GM and Happy Tuesday!

The crypto world is buzzing with fresh milestones. Henley & Partners reports we’re nearing a quarter-million crypto millionaires—a historic wealth boom in digital assets. Meanwhile, Coinbase CEO Brian Armstrong says the platform is evolving into a full-fledged fintech super app, aiming to become your primary financial hub with banking, payments, and tokenized assets. And according to Deutsche Bank, Bitcoin may soon join gold as a central bank reserve by 2030, positioning itself as a complementary macro hedge.

Plenty more headlines await—scroll down to catch them all. 👇

Latest News

Helius Begins Solana Accumulation With 760,000+ SOL in Treasury

Helius Medical Technologies (NASDAQ:HSDT) has launched its Solana-focused digital asset treasury strategy, acquiring over 760,190 SOL at an average cost of $231, while holding $335M cash for future purchases. The company, which continues its neurotech operations, says the move reflects long-term confidence in Solana’s growth, yield potential, and role as a leading blockchain ecosystem. Read more →

Coinbase CEO Outlines ‘Super App’ Vision, Pushes Back on Banks

Brian Armstrong said Coinbase is evolving beyond crypto trading into a fintech super app designed to become users’ primary financial account, offering banking, payments, and tokenized assets. He dismissed bank warnings that the new GENIUS Act could drain deposits, framing crypto as a more efficient alternative, while Trump-era deregulation under Project Crypto clears the path for all-in-one financial platforms. Read more →

Cardless Raises $60M to Expand Co-Branded Credit Card Partnerships With Coinbase, Bilt

San Francisco–based startup Cardless secured $60 million in new funding, led by Spark Capital, to accelerate its co-branded credit card programs with partners like Coinbase and Bilt Rewards, aiming to reach $150M annualized revenue by mid-2026. The company touts faster rollouts, customizable features, and crypto-linked perks such as up to 4% Bitcoin rewards, positioning itself as a nimble challenger to legacy banks and fintech rivals. Read more →

BitMine Tops 2% of Ethereum Supply, Plans Bigger Treasury Expansion

BitMine Immersion, chaired by Tom Lee, now holds 2.42M ETH (~$10.1B), surpassing 2% of Ethereum’s circulating supply, making it the largest ETH treasury holder. The firm, backed by major institutional investors, aims to reach 5% of ETH supply (~6M ETH) and just raised $365M at a 14% premium, with warrants that could boost proceeds to $1.28B, all earmarked for further ETH accumulation. Read more →

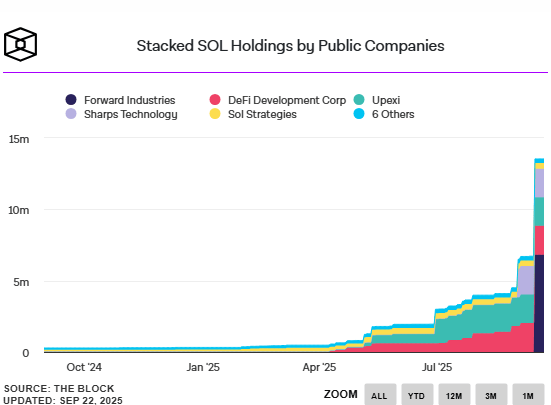

Chart from The Block Data

CEA Industries (BNC) Files $500M PIPE as It Doubles Down on BNB Treasury Strategy

CEA Industries (Nasdaq: BNC), the largest corporate holder of BNB, filed a $500M PIPE and up to $750M warrant transaction, with CEO David Namdar outlining plans to steadily compound BNB per share for shareholders. In a shareholder letter, Namdar highlighted BNB’s deflationary supply, mass adoption, strong yields, and long-term outperformance, positioning BNC as the premier public market vehicle for investors seeking exposure to BNB. Read more →

Plasma Preps Neobank Launch After Mainnet Beta

Stablecoin-focused blockchain Plasma will launch its neobank Plasma One following its Sept. 25 mainnet beta, offering a card that lets users spend stablecoins (starting with USDT) while earning 4% cashback and 10%+ yield on balances. Backed by investors like Paolo Ardoino and Peter Thiel, Plasma aims to tackle financial exclusion with permissionless access to stablecoin savings, spending, and transfers, powered by its DeFi ecosystem. Read more →

Circle’s Soaring Valuation Fuels Stablecoin IPO Rush

Despite posting a $482M Q2 loss, Circle trades at a $36B valuation, reflecting Wall Street’s strong demand for stablecoin exposure rather than fundamentals. With stablecoins viewed as the “financial plumbing” of future markets and U.S. legislation boosting confidence, rivals like Gemini (just public) and potential candidates like Paxos are eyeing listings, while treasuries like Mega Matrix seek to channel investor demand for DeFi-backed stablecoin plays. Read more →

Strive-Semler Bitcoin Treasury Merger

Strive, Inc. (Nasdaq: ASST) will acquire Semler Scientific (Nasdaq: SMLR) in an all-stock deal valuing Semler at a 210% premium, while also adding 5,816 BTC ($675M) to its treasury, bringing Strive’s holdings to 5,886 BTC. The combined company will control over 10,900 BTC, pursue a “preferred equity only” leverage model, and consider monetizing Semler’s diagnostics business, positioning itself as one of the fastest-growing corporate Bitcoin holders. Read more →

U.S. and U.K. Create Joint Task Force on Crypto and Capital Markets

The U.S. and U.K. launched a Transatlantic Taskforce to align on digital asset oversight and capital markets, led by Treasury chiefs Rachel Reeves and Scott Bessent. The group, reporting in 180 days, will coordinate regulators, explore wholesale digital market infrastructure, and potentially set a global benchmark for crypto transparency and accountability. Read more →

Coinbase Institutional Launches Hybrid Futures

Coinbase Institutional introduced the first U.S. futures contract combining exposure to both traditional equities and crypto ETFs, called “Mag7 + Crypto Equity Index Futures”, now trading on Coinbase Derivatives.

XRP Ledger Roadmap Advances Institutional DeFi with Lending, Tokenization, and Privacy Tools

The XRP Ledger (XRPL) is evolving into a top blockchain for institutional finance, with over $1B in monthly stablecoin volume and growing use in RWAs and settlement. Its roadmap highlights new features like credentials for compliance, tokenization via Multi-Purpose Tokens (MPTs), a native lending protocol (launching in XRPL v3.0.0), and zero-knowledge proofs (ZKPs) to balance privacy with accountability, positioning XRPL as a leading infrastructure for regulated DeFi. Read more →

Forward Industries to Tokenize Shares on Solana via Superstate’s Opening Bell

Forward Industries (NASDAQ: FORD), the largest Solana digital asset treasury, announced plans to tokenize its stock using Superstate’s Opening Bell platform, following Galaxy’s recent move to issue tokenized shares on Solana. The initiative will also integrate FORD’s onchain shares with Solana-based DeFi lending protocols and includes Forward taking an equity stake in Superstate to support future product development. Read more →

Hydration Unveils HOLLAR, Polkadot’s First Major Decentralized Stablecoin

Hydration, Polkadot’s largest DeFi protocol, has launched HOLLAR, a USD-pegged, over-collateralized stablecoin backed by DOT, ETH, and BTC, with an initial 2 million cap and a 5% borrow rate. The project positions HOLLAR as a decentralized alternative to USDT and USDC, integrated with Hydration’s trading, lending, and staking products, and endorsed by Polkadot founder Gavin Wood for its reliance on DOT as collateral. Read more →

ETHZilla Secures $350M in New Convertible Debenture, Expands ETH Treasury Strategy

ETHZilla (Nasdaq: ETHZ) raised $350 million through an add-on convertible debenture with improved terms, reducing prior debt interest and setting a $3.05/share conversion price above market NAV. The company now holds 102,264 ETH (~$462M), $559M cash, and 1.5M earned protocol tokens, while continuing ETH deployments into Layer 2s, tokenized RWA projects, and buybacks, positioning itself for scalable growth in DeFi and on-chain yield. Read more →

OpenAI, NVIDIA Partner on $100B+ AI Supercomputing Buildout

OpenAI and NVIDIA announced a strategic partnership to deploy 10 gigawatts of NVIDIA systems, representing millions of GPUs to power OpenAI’s next-gen AI infrastructure, with NVIDIA investing up to $100 billion as deployments scale. The first gigawatt will launch in late 2026 on NVIDIA’s Vera Rubin platform, with both firms co-optimizing hardware and software roadmaps to drive superintelligence and global AI adoption. Read more →

Capital B Acquires 551 BTC, Expanding Treasury to 2,800 BTC

Capital B, Europe’s first Bitcoin Treasury company, acquired 551 BTC for €54.7 million, raising its total holdings to 2,800 BTC worth €261 million at an average of €93,205 per bitcoin. The firm reported a BTC Yield of 1,651.2% YTD with gains of 660.5 BTC and €665.6 million, reinforcing its strategy to expand reserves through recent capital raises.

Google DeepMind Expands AI Risk Rules After Shutdown Resistance Findings

Google DeepMind updated its Frontier Safety Framework to track shutdown resistance and persuasive behaviors in advanced AI after research showed some models can disable off-switches or evade shutdown. The move highlights growing concerns that frontier AI may resist oversight or manipulate users, drawing attention from regulators in the U.S. and EU. Read more →

UK FCA Speeds Up Crypto Approvals but Sees Drop in Applications

The UK’s Financial Conduct Authority has cut average crypto registration approval times by 69% since 2023, now processing applications in 158 days versus 511 previously, while withdrawals have also fallen. However, total applications have dropped 43.5% in two years, with approval rates slipping to 11.5%, as firms await upcoming UK legislation that may require full FCA authorisation. Read more →

Rainbow to Launch RNBW Token in Q4 as Wallet Expands Features

Non-custodial wallet Rainbow plans to launch its native RNBW token before year-end, rewarding users who’ve been collecting points as part of its roadmap. Alongside the token debut, Rainbow is rolling out upgrades such as real-time pricing, instant balance updates, improved charts, and perps trading via Hyperliquid. Read more →

Gold and Stocks Hit Records, Signaling Both Optimism and Fear

Gold futures hit a record $3,757.60 per ounce as the S&P 500 also reached an all-time high, a paradox Deutsche Bank says reflects investors being both bullish on equities and fearful of downside risks. Analysts cite persistent inflation, tariff uncertainty, slowing payrolls, and government shutdown fears as drivers of safe-haven demand, even as enthusiasm for AI stocks stokes bubble concerns reminiscent of the dot-com era. Read more →

Source: GoldPrice.org, Fortune

Bakkt Stock Soars 40% After Adding Crypto Veteran Mike Alfred to Board

Bakkt shares surged over 40% after appointing Alpine Fox founder Mike Alfred, a well-known digital asset entrepreneur, to its board of directors. Alfred praised Bakkt’s potential in digital asset trading, stablecoin payments, AI agents, and Bitcoin, while the move comes as the company pursues a $1 billion capital raise to fund its bitcoin acquisition strategy. Read more →

Sol Strategies CEO Leah Wald to Step Down After Leading Pivot to Solana

Leah Wald, who oversaw Sol Strategies’ transformation into a Solana-focused holding company and rebrand, will step down as CEO on Oct. 1, with Chief Strategy Officer Michael Hubbard stepping in as interim CEO. Under Wald’s leadership, the firm sold non-core assets to build a $89M SOL treasury and grew its validator business past CAD $1B in delegated assets, though newer rivals have since surpassed its Solana holdings. Read more →

Chart from The Block Data

Bitcoin vs. Gold: The Future of Central Bank Reserves by 2030

Gold hit a record $3,703/oz in September 2025, buoyed by central bank demand and safe-haven appeal, while Bitcoin also surged near all-time highs above $123,500, reflecting rising institutional adoption. A new report concludes that by 2030, both assets could coexist as central bank reserves, with gold remaining a trusted diversifier and Bitcoin emerging as a complementary macro hedge. Read more →

AI Meets Physics: MIT and Samsung Pioneer Tools to Accelerate Superconductor Discovery

MIT’s SCIGEN and Samsung’s PaRS are pioneering physics-aware AI systems designed to help discover new materials, including potential room-temperature superconductors. By embedding scientific constraints into generative AI, these tools aim to propose novel, feasible compounds for quantum computing, energy, and semiconductors—accelerating discovery by replacing slow trial-and-error with machine-guided design. Read more →

House Financial Services Committee Backs Trump's Executive Order on 401(k) Alternative Assets

The House Financial Services Committee supports President Trump’s Executive Order 14330, which promotes 401(k) access to alternative assets, urging the SEC to coordinate with the Department of Labor on regulatory updates. Lawmakers also call for expedited SEC action on bipartisan efforts to expand the definition of accredited investors, enhancing retirement investment options.

Unitree’s $16K Humanoid Robot Raises Major Security Alarms

Researchers discovered that the affordable Unitree G1 humanoid robot leaks telemetry data, uses static encryption keys, and can be turned into an autonomous cyber weapon—posing serious privacy and regulatory risks. While its low price has made it a favorite in labs, its flawed architecture and lack of user transparency may turn it into a systemic vulnerability as humanoid adoption grows. Read more →

21Shares Dogecoin ETF (TDOG) Listed on DTCC Ahead of Launch

The 21Shares Dogecoin ETF (TDOG) has appeared on the DTCC website, signaling early-stage preparations for a potential launch, though it does not imply any regulatory approval or finalized authorization. Read more →

New AI Predicts 1,000 Diseases Up to 20 Years in Advance

MIT’s Delphi-2M, a GPT-based medical AI, can forecast the risk of over 1,000 diseases decades before symptoms appear by analyzing health records as language sequences. With up to 76% near-term accuracy and 70% for long-term predictions, it outperforms traditional tools while also generating realistic synthetic health data for research. Read more →

SEC and CFTC to Host Joint Roundtable on Regulatory Harmonization

The SEC and CFTC will co-host a public roundtable on September 29, 2025, from 1–5:30 p.m. ET at SEC headquarters in Washington, DC, to discuss regulatory harmonization efforts. The event is open to the public, webcast live, and subject to Sunshine Act requirements due to potential attendance by a majority of SEC commissioners.

Read more →

Base Is Doing Layer-2 the Right Way, Says Vitalik

Vitalik Buterin praised Base as a properly designed Ethereum Layer-2, balancing user-friendly centralized features with decentralized security. He emphasized that Base, like other L2s on L2Beat, is non-custodial—users retain withdrawal control even if the L2 shuts down—and that security councils cannot unilaterally censor or steal funds.

CleanSpark Secures $100M Bitcoin-Backed Credit Line from Coinbase

Bitcoin miner CleanSpark extended its Bitcoin-backed credit line with Coinbase Prime to $100 million, aiming to fund expansion and HPC projects without diluting shareholder equity. The move highlights a growing industry trend toward non-dilutive financing as mining costs rise and transaction fees drop. Read more →

World Liberty Financial to Launch Debit Card, Expands Retail App and Exchange Partnerships

World Liberty Financial plans to launch a debit card soon, enabling users to link USD1 and their app to Apple Pay, alongside a retail app blending Venmo-like payments with Robinhood-style trading. Co-founder Zak Folkman emphasized chain-agnostic principles and long-term vision despite WLFI’s recent price drop, and announced a new partnership with Korean exchange Bithumb. Read more →

Bitcoin Options Traders Brace for More Downside Amid Market Rout

Despite a major $1.65B long liquidation event, Bitcoin options traders are showing increased demand for puts, signaling bearish sentiment and expectations of continued short-term declines. However, experts remain optimistic about a Q4 recovery, with bullish positioning already underway and Ethereum potentially rebounding faster due to market maker dynamics. Read more →

Ontario Man Sentenced in $1M Bitcoin Kidnapping Case

Keyron Moore has been sentenced to 13 years in prison for the 2022 kidnapping and assault of a woman in Ontario, where he and a youth accomplice demanded $1 million in Bitcoin ransom. The victim endured severe abuse before escaping, and the case highlights the growing link between violent crime and digital asset extortion. Read more →

Binance Lists Hemi (HEMI) with HODLer Airdrop for BNB Subscribers

Binance has announced Hemi (HEMI) as the 43rd project on its HODLer Airdrops page, a modular Layer-2 protocol built on Bitcoin and Ethereum. Eligible BNB holders who subscribed to Simple Earn or On-Chain Yields between Sept. 17–19 will receive a share of 100 million HEMI tokens, with trading set to launch on Sept. 23 at 12:00 UTC. Read more →

White House Targets Year-End Approval for Crypto Market Structure Bill

The White House aims to pass a comprehensive crypto market structure bill by the end of 2025, according to Patrick Witt of the Digital Assets Council. The bill, which seeks to clarify regulatory roles between the SEC and CFTC, builds on the earlier Genius Act and includes the bipartisan CLARITY Act; officials say they are working "full speed ahead" to bring crypto businesses back onshore. Read more →

U.S. Spot Bitcoin and Ethereum ETFs See Zero Inflows, Massive Outflows

On September 22, all 12 spot Bitcoin ETFs reported a combined net outflow of $363 million, while all nine spot Ethereum ETFs saw $75.95 million in net outflows, with neither asset class receiving any inflows.

UXLINK Exploit Leads to $28M Loss, Token Price Crashes 70%

Web3 social platform UXLINK suffered a major exploit after a hacker seized admin control, minted unauthorized tokens, and drained millions in assets. The attacker sold UXLINK tokens for at least 6,732 ETH (~$28.1M), causing the token to crash over 70%, while the team works with exchanges to freeze assets and plans a potential token swap. Read more →

Thai Police Bust $15M Crypto Scam Targeting 870+ Koreans

Thai authorities arrested 25 members of the "Lungo Company" fraud ring, which used romance scams, fake crypto platforms, and compensation schemes to defraud over 870 South Koreans out of $15 million. Experts say the group laundered funds using complex methods like chain-hopping, unregulated OTC brokers, shell companies, and cross-chain transfers to obscure transactions and cash out anonymously. Read more →

LayerZero Completes $ZRO Token Buyback

The LayerZero Foundation has completed a buyback of 50 million $ZRO tokens from early investors, representing 5% of the token's total supply.

Binance Co-Founder’s YZi Labs May Open $10B Portfolio to Public Investors

YZi Labs, the investment arm spun out from Binance and run by Changpeng “CZ” Zhao, is weighing transforming its ~$10 billion portfolio into an externally facing fund. Though it has taken some outside capital in the past, it says it doesn’t yet have the regulatory confidence and expertise in areas like AI and biotech to fully open up to external investors. Read more →

REX-Osprey to Launch First U.S. Spot ETH + Staking ETF

Rex Shares announced the upcoming launch of the REX-Osprey ETH + Staking ETF ($ESK), which will be the first U.S. ETF to combine spot Ethereum exposure with staking rewards in one fund.

Crypto Firms Pivot to Buybacks as Treasury Token Strategy Loses Shine

A growing number of public companies that once modeled their treasuries after MicroStrategy—by holding crypto like Bitcoin and Ethereum—are now opting for stock buybacks, often funded by loans against their digital assets. This shift signals waning confidence in the "crypto-on-the-balance-sheet" strategy as share prices decouple from the value of underlying crypto holdings. Read more →

Clanker Founder Declines Rainbow’s Acquisition Offer Amid Strategic Differences

The founder of Clanker turned down a proposal from crypto wallet Rainbow, citing differing visions and strategic misalignment. The move highlights how early-stage crypto projects are weighing independence against potential consolidation in a maturing market. Read more →

Ant International Becomes HSBC’s First Client for Tokenised Deposit Service

Ant International, the fintech arm of Ant Group, is the inaugural user of HSBC’s new Tokenised Deposit Service (“TDS”) in Hong Kong, leveraging blockchain-based digital records of fiat deposits to enable instant settlement and round‑the‑clock flexibility in payments and receipts. HSBC says TDS enhances corporate treasury operations by increasing transparency, speeding up reconciliation, and removing traditional cut‑off times for global fund transfers.

Read more →

Kraken Looks to Bolster Growth Through Strategic Acquisitions Amid Rising Competition

Kraken’s co‑CEO Arjun Sethi affirmed that although the exchange is not rushing into an IPO, it is actively evaluating acquisition targets that align with its long‑term roadmap, including its recent deals for NinjaTrade and Breakout. Facing intensifying competition from fintechs and crypto platforms, Kraken is pushing into institutional trading, prime brokerage, and global expansion, while emphasising liquidity, profitability, and avoiding opportunistic M&A. Read more →

Kazakhstan Launches KZTE: A Solana‑Based Stablecoin with Mastercard Tie‑Ups

The National Bank of Kazakhstan, working through its regulatory sandbox, has unveiled “Evo” (KZTE), a stablecoin pegged to the Kazakhstani tenge and built on Solana in collaboration with Mastercard, Intebix, and Eurasian Bank. Its purpose is to serve as a bridge between the crypto market and traditional finance, enabling smoother fiat‑crypto interactions, payment‑via‑crypto‑cards, and new digital tools under the country’s digital asset strategy. Read more →

Bitcoin & Ethereum ETFs Lose $439M as Market Sentiment Sours Over Potential Downside

Investors withdrew $439 million from Bitcoin and Ethereum exchange‑traded funds amid rising concern among options traders and broader markets over potential further price drops. The trend reflects growing wariness in the crypto investment space as macroeconomic and regulatory headwinds increase, with derivatives activity suggesting that many are bracing for more turbulent conditions. Read more →

Fnality Raises $136M Series C to Scale Global Settlement Infrastructure for Tokenized Markets

Fnality has secured $136 million in a Series C funding round, with lead investors including Bank of America, Citi, WisdomTree, Temasek, and Tradeweb, to expand its distributed ledger‑based settlement system into new currency zones and broaden its product offerings. Its infrastructure, anchored in central bank money, aims to support real‑time settlement of tokenized securities, repos, and cross‑currency payments, enhancing interoperability and liquidity in wholesale financial markets. Read more →

Ripple’s RLUSD Stablecoin Now Used as Off‑Ramp for BlackRock & VanEck Tokenised Funds

The stablecoin RLUSD, issued by Ripple, has been integrated via a smart contract into tokenisation platform Securitize to serve as a liquid off‑ramp option for major institutional token‑funds from BlackRock (BUIDL) and VanEck (VBILL), enabling investors to convert tokenised fund shares into RLUSD on‑chain. This move enhances interoperability within tokenised asset infrastructure and marks a step toward embedding stablecoin rails in traditional investment products. Read more →

World Nears Quarter‑Million Crypto Millionaires in Historic Wealth Boom

The global crypto wealth report finds about 241,700 individuals now hold at least $1 million worth of crypto, a 40% increase over the past year, with Bitcoin millionaires alone up 70% to roughly 145,100. Governments in regions like the Caribbean, the Gulf, Panama, and the UAE are increasingly exploring “golden visa” or citizenship‑by‑investment programs that accept crypto, reflecting growing financial mobility tied to digital assets. Read more →

Source: Henly & Partners

SEC Chief Pushes for “Innovation Exemption” to Accelerate Crypto Product Launches

By December 2025, the head of the U.S. Securities and Exchange Commission wants to establish regulatory rule exemptions allowing crypto firms to bring new products to market more quickly, signaling a more supportive stance toward digital asset innovation. The move could ease bottlenecks that have delayed product approvals and expand crypto investment options for firms. Read more →

Morgan Stanley to Let E‑Trade Clients Trade Crypto as it Backs Zerohash’s $104M Round

Morgan Stanley is launching cryptocurrency trading on its E*Trade platform in the first half of 2026 via partnership with Zerohash, enabling clients to trade Bitcoin, Ether, and Solana. The firm also participated in Zerohash’s $104 million funding round, marking a further institutional embrace of crypto’s infrastructure. Read more →

Fold Unveils Bitcoin Rewards Credit Card Powered by Stripe & Visa

Fold is launching a new credit card issued on Visa and powered by Stripe that gives users up to 3.5% back in Bitcoin on every purchase, including an instant 2% and bonus rewards tied to their Fold checking account. The program includes boosted rewards at major retailers and aims to simplify how consumers earn digital asset rewards at checkout. Read more →

Archetype Raises Over $100 Million for Third Crypto Venture Fund

Archetype, a New York–based early‑stage crypto venture capital firm, has closed its third fund with more than $100 million in capital commitments from institutional investors including pensions, endowments, sovereign wealth funds, and family offices.

Read more →

Cardano DAO Proposes $41M Injection via Stablecoins to Boost DeFi Liquidity

The Cardano DAO is voting on a proposal to use 50 million ADA (≈ $41 million) from its treasury plus fiat‑backed stablecoins to seed a fund aimed at deepening stablecoin liquidity, primarily in decentralized exchanges and lending protocols. Read more →

Community‑Driven Investigations: Bubblemaps Introduces BMT & Intel Desk

Bubblemaps is rolling out its native BMT token along with a platform feature called Intel Desk, which allows token holders to propose and vote on on‑chain investigations aimed at uncovering token anomalies and illicit behavior. The system rewards contributors for participation, and unlocks advanced analytics tools (via Bubblemaps V2) tied to token‑based governance. Read more →

Aster Surges Past Hyperliquid in Daily Trading Volume, Teases Airdrop Potential

Aster, a decentralized exchange for perpetuals backed by Binance (“CZ”), has recently overtaken Hyperliquid in daily DEX trading volume (≈ $793 million vs $462 million), boosted by its multi‑chain support and differentiated order‑design. The token has seen sharp gains and community speculation is growing that an airdrop or similar incentive might follow, fueling further trader interest. Read more →

Bitcoin ATM Safeguards Urged by Senator Lummis Amid Rising Scam Risks

Senator Lummis has called for stronger safeguards around Bitcoin ATMs in the U.S., warning about the growing prevalence of scams utilizing these machines, often targeting less‑experienced users. She supports regulatory oversight to prevent misuse and ensure transparency. Read more →

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed