Figma’s Bitcoin Bet, Institutional Ethereum Moves, and Global Crypto Policy Shifts

The cryptocurrency landscape is undergoing a notable transformation as major tech firms, financial institutions, and regulators shape its trajectory. Figma’s IPO filing at a $16.5 billion valuation stunned investors, not only for its public market ambitions but also for revealing $70 million in Bitcoin ETF holdings, with plans to expand its BTC exposure. Simultaneously, Ethereum made a strategic move by raising its block gas limit by 25% to 45 million, a step toward scaling its infrastructure to meet surging demand. The network’s validator exit queue hit a record 625,000 ETH as early stakers and institutions take profits following ETH’s recent rally, even as demand to stake ETH remains strong.

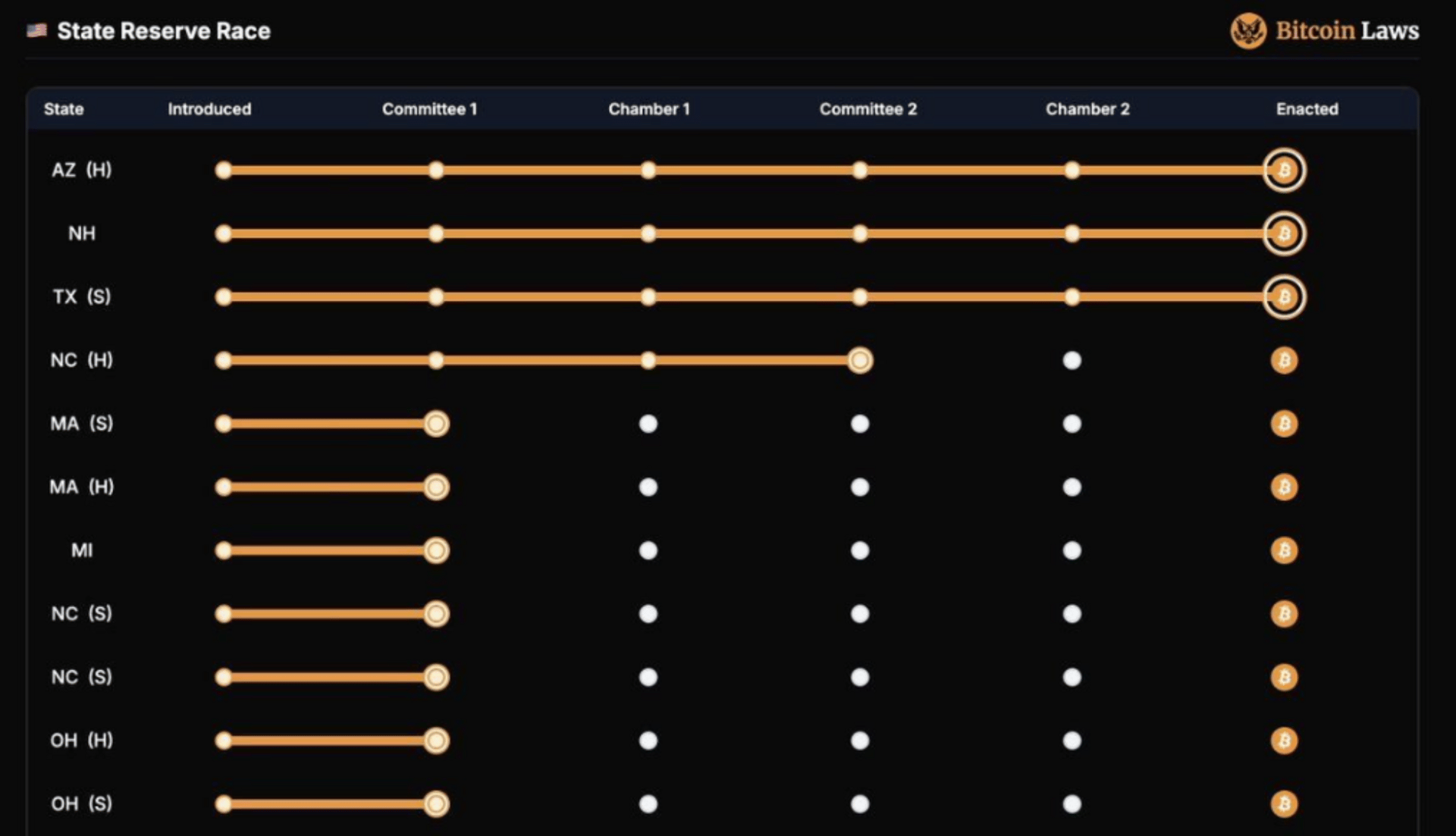

In Europe, digital asset exchange Archax is acquiring Deutsche Digital Assets, aiming to penetrate Germany’s BaFin-regulated market and cement its dominance across the UK, France, and Spain. Meanwhile, back in the U.S., four Reserve bills seeking to define Bitcoin as legal tender remain under consideration, though North Carolina’s is expected to fail as its legislative session nears conclusion. On the global stage, Binance’s legal troubles in Nigeria have stalled again due to a judge’s absence, casting further doubt on the country’s enforcement capacity. Despite high-profile accusations of money laundering and terrorism financing, procedural failures continue to undercut the Nigerian government’s case.

Ethereum NFTs are rebounding as collections like CryptoPunks, Pudgy Penguins, and Moonbirds gain momentum. Daily volume surged past $13 million, led by a major CryptoPunks sweep, while Pudgy Penguins’ PENGU token ballooned to a $2.3 billion market cap. Stablecoin adoption is also accelerating, topping $261 billion in global market cap as P2P usage rises in nations like Nigeria and China. U.S. corporations such as JPMorgan and Amazon are leveraging stablecoins for cost-efficient cross- border transactions, and Telegram has launched its TON Wallet in the U.S. to meet growing demand, enabling direct crypto access for its 87 million American users.

The market’s speculative energy is evident in SharpLink Gaming's Ethereum treasury buildup and meme token madness. SharpLink added nearly 80,000 ETH last week and now holds 360,000 ETH, worth over $1.3 billion, leveraging its ATM facility and staking strategy. Meanwhile, Fartcoin, a Solana-based memecoin, has risen to the top 10 by derivatives open interest, surpassing altcoin giants despite being 83rd by market cap. With open interest equaling 65% of its market cap, analysts warn of looming liquidations and frothy conditions. Sahara AI added to the momentum by launching a gig-economy- style data-labeling platform that rewards contributors in tokens and stablecoins.

Regulatory clarity is emerging with the passage of the GENIUS and CLARITY Acts, prompting institutional action. BitMine Immersion, Bit Digital, and BTCS Inc. are leading an “Ethereum Microstrategy” movement by acquiring large ETH reserves for staking income. Fidelity and VanEck have filed ETF amendments to allow in-kind creations and redemptions, while 21Shares is preparing a spot ONDO ETP, and CoinShares secured MiCA authorization in the EU. Still, volatility persists—Bitcoin hit $123,000 before retracing to $118,800 as traders brace for Fed Chair Powell’s upcoming speech. Over $536 million in positions were liquidated in a single day, while ETH ETFs recorded $2 billion in inflows.

Adding to the momentum, Elon Musk’s Space X quietly moved 1,308 BTC, while Kitabo Co., a Japanese textile firm, began dollar-cost averaging $5.4 million into BTC to offset financial losses. Trump’s crypto agenda advanced with a $550 billion investment deal with Japan, new tariffs on the Philippines, and expanded WLFI activity, including ETH staking. Meanwhile, traditional finance continues integrating with crypto as PNC Bank partners with Coinbase, and MEXC introduces tokenized U.S. stock futures with zero fees. As digital assets entrench themselves deeper into finance and technology, the convergence of policy, speculation, and infrastructure paints a bullish yet turbulent picture for the months ahead.

Share this newsletter with two friends and get a personal shout-out here 🗣

Must be subscribed