Gm! Happy hump day to you!

The first Dogecoin ETF is scheduled to start trading on September 11th, while the SEC has deferred decisions for its competitors to launch the same product. Grok-4, Holoworld AI agents, and AI Master the World reveal their latest AI tools, and DATS continue to accumulate assets such as BTC, ETH, SOL, and BNB.

Latest News

Grayscale files for Hedera, Litecoin, and Bitcoin Cash ETFs with SEC

Grayscale submitted three SEC filings: an S-1 for a Hedera ETF and S-3 forms for a Litecoin ETF and its Bitcoin Cash Trust. The proposals are still pending and require SEC approval or amendments before becoming effective. Read more →

Ethena pitches BlackRock-backed stablecoin proposal for Hyperliquid

Ethena Labs submitted a proposal to issue USDH, a native Hyperliquid stablecoin backed by tokenized U.S. Treasuries via BlackRock’s BUIDL fund. The plan includes returning reserve revenue to the ecosystem and migrating key trading pairs. Read more →

PredictIt secures CFTC approval for October relaunch in U.S.

Prediction market PredictIt will relaunch in October as a fully regulated platform after receiving approval to operate as both a Designated Contract Market and a Derivatives Clearing Organization. The move enables expanded trading and regulatory compliance for U.S. users. Read more →

First U.S. Dogecoin ETF expected this week as SEC delays Bitwise bid

The first U.S.-based Dogecoin ETF is poised to launch this Thursday, while the SEC has deferred its decision on Bitwise’s competing DOGE fund proposal. The move marks a milestone for meme-asset integration into traditional finance. Read more →

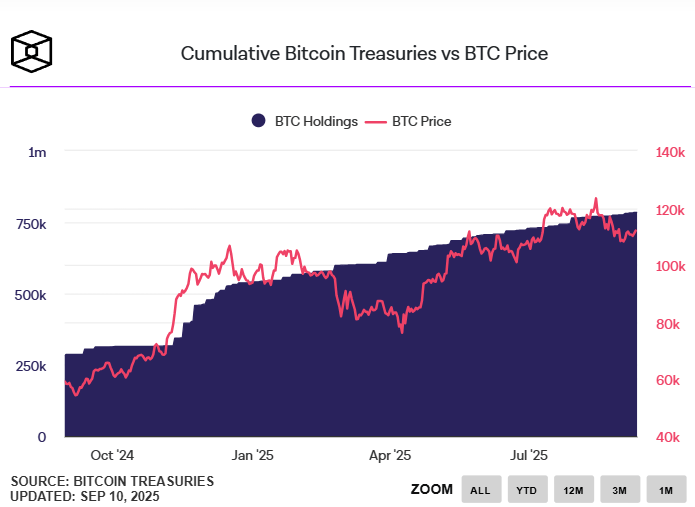

Asset Entities shareholders approve merger with Ramaswamy’s Strive to form Bitcoin treasury firm

Asset Entities has finalized its merger with Strive, a firm tied to Vivek Ramaswamy, to launch a newly structured Bitcoin treasury company. The entity will focus on holding and managing BTC as a balance sheet asset. Read more →

Trump Media Enables Truth Social Users to Convert Gems into CRO Tokens

Trump Media has updated its Truth Social platform to let users convert “gems” earned through platform activity into Cronos (CRO) tokens, shifting away from earlier plans for a proprietary utility token. This deepens Trump Media’s partnership with Crypto.com, which includes acquiring $105 million in CRO as part of a broader $6.4 billion digital asset strategy. Read more →

SEC delays decision on Grayscale Hedera Trust, updates BCH and LTC filings

The SEC has postponed its decision on Grayscale’s Hedera Trust to November 12 and acknowledged amended S-3 filings for Litecoin and Bitcoin Cash products. All filings remain under review and subject to approval. Read more →

GameStop Q2 Loss Narrows as Bitcoin Boosts Balance Sheet

GameStop reported a reduced Q2 loss of $18.5 million, buoyed by $528.6 million in Bitcoin holdings that generated a $28.6 million unrealized gain. While revenue declined to $673.9 million, the crypto investment helped offset hardware and software sales drops, with collectibles continuing to perform well. Read more →

Circle mints $500M USDC as Solana supply surpasses $25B

Circle minted $500 million in USDC in two large batches, pushing total supply on Solana beyond $25 billion. The move reflects rising stablecoin velocity and network preference among institutions. Read more →

Apple enhances macOS defenses with memory integrity enforcement

Apple has introduced memory integrity enforcement for macOS, strengthening protections against kernel-level exploits. The feature adds another layer of hardware-verified security to Apple’s operating system stack. Read more →

SOL Strategies begins trading on Nasdaq under ticker STKE

Solana-focused treasury firm SOL Strategies has officially listed on the Nasdaq Global Select Market under the symbol STKE. The debut marks a milestone for Solana-native asset managers entering U.S. public markets. Read more →

SEC memo details Mysten Labs discussions on Sui staking and rewards

An internal SEC memo outlines a meeting with Mysten Labs regarding Sui’s staking mechanics, validator incentives, and how rewards are distributed. The agency continues to examine token economics across Layer 1 networks. Read more →

Avalon Labs burns $1.88M in AVL tokens, pushing total supply cut to 37%

Avalon Labs has completed a $1.88 million buyback and burn of its AVL token, funded entirely by monthly protocol revenue. Combined with an earlier 80 million token burn in June, the firm has now destroyed 37% of AVL’s circulating supply.

Bitcoin ETF inflows remain modest as Ethereum products rebound after six-day slide

On September 9, Spot Bitcoin ETFs posted $23.05 million in net inflows, driven solely by BlackRock’s IBIT, which added $169 million. Spot Ethereum ETFs recorded $44.16 million in net inflows, reversing a six-day streak of outflows.

KindlyMD’s Nakamoto unit commits $30M to Metaplanet’s Bitcoin treasury raise

Nakamoto, a subsidiary of KindlyMD, has pledged up to $30 million toward Metaplanet’s $1.4 billion equity raise aimed at expanding its Bitcoin holdings. This marks Nakamoto’s largest investment to date and its first in an Asian public company with a Bitcoin-focused treasury. Metaplanet, now holding 20,136 BTC, ranks as the sixth-largest public Bitcoin holder globally. The deal is set to close on Sept. 16. Read more →

SEC Cracks Down on U.S. Firms Tied to Chinese ‘Pump and Dump’ Schemes

The SEC has launched a task force targeting U.S.-based auditors and underwriters allegedly enabling fraudulent Chinese IPOs tied to pump-and-dump schemes that have cost investors billions. In response, Nasdaq is tightening listing standards, including a $25 million minimum offering size for Chinese firms, to curb abuse. Read more →

Hyperliquid Achieves Massive Trading Volume with Just 11 Employees

Hyperliquid—a DeFi exchange known for blazing-fast execution and split-chain infrastructure—reached $330 billion in monthly trading volume in July 2025, all managed by a lean team of 11. The feat underscores how technical innovation can scale operations without expanding headcount. Read more →

Source: CoinTelegraph

Paxos Unveils USDH V2 Proposal Featuring PayPal Integration

Paxos introduced USDH V2, its refined bid for Hyperliquid’s native stablecoin contract, which includes integration with PayPal and Venmo, capped rewards tied to TVL milestones, and yield incentives for migration of trading pairs. The proposal aims to supercharge Hyperliquid’s global reach with familiar consumer rails. Read more →

Linea Recovers Quickly After Temporary Sequencer Outage

The Linea network experienced a brief outage that disrupted its mainnet sequencing before quickly resuming block production hours later. The swift recovery minimized user impact and underlined the resilience of its infrastructure. Read more →

Kiln Gracefully Exits Ethereum Validator Roles Amid Market Concerns

Kiln initiated an orderly exit from all Ethereum validator nodes as a safety measure in reaction to broader market stress after a major platform hack targeting SwissBorg. The withdrawal reflects a cautious posture on infrastructure risk amid ongoing ecosystem volatility. Read more →

Kraken Brings Tokenized U.S. Stocks to European Users

Kraken has launched its xStocks offering in the EU, allowing European clients to trade tokenized U.S. equities directly on its platform. The expansion enhances global access to U.S. stock exposure via blockchain. Read more →

Gemini & Figure Raise IPO Price Targets Amid Crypto Market Optimism

Gemini raised its IPO price range to $24–$26 per share, setting a valuation near $3 billion, while the SEC-approved Figure Technologies also expanded its IPO terms on the same day. These moves highlight robust investor interest in crypto-related equities. Read more →

India Presses Pause on Broad Crypto Regulation Over Systemic Risk Fears

India is resisting the creation of comprehensive crypto legislation, warning that regulation could legitimize the market and introduce systemic threats to financial stability. Instead, the country maintains limited oversight focused on containing speculative risks. Read more →

Binance to Launch Holoworld AI (HOLO) With HODLer Airdrop Incentives

Binance has announced Holoworld AI (HOLO) as its 38th HODLer Airdrops project, offering retroactive airdrops to users who held BNB in Simple Earn or On-Chain Yields between Aug. 29 and Sept. 1. Trading for HOLO begins on Sept. 11, with 30.7 million tokens (1.5% of supply) allocated to airdrops and 16.96% of the total supply circulating at launch. Read more →

BingX Launches AI-Powered Trading Strategist “AI Master the World”

Crypto derivatives platform BingX unveiled “AI Master the World,” its first AI-powered trading strategist designed to help users automate strategy execution. The tool leverages AI to analyze market data and make real-time trade recommendations. Read more →

Polygon POS Chain Faces Setback in Achieving Finality

Polygon’s Proof-of-Stake (POS) network is experiencing delays in achieving consensus finality, raising temporary concerns about transaction conclusiveness and validator performance. The issue points to growing challenges in scaling security on Ethereum layer-2 networks. Read more →

Grok-4 Turns Crypto News into Trade Signals

A new guide explains how to use Grok‑4 to transform real-time crypto news into actionable trading signals, providing users with methods for monitoring events and automating trades. This article showcases Grok‑4’s capabilities in parsing headlines and generating alert: Read more →

Crypto Featured Again in Indian Asset Disclosures as Policy Lags

For the second year in a row, Indian ministers have declared cryptocurrency holdings in their official asset disclosures, even as the country stalls on broader crypto regulation. It reflects growing personal interest amid ongoing policy ambiguity. Read more →

Pump Fun’s Token Jumps After Binance.US Listing

Newly listed token, PUMP, surged double digits following its debut on Binance.US, demonstrating the power of exchange listings to ignite speculative rallies. Read more →

AI Agents Aim to Build the “Holoworld”—Vision or Reality?

A feature on wublock Substack explores the rise of AI agents as virtual citizens, shaping digital spaces like “Holoworlds,” and assesses the potential—and risks—of autonomous AI personas emerging in web3 environments. Read more →

CyberKongz Airdrops 2% of KONG Tokens to OpenSea Users

NFT brand CyberKongz announced a 2% airdrop of KONG tokens to OpenSea users, happening on September 10 (or 11, depending on which part of the world you’re in), rewarding community participants with new utility rewards. Read more →

Binance US Slashes Fees Amid Persistently Low Trading Volumes

Binance US reduced trading fees across several tiers to encourage activity, as platform volume continues to underperform expectations. The move is aimed at boosting retention and liquidity on its exchange. Read more →

SEC Chair Says Most Tokens Aren’t Securities, Backs Crypto Super Apps

The SEC Chair declared that the majority of digital tokens should not be classified as securities and expressed support for “super app” platforms integrating crypto and finance. This signals a more flexible regulatory approach to token classification and ecosystem innovation. Read more →

Binance and Franklin Templeton Partner to Bridge TradFi and Digital Assets

Binance and Franklin Templeton are collaborating to develop digital asset products that combine traditional finance scale with blockchain efficiency, focusing on compliant tokenization, faster settlements, and broader market access. The partnership aims to accelerate blockchain adoption and deliver scalable, institutional-grade investment solutions tailored to global capital markets. Read more →

DeFi Lending TVL Soars to $130B, Led by Aave and Morpho

DeFi lending has surpassed an all-time high with $130 billion in total value locked (TVL), driven by tokenized real-world assets, looping strategies, and strong stablecoin growth. Aave dominates with over $68 billion, followed by Morpho and JustLend, showcasing how lending now outpaces liquid staking in DeFi. Read more →

Gearbox Recovers from 80% Crash, Reaches $340M TVL

After an 80% TVL crash last year, Gearbox has rebounded to $340 million, fueled by unique leveraged “credit accounts”, integration of illiquid assets like Mellow Finance, and its Permissionless lending market. The protocol now spans 27 blockchains, emphasizing usability over speculative yield-chasing. Read more →

DOJ Seeks to Recover $12M in USDT From Crypto Scam

The U.S. Department of Justice filed a civil forfeiture complaint to seize over $12 million in USDT tied to a fake trading platform that defrauded victims, mainly Mandarin-speaking investors. The case highlights civil forfeiture as a key tool for disrupting crypto scams and recovering funds for victims. Read more →

Robin Energy Shares Surge 90% on $5M Bitcoin Purchase

Robin Energy, a petrochemical shipping company, saw its stock jump nearly 90% after completing its first $5 million Bitcoin acquisition, signaling a dramatic entry into crypto treasury strategies. Read more →

Chart from The Block Data

Consensys Launches Ethereum L2 Linea with $9.4B Token Airdrop

Consensys has officially launched the Linea Layer 2, backed by a massive $9.4 billion airdrop, following a brief outage. The rollout aims to onboard users broadly with an expansive token distribution strategy. Read more →

Backpack Crypto Exchange Expansion Underway in U.S.

Backpack, a crypto exchange, is set to launch operations in multiple U.S. states this year, expanding its footprint following regulatory approvals. Read more →

Ledger Unveils Enterprise Mobile App, Adds TRON Stablecoin Support

Ledger has introduced a mobile app for enterprise users, now including support for TRON-based stablecoins, enhancing secure treasury and institutional wallet management.

Read more →

LitFinancial Introduces Ethereum Stablecoin to Streamline Mortgage Lending

LitFinancial launched litUSD, an Ethereum-based stablecoin pegged 1:1 to USD, aimed at lowering funding costs and enabling transparent, on-chain mortgage settlements. The move could transform liquidity in secondary mortgage markets.

Read more →

CEA Industries Boosts BNB Holdings to $368M

CEA Industries ($BNC) has expanded its Binance Coin (BNB) holdings to 418,888 BNB ($368M), reinforcing its status as the world’s largest corporate BNB treasury. The company aims to own 1% of BNB’s total supply by year-end, with plans that could push its holdings past $1.25B, reflecting a focused strategy to lead institutional adoption of BNB in the digital asset market. Read more →

Polygon PoS Hard Fork Successfully Restores Network Finality

Polygon Foundation confirmed the successful completion of its PoS mainnet hard fork, restoring state sync, consensus finality, and checkpoint processing, with continued monitoring underway.

Coinbase to List KMNO, DOLO, and LAYER on Sept. 11

Coinbase will launch spot trading for Kamino (KMNO), Dolomite (DOLO), and Solayer (LAYER) on September 11, pending liquidity, with trading pairs against USD.

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed