnikov, a Russian crypto entrepreneur indicted by the DOJ for allegedly orchestrating a $300 million DeFi Ponzi scheme through Forsage. Despite Okhotnikov facing charges in the U.S., the film—with a star-studded cast including Dolph Lundgren and Tyrese Gibson—marks Spacey’s directorial return and reflects Okhotnikov’s libertarian philosophy amid his pivot to a metaverse wellness venture. Read more —>

Bitcoin Miners Hit Record Valuations by Pivoting to AI

Publicly traded Bitcoin miners saw their combined market cap reach an all-time high of over $39 billion in August, driven in part by their expansion into high-performance computing (HPC) for artificial intelligence, according to JP Morgan. As mining profitability declines due to rising costs and reduced block rewards, firms like Hut 8 and HIVE are developing new energy-intensive data centers to diversify revenue, though some industry players remain cautious about the long-term demand for HPC services. Read more —>

SEC and CFTC Greenlight Spot Crypto Trading on Registered Exchanges

In a joint statement, the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) announced they will permit certain spot crypto assets to be traded on registered exchanges, signaling a coordinated push to integrate digital assets into the traditional financial system. This marks a significant regulatory shift under the Trump administration, as both agencies prepare to engage with platforms while Congress continues to deliberate a broader crypto market structure bill. Read more —>

Ethereum Foundation to Gradually Convert 10K ETH for Funding Initiatives

The Ethereum Foundation announced it will convert 10,000 ETH through centralized exchanges over the coming weeks to support ongoing research, grants, and donations. To minimize market impact, the conversions will be executed in smaller incremental orders rather than one large transaction.

Retail Interest in Memecoins Rises Again, but Mania Still Distant

Google searches for "memecoin" have climbed to a score of 57, indicating a renewed but moderate level of retail interest compared to January’s peak frenzy during the TRUMP memecoin surge. While the resurgence hints at growing attention, the lack of hype from influencers and a more developed infrastructure suggest a potentially more stable phase for memecoin speculation. Read more —>

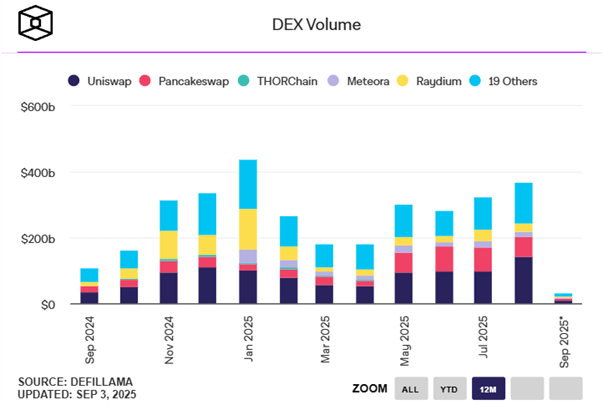

Source: The Block Data

CIMG Inc. Sells $55M in Stock for 500 Bitcoin as Part of Long-Term Crypto Strategy

CIMG Inc. has completed the sale of 220 million shares of common stock for $55 million, accepting payment in 500 Bitcoin as part of its plan to build a long-term digital asset reserve. The company aims to integrate more deeply with the blockchain and AI ecosystems and sees this move as a strategic step toward leading innovation in Bitcoin finance. Read more —>

SEC Crypto Task Force Engages Robinhood on Tokenized Asset Regulations

The SEC's Crypto Task Force met with Robinhood on September 2 to explore regulatory frameworks surrounding crypto assets. Discussions focused on the trading of tokenized securities, non-security digital assets, and the potential for tokenizing traditional securities within existing legal guidelines. Read more —>

Binance to Delist BAKE, HIFI, and SLF Tokens on September 17

Binance will remove BakeryToken (BAKE), Hifi Finance (HIFI), and Self Chain (SLF) from all spot trading pairs and related services on September 17, 2025, following its latest asset review assessing factors like development activity, liquidity, and regulatory compliance. Users are urged to close positions and withdraw these tokens before support phases out across services—including margin trading, Simple Earn, and Binance Pay—culminating in the end of withdrawals by November 17. Read more —>

Judge Spares Chrome in Google Antitrust Case, Mandates Data Sharing

A U.S. federal judge ruled that Google can keep its Chrome browser but must adopt regulatory remedies to curb its dominance in online search and advertising, including sharing portions of its search index and user data with competitors. The decision reflects a shift toward softer antitrust enforcement—favoring contractual reforms and data access over forced breakups—as Google faces growing pressure from AI-powered rivals and increasing scrutiny of its integrated tech ecosystem. Read more —>

Bitcoin ETFs Regain Momentum with $332M Inflows as Ethereum Sees Outflows

Bitcoin ETFs attracted $332.7 million in net inflows on Tuesday—led by Fidelity and BlackRock—overtaking Ethereum ETFs, which saw $135.3 million in net outflows. The shift suggests institutional investors are reallocating toward Bitcoin for its perceived stability, even as Ethereum’s yield appeal and treasury adoption continue to underpin long-term interest. Read more —>

India’s Stablecoin Stalemate Risks Trillions as Asian Rivals Surge Ahead

India's crypto ecosystem remains paralyzed by bureaucratic gridlock, leaving the country behind in the regional stablecoin race as nations like Japan, South Korea, and Hong Kong rapidly deploy regulatory frameworks and pilot programs. Despite the potential to save $68 billion annually through stablecoin integration, India’s top talent has largely moved abroad, and banks remain hesitant to proceed without clear guidance from the Reserve Bank, while experts urge the government to act swiftly or risk missing the next wave of global digital finance leadership. Read more —>

Bessent to Begin Fed Chair Interviews Friday

Treasury Secretary Scott Bessent will begin interviewing candidates for the next Federal Reserve chair on Friday, with sessions continuing into next week. Among the 11 contenders are Fed governors Christopher Waller and Michelle Bowman, National Economic Council Director Kevin Hassett, and former governor Kevin Warsh; Bessent will present a shortlist to President Trump after completing the interviews. Read more —>

Fosun Launches $328M Tokenized Shares of Sisram Medical in Hong Kong

Fosun Wealth Holdings has tokenized $328 million worth of Sisram Medical shares using Vaulta, Solana, Ethereum, and Sonic, marking a significant step in Hong Kong’s broader ambition to become a blockchain and crypto hub. This move reflects growing momentum in real-world asset tokenization, with Fosun pledging to expand the initiative to other bonds and equities in the future. Read more —>

OKX Fined $2.6M by Dutch Central Bank Over Unregistered Crypto Services

Crypto exchange OKX was fined €2.25 million ($2.6 million) by the Dutch National Bank for offering unregistered crypto services in the Netherlands between July 2023 and August 2024, in violation of local anti-money laundering laws. The penalty, which OKX says stems from a resolved legacy issue, follows similar actions against other exchanges and was reduced due to the company's corrective measures, including transitioning Dutch users to a MiCA-compliant entity. Read more —>

Crypto Exchange Volume Hits $1.86 Trillion in August, Highest Since January

Global crypto exchange spot volume surged to $1.86 trillion in August, the most active month since January, driven by renewed investor interest—particularly in Ethereum-related assets. Binance led centralized exchanges with $737.1 billion in volume, while decentralized platforms like Uniswap and PancakeSwap contributed to a $368.8 billion DEX total, also the highest since January. Read more —>

Source: The Block Data

Source: The Block Data

Bug in Paradigm’s Reth Client Briefly Stalls Ethereum Nodes

A bug in Paradigm’s Reth Ethereum execution client caused temporary disruptions for nodes using versions 1.6.0 and 1.4.8, halting their ability to validate new blocks at a specific block height. While the issue affected only a small fraction of the network—about 5.4% of execution layer clients—Paradigm is still investigating the root cause and has provided recovery instructions for operators. Read more —>

KuCoin Joins Forces with VBA and 1Matrix to Accelerate Vietnam’s Blockchain Future

KuCoin has signed a strategic partnership with Vietnam’s Blockchain and Digital Assets Association (VBA) and 1Matrix to advance blockchain infrastructure and digital asset adoption across the country, supporting Vietnam’s National Blockchain Strategy through tech transfer, policy support, and localized innovation. The collaboration aims to foster a transparent and secure digital financial ecosystem, empowering startups, promoting compliance, and positioning Vietnam as a leader in global blockchain development. Read more —>

Winklevoss-Backed Treasury Aims for European Bitcoin Listing with $147M Raise

Treasury BV, backed by Winklevoss Capital and Nakamoto Holdings, has raised $147 million to acquire over 1,000 bitcoin and pursue a reverse listing on Euronext Amsterdam, aiming to become Europe’s leading publicly traded bitcoin treasury. Alongside its listing through Dutch firm MKB Nedsense, Treasury has also acquired Bitcoin Amsterdam to accelerate regional adoption, positioning bitcoin as a core financial asset across Europe. Read more —>

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed