Gm! Welcome to Thursday!

Countries around the globe are pushing for crypto and stablecoin regulations, while altcoin season indicators reach highs that haven’t been seen since December 2024. Also, there's SEC delays in the Ethereum staking and altcoin ETF proposal space, a renewed concern over bots on the internet causing mayhem, and more.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Latest News

Chainlink to Bring More Trump Administration Agencies On‑Chain, Eye Supporting Elections

Chainlink co‑founder Sergey Nazarov said the company plans to expand its collaboration with multiple U.S. government agencies to provide on‑chain infrastructure, aiming especially to improve transparency and integrity around elections. This extends earlier work (e.g. with the Department of Commerce) to publish economic data on chains, and represents a broader push to embed public agency data in decentralized systems. Read more →

Pop Culture Group Invests $33 Million in Bitcoin to Power Web3 Entertainment Strategy

Pop Culture Group (CPOP) bought 300 BTC (about $33 million) to create a treasury reserve supporting a new crypto fund focused on Web3 entertainment, including content creators, live shows, and token‑based engagement. The strategy includes further expansion into Ethereum, utility tokens (e.g. its own “BOT”), and integrating blockchain into its entertainment ecosystem. Read more →

Texas Resident Must Pay $12.5M After Crypto Ponzi Scheme Revealed

Texas resident Nathan Fuller ran Privvy Investments, operating a crypto investment scheme, was denied bankruptcy protection for over $12.5 million in debts after a court found he had redirected investor money to personal purchases and concealed assets. The U.S. Trustee Program (USTP) uncovered evidence of false statements and forged documents in his bankruptcy filings. Read more →

SEC Delays Rulings on Ethereum Staking & Altcoin ETF Proposals

The SEC has pushed back its deadlines to rule on proposals to add staking to BlackRock’s Ethereum ETF until October 30, and delayed decisions on Franklin Templeton’s Solana and XRP ETF filings to November 14, citing the need for more evaluation. This is part of a broader trend of postponements for altcoin fund approvals and adjustments in crypto‑regulation timing. Read more →

‘Widespread’ NPM Exploit Steals Just $1K Despite Panic

A major supply chain attack exploited JavaScript packages (notably “Qix”) via malicious updates that targeted wallet‑transaction functionality. The breach sparked broad concern because of the potential reach—10% of cloud environments and nearly all using the affected packages—but in total only $1,043 was stolen, thanks to fast detection and limited payload scope. Read more →

Gemini’s IPO Valuation Climbs Over $3B Amid Raised Share Price Range

Gemini increased its IPO price range to $24–$26 per share, targeting a valuation north of $3 billion, up from earlier expectations. The offering size remains about 16.67 million shares, and the company has secured Nasdaq as a $50 million strategic investor. Gemini is expected to begin trading tomorrow under the ticker GEMI. Read more →

Sonic’s Total Value Locked Falls 67% Since May as Token Slumps

Sonic’s TVL has dropped from approximately $1.1 billion in May to around $367 million, a decline of roughly 67%, according to DeFiLlama, accompanying a drop in the network’s token price. The fall coincides with the end of a market‑maker agreement with Wintermute, highlighting vulnerabilities for new blockchains dependent on such support. Read more →

Source: DefiLlama

Belarus Directs Banks to Embrace Crypto and Tokenization Amid Sanctions

Belarusian President Lukashenko instructed commercial banks to expand crypto usage in payments and to adopt tokenization and smart contracts in a strategy to counter Western sanctions, noting $1.7 billion in external payments already processed via exchanges and projections of $3 billion by year‑end. The policy shift aims to reduce intermediaries, boost automation, and enhance control over financial flows under sanction pressure. Read more →

Strategy Treasury Firm Escapes Accounting Lawsuit After Dismissal

Strategy, one of the world’s largest corporate Bitcoin holders, saw a lawsuit alleging improper accounting practices and breaches of fiduciary duty dismissed. The case was brought by shareholders but dropped before advancing, marking another in a series of legal challenges the firm has faced this year. Read more →

Brian Quintenz Publishes Texts with Gemini Twins Ahead of IPO

CFTC nominee Brian Quintenz released private text messages exchanged with Cameron and Tyler Winklevoss in which they asked for assurances from him regarding enforcement actions, particularly related to a past civil case involving Gemini. Quintenz says he refused, and the disclosure came just before Gemini’s IPO, raising concerns about potential attempts to influence his confirmation process. Read more →

VanEck Seeks To File ETF and ETP for Hyperliquid Staking Token (HYPE)

VanEck plans to file for a U.S. spot staking ETF for Hyperliquid’s token HYPE and also an exchange‑traded product (ETP) in Europe, providing regulated exposure to the token. The filings may include provisions for using part of net product profits to buy back HYPE, reflecting strong demand for the asset and VanEck’s bullish stance on its potential.

Read more →

NVIDIA Rubin CPX Boosts Inference Performance for Million‑Token Context Workloads

NVIDIA has introduced the Rubin CPX GPU, a new accelerator tailored for long‑context AI inference workloads exceeding 1 million tokens, delivering 30 petaFLOPs of NVFP4 compute power, hardware attention acceleration, and enhanced memory and interconnect capabilities. Under the SMART framework, this disaggregated architecture (separating context and generation phases) improves throughput, lowers latency, and enables more efficient use of compute/memory resources for large‑scale generative AI tasks. Read more →

REX-Osprey Crypto ETFs Set for Launch Friday

REX and Osprey’s suite of crypto ETFs — including funds tied to Bonk, Trump, Bitcoin, XRP, and Dogecoin — are set to begin trading Friday after clearing the SEC’s 75-day review window, barring any last-minute objections. These 1940 Act funds follow a simpler approval process than spot-based ETFs, while the SEC continues to delay rulings on rival ETH, SOL, and XRP products. Read more →

Bitmine Adds $201M in ETH, Total Holdings Now $9.24B

Ethereum mega-holder Bitmine received 46,255 ETH (~$201M) from a Bitgo address, bringing its total stash to 2.13 million ETH worth around $9.24 billion, according to OnchainLens. The firm is often dubbed Ethereum’s “MicroStrategy” due to its large-scale accumulation strategy. Read more →

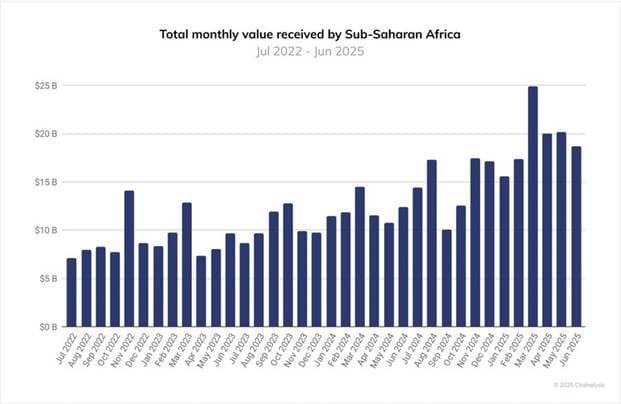

Sub-Saharan Africa Ranks #3 in Crypto Adoption Growth

Sub-Saharan Africa has become the third-fastest growing region for crypto adoption globally, trailing only Asia-Pacific and Latin America, according to a new Chainalysis report. The region continues to show strong grassroots engagement and increasing institutional interest.

Source: Chainalysis

Chainlink Data Streams Go Live on Sei Network

Chainlink Data Streams have officially launched on the Sei Network as its preferred oracle solution, offering ultra-low latency, liquidity-weighted data, and institutional-grade reliability. The integration brings U.S. government economic data onchain, powering next-gen DeFi, trading, and real-world asset applications with sub-second speed and high fidelity. Read more →

Ethena Transfers $196M ENA; Arthur Hayes Buys $468K Worth

In the last 8 hours, 246 million ENA tokens—valued at approximately $196 million—were transferred from Ethena’s custody wallet to Coinbase Prime. Simultaneously, BitMEX co-founder Arthur Hayes purchased 578,956 ENA for around $467,700 on Binance. Read more →

WLFI Unveils ‘Project Wings’ to Boost USD1 on Solana

Trump-backed WLFI has launched Project Wings to accelerate adoption of its USD1 token within the Solana ecosystem. The initiative includes new USD1 trading pairs on Bonk.fun and Raydium, with more details to follow via official channels. Read more →

BitMine Adds $201M in ETH to Treasury via BitGo

BitMine Immersion Technologies acquired 46,255 ETH (about $201 million) from a BitGo custody wallet, bringing its total Ethereum holdings to approximately 2,126,018 ETH, valued at $9.24–$9.30 billion. The acquisition solidifies BitMine’s position as the world’s largest corporate ETH treasury holder. Read more →

Chart from The Block Data

Kraken to List Paxos’ USDH and Hyperliquid’s HYPE

Kraken plans to list Paxos-issued USDH and Hyperliquid’s HYPE token at launch, offering free USD on/off ramps, pending final approval. The move supports stablecoin adoption and broader accessibility to Hyperliquid’s ecosystem.

Scroll DAO Pauses New Proposals Pending Governance Overhaul

Scroll has announced that while all already-accepted proposals will continue, it will halt consideration of new proposals until a revised governance model is introduced. The pause is intended to create a more efficient, aligned, and sustainable framework for the DAO moving forward.

Bitcoin and Ethereum ETFs See Surge in Inflows

Bitcoin spot ETFs recorded $757 million in net inflows on September 10, marking their third straight day of gains. Ethereum spot ETFs also rebounded with $172 million in net inflows, led by BlackRock’s ETHA at $74.5 million.

Avalanche Seeks $1B for Discounted AVAX Purchases via Crypto Treasury Firms

The Avalanche Foundation is working to raise $1 billion through two digital asset treasury vehicles that will buy discounted AVAX tokens. One deal, advised by Anthony Scaramucci and led by Hivemind Capital, involves a Nasdaq-listed firm aiming to raise $500 million by month-end, while the other—backed by Dragonfly Capital—is a SPAC targeting a similar amount with a possible October close. Read more →

Nemo Protocol Suffers $2.6M Exploit Over Un‑audited Code

The Sui‑based DeFi protocol Nemo lost $2.6 million due to a vulnerability in unaudited code that included a flawed slippage function and lacked multisig controls. The team has paused protocol operations, is working on patches, and plans to compensate affected users. Read more →

Ethereum Futures Surge While Spot Capital Flows Rotate to Bitcoin

Ethereum futures volume rose sharply—reaching $49.4 billion over 24 hours—surpassing Bitcoin’s futures volume, even as institutional money shifted into spot Bitcoin ETFs ($1.39B inflows) while Ethereum ETFs saw outflows (~$668M) in the same period. Altcoins now account for about 50% of trading volume, rising from ~40% the prior week. Read more →

Arthur Hayes Buys Nearly $1M ENA Ahead of USDH Ticker Vote

Arthur Hayes acquired roughly $995,000 worth of ENA tokens over 48 hours ahead of Hyperliquid’s validator decision on the USDH stablecoin ticker, signaling positioning ahead of the vote. His purchases coincide with Ethena’s competitive proposal, which promises 95% revenue sharing to Hyperliquid and plans to cover migration costs. Read more →

Sharps Technology and Pudgy Penguins Partner to Expand Solana Exposure

Sharps Technology (NASDAQ: STSS), a major Solana treasury holder, has formed a strategic partnership with Pudgy Penguins to bring broader institutional and retail attention to the Solana digital asset ecosystem. The collaboration will integrate Pudgy Penguins' widely recognized IP—boasting 220B+ views and major brand partnerships—into STSS's $400M+ SOL treasury, aiming to deepen cultural and institutional engagement in Web3. Read more →

Hong Kong Imposes New Capital Requirements for Crypto‑Asset Banks

Hong Kong’s regulators are moving forward with proposals that would require banks serving crypto businesses to hold extra capital buffers and meet tighter risk controls. The rules aim to ensure banks remain resilient amid crypto market volatility and protect against asset securities concerns. Read more →

Hong Kong Police Arrest Two for Illicit Crypto Mining in Care Homes

Authorities in Hong Kong arrested two individuals accused of using elderly care homes to host unauthorized crypto mining operations, allegedly to cover high energy costs while exploiting vulnerable residents’ premises. The case underscores growing law enforcement attention toward misuse of elder-care infrastructure for digital asset operations. Read more →

SSV Labs CEO: Protocol Stands Despite Validator Slashing Incidents

Despite reports of validator slashing events, the CEO of SSV Labs reassured that the protocol remains secure, and users’ funds were not compromised. The accompanying incidents are being addressed, with transparency maintained throughout. Read more →

KuCoin Taps Golf Icon Adam Scott as Global Brand Ambassador

Cryptocurrency exchange KuCoin announced a partnership with pro golfer Adam Scott, who joins as a global brand ambassador. The move is part of KuCoin’s broader marketing push to build awareness among mainstream audiences. Read more →

Source: KuCoin

DeFi Lending TVL Hits ATH at $130B; Major Players Revealed

Total value locked (TVL) in DeFi lending has surged to an all‑time high of $130 billion, largely driven by platforms like Aave, Morpho, and JustLend. Stablecoin demand, tokenized real‑world assets, and expansive credit markets are identified as key growth drivers. Read more →

Upbit Lists Two New Tokens; Trading to Begin Sept 12

Upbit announced that the tokens BLURK and CTOGE will be listed and begin trading at 9:00 AM KST on September 12, 2025, subject to liquidity. Deposits for both tokens open earlier on the same day. Read more →

Senator John Kennedy: GOP Not Yet United on Crypto Legislation

Senator Kennedy said that Republicans are not prepared to advance a comprehensive crypto bill, citing lingering disagreements over regulatory clarity and enforcement. Key sticking points include approaches to stablecoins, jurisdiction, and the balance of oversight between agencies. Read more →

The MYX Affair: A Deliberately Orchestrated Exit-Liquidity Trap

The MYX token's explosive rally—rising over 1,100% in a week—was a calculated exit-liquidity strategy driven by coordinated short squeezes, wash trading, and a precisely timed token unlock. Whales used limited float and media hype to trap both longs and shorts, enabling insiders to offload tokens at peak prices. Read more →

Forward Industries Closes $1.65B Deal to Build Solana Treasury; Shares Surge

Forward Industries (NASDAQ: FORD) has closed a $1.65 billion private placement with Galaxy Digital, Jump Crypto, and Multicoin Capital to execute a Solana‑based treasury strategy. The news drove its stock up roughly 15% in pre‑market trading. Read more →

Kraken Rolls Out Crypto Perpetuals in Select Jurisdictions

Kraken announced that it is launching perpetual futures trading for cryptocurrencies in certain supported regions, expanding its derivatives offerings. The platform says trading will be subject to regulatory approvals and regional restrictions. Read more →

U.S. CPI Rises 0.4% in August, Core Inflation Holds Steady

U.S. consumer prices jumped 0.4% in August, slightly above expectations, while the core inflation measure (excluding food and energy) remained aligned with forecasts. The report adds complexity to Federal Reserve rate outlooks as inflation remains sticky. Read more →

Taoshi Partners With Bittensor to Launch DeFi Forex Exchange

Taoshi, a decentralized finance protocol, is teaming up with Bittensor to bring foreign exchange markets into DeFi through a new exchange offering. The collaboration aims to enable seamless cross‑currency transactions on blockchain with enhanced accessibility. Read more →

South Korea Crypto Firms to Regain Venture Company Status

South Korea will lift restrictions preventing crypto trading and brokerage businesses from qualifying as "venture companies" under the Venture Business Act, effective September 16, opening them to tax incentives and government support. The change reverses a 2018 ban, and is meant to spur growth in crypto, blockchain, smart contract, and cybersecurity sectors. Read more →

Altcoin‑Season Indicators Hit Their Highest Levels This Year

Altcoin season indicators from Blockchain Center and CoinGlass have climbed to 76/100, the highest since December, while CoinMarketCap shows slightly lower readings but similarly strong trends; many altcoins have been outperforming Bitcoin over recent months. Rising social media attention and gains in coins like AVAX and DOGE point toward a renewed risk‑on sentiment in the crypto market. Read more →

Source: Blockchain Center

DigiFT, Chainlink, and UBS Automate Tokenized Fund Operations under Hong Kong Pilot Scheme

DigiFT, Chainlink, and UBS Tokenize have been approved under Hong Kong’s Cyberport Blockchain & Digital Asset Pilot Subsidy Scheme to build a regulated, blockchain‑based infrastructure that automates the distribution, settlement, and lifecycle management of tokenized funds. Investors will submit subscription/redemption orders via DigiFT’s smart contracts, which trigger Chainlink’s Digital Transfer Agent framework and are recorded onchain under UBS’s tokenized product contracts, streamlining fund operations and boosting efficiency. Read more →

China May Restrict Stablecoin Activity by Mainland Firms in Hong Kong

Chinese regulators are reportedly planning to limit the involvement of state-owned enterprises, banks, and major internet firms in Hong Kong’s stablecoin market, amid concerns over risk and regulatory clarity. While Hong Kong has seen interest from 77 institutions in its new stablecoin licensing regime, policy shifts suggest many mainland entities—including HSBC and ICBC—may withdraw or delay participation, reflecting China’s cautious stance toward stablecoins despite limited signs of openness. Read more →

BIT Mining Boosts Its Solana Treasury with 17,221 SOL

BIT Mining (soon to be SOLAI Limited) added 17,221 more SOL to its treasury, bringing its total Solana holdings to roughly 44,412 SOL (~$9.95 million). The company is building out validator operations and pushing its expanding role in Solana’s ecosystem, including launching the DOLAI USD‑stablecoin with Brale Inc. Read more →

What People Get Wrong About VeeFriends (Andy Krainak)

Andy Krainak, President of VeeFriends, describes misconceptions around the project — including underestimations of Gary Vaynerchuk’s involvement in design, branding, and events. He emphasizes the intentional cultural IP strategy, artwork detail, and long-term vision that many overlook. Read more →

Brazil Cracks Down on Illegal Crypto Mining in Rio

A man in Governador Island, Rio de Janeiro, was arrested for running an illicit crypto mining operation that siphoned off-grid electricity 24/7 without proper metering. Brazil’s ruling party is pushing for stricter regulation so that only licensed operators may conduct crypto mining. Read more →

MOGU Stock Surges ~200% After Board Approves Digital Asset Allocation

Chinese retail and lifestyle platform MOGU announced its board has approved up to $20 million in strategic allocation into digital assets, particularly Bitcoin, Ethereum, and Solana. The decision sparked nearly a 200% jump in its stock price. Read more →

SharpLink Treasury Push Seen as “White Swan Event” for Ethereum

Joseph Chalom, co‑CEO of SharpLink Gaming (an Ethereum treasury company), described their large ETH holdings and public treasury strategy as a potential “white swan event” that could drive institutional adoption of Ethereum. SharpLink, which has accumulated over $3.7B worth of ETH, aims to introduce traditional finance entities to stablecoins, tokenization, and the potential capital efficiencies of blockchain finance. Read more →

Huge Spike in Downloads for Jack Dorsey’s Bitchat During Nepal and Indonesia Protests

During recent social media bans and anti‑government protests, downloads of Bitchat, the decentralized messaging app created by Jack Dorsey, surged in Nepal (from about 3,300 to nearly 49,000) and also spiked previously in Indonesia. The app, which works without internet or phone numbers via Bluetooth mesh, has gained traction as a tool for communication during state censorship. Read more →

Linea’s Tokenomics Plan Pivots to Token Burning and Fee‑Sharing to Support Price Post‑Airdrop

Linea intends to burn 80% of its protocol fees (20% of them also burned in ETH) in hopes of counteracting sell‑pressure from its recent large token airdrop. Further, its tokens will be distributed to users as rewards for app usage (not governance), aiming to create a revenue loop that supports token value through user adoption. Read more →

21Shares Launches DYDX ETP to Offer Regulated Exposure to DeFi Derivatives

21Shares introduced the first ETP tied to dYdX (ticker: DYDX) on Euronext Paris and Amsterdam, giving institutional investors regulated, physically-backed exposure to the decentralized derivatives protocol. The product is supported by dYdX’s Treasury subDAO, formal custodial arrangements, and comes amid increasing institutional demand for DeFi derivatives. Read more →

Turn Your Selfies into Figurines with Google’s Nano Banana AI

Google’s new Nano Banana tool (Gemini 2.5 Flash Image) lets users convert full-body selfies into hyperrealistic, 1/7‑scale collectible figurines—complete with customizable materials, poses, props, and clear acrylic bases. The feature went viral after launching in late August, generating over 200 million images, drawing millions of new users, and inspiring a burst of creative use on social media. Read more →

Surge in Crypto Stocks as Bitcoin Treasury Plays Slip

Stocks like Galaxy Digital, Circle, and Bitfarms rose more than 10% on Thursday even as bitcoin’s price crept up modestly. Meanwhile, firms focused on holding bitcoin in treasury (like Metaplanet and Nakamoto) dropped significantly, showing divergence between businesses mining/serving crypto infrastructure vs those simply holding assets. Read more →

Figure’s IPO Pops to $36, Lifts Valuation to $7.6 Billion

Figure Technology Solutions debuted at $36 per share on Thursday—well above its $25 pricing—boosting the blockchain lender’s valuation to $7.6 billion. The strong listing follows a wave of successful crypto-related IPOs amid a friendlier regulatory climate and growing Wall Street appetite for blockchain-based finance firms. Read more →

Bot Networks Suspected in Amplifying Civil War‑Rhetoric After Charlie Kirk Killing

After the assassination of Charlie Kirk, there was a rapid increase of social media posts on X invoking “civil war” and violent rhetoric, many from low‑engagement or generically profiled accounts that look bot‑like. Researchers warn that while no definitive attribution has been made, the style and timing resemble past campaigns using botnets or automated amplification, especially given evolving AI tools that help disguise coordination. Read more →

Kiln Unstakes ETH After Security Breach; Validator Queue Jumps

Staking provider Kiln has begun exiting all its Ethereum validators, following a security incident involving its API which led to a loss of over $40 million in staked Solana via SwissBorg. This move caused a roughly 150% increase in the Ethereum validator exit queue as a precaution to protect its assets. Read more →

Source: The Defiant, Validator Queue

Debate Over Ethics as Crypto Traders Profit From Charlie Kirk’s Death

In the wake of Charlie Kirk’s murder, some crypto traders made gains by speculating on “tokenized death bonds” or otherwise trading on news of the event. This draws ethical questions over profiting from tragedies, even among trades that are legal, with observers noting tension between market opportunity and moral boundaries. Read more →

BlackRock Eyes Tokenized ETFs After Bitcoin Fund Success

BlackRock is exploring ways to tokenize exchange-traded funds, potentially enabling 24/7 trading, global access, and use as collateral on blockchain networks. The move builds on the firm’s $2B tokenized money-market fund and blockbuster Bitcoin ETF, though regulators must reconcile blockchain’s instant settlement with Wall Street’s clearing systems. Read more →

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed