It’s FriYay!

Starting out with Gemini’s IPO, the crypto market is looking bullish today! Plus, there’s interesting and significant AI, memecoin, fundraising news, and more.

Let’s get into it!

Latest News

U.S. Commerce Data Set to Flow Into Sei via Chainlink

Sei will soon integrate official U.S. government macroeconomic indicators, including GDP, through the Chainlink data standard. The move is designed to strengthen institutional-grade markets on Sei by providing secure and reliable access to trusted economic data.

Pendle’s Kinetiq Markets Surpass $1 Billion

Yield tokenization platform Pendle and liquid staking protocol Kinetiq have together pushed Pendle’s kHYPE markets past $1.13 billion in total value locked, making it the third-largest market on Pendle. Much of the activity is attributed to speculation over a future Kinetiq token airdrop: nearly 80% of the value is concentrated in kHYPE, with the remainder in Veda kHYPE (vkHYPE) markets. Read more →

OpenSea Quietly Increases NFT Fees by 100% Ahead of SEA Token Launch

OpenSea is doubling its NFT trading fee from 0.5% to 1% starting September 15, and will also charge 0.85% on token swaps. Half of the revenue from these fees will go into a rewards pool to support pre-token generation event (pre-TGE) rewards; meanwhile the marketplace is expanding its product offerings, including a mobile app, a curated “Flagship Collection,” and plans for the SEA token launch. Read more →

BlackRock Working on Tokenizing Funds Tied to Real-World Assets

BlackRock is exploring how to tokenise exchange-traded funds (ETFs) tied to real-world assets such as stocks, subject to regulatory approvals. This would build on its existing tokenized money market fund, “BUIDL,” and could enable ETFs to trade on blockchain platforms, offering benefits like faster settlement and broader access. Read more →

Chainlink Reserve Grows to 280K LINK Holdings

The Chainlink Reserve added 43,034.62 LINK on September 11, bringing its total balance to 280,048.69 LINK. The reserve is funded by off-chain revenue from enterprise adoption and on-chain fees from service usage, supporting the network’s long-term sustainability.

U.S. Equities Hit New Highs as Markets Rally

On September 11, 2025, the S&P 500 closed at a record high of 6,587.47, while the Dow Jones surged by 617 points to 46,108.00, reflecting strong gains across large-cap stocks. Broad market optimism appeared driven by (among other factors) robust corporate earnings, favorable economic data, and eased investor concerns, contributing to investors’ risk-on sentiment. Read more →

CleanCore Solutions Buys More DOGE as First Dogecoin ETF Draws Near

CleanCore Solutions, which has launched an “Official Dogecoin Treasury” backed by the Dogecoin Foundation and its commercial arm House of Doge, has acquired an additional 285.4 million DOGE—bringing its holdings to over 500 million DOGE as part of a goal to accumulate 1 billion DOGE within 30 days. Read more →

Paraguay’s Ueno Bank Moves to Post‑Quantum Security, Backed by Quantum‑Resistant Hybrid Blockchain

Ueno Bank, Paraguay’s largest bank serving over 2.2 million customers, is deploying post‑quantum signatures and immutable timestamps on documents using SignQuantum and the QANplatform, a quantum‑resistant hybrid Layer‑1 blockchain. The system anchors data both on a private, on‑premises chain for internal verifiability and on a public chain for external proof, and follows cryptography standards aligned with the US NIST’s post‑quantum signature guidelines. Read more →

Safety Shot Launches BONK Holdings to Build BONK Treasury

Safety Shot, Inc. has formed a subsidiary called BONK Holdings LLC and invested $5 million more into BONK tokens, raising its treasury to over $63 million. The company now controls over 228.9 billion BONK tokens — roughly 2.5% of BONK’s circulating supply — and plans to actively manage the treasury via staking, liquidity provision, yield farming, plus a 10% revenue‑share partnership with letsBONK.fun to fund further BONK acquisitions. Read more →

Native Markets Heavily Favored in Hyperliquid’s USDH Stablecoin Bid

In the competition to issue Hyperliquid’s USDH stablecoin, Native Markets has emerged as the early frontrunner. According to Polymarket betting data and validator signals, Native Markets is leading over competitors like Paxos and Ethena, with the vote for issuer expected to conclude on September 14. Read more →

Gemini Limits IPO Size to $425 Million

Gemini Space Station Inc., the crypto exchange founded by Tyler and Cameron Winklevoss, has capped the base size of its initial public offering at $425 million, despite demand exceeding 20x the shares offered. The IPO will consist of about 15.2 million shares priced at $28 each, above the earlier range of $24–$26, putting the company’s non‑diluted valuation at approximately $3.33 billion. Read more →

WLFI Holders Consider 100% Buyback‑and‑Burn Proposal

World Liberty Financial (WLFI) is considering a proposal to allocate all fees generated by protocol‑owned liquidity (POL) toward open‑market buybacks and permanent token burns. The proposal aims to reduce circulating supply, strengthen value for long‑term holders, and follows an earlier burn of 47 million tokens (~0.19% of supply) after a steep price drop. Read more →

Dogecoin Rises 20% as Treasury Firm Amasses DOGE, ETF Nears Launch

Dogecoin surged nearly 20% over the past week, outperforming major cryptocurrencies like Bitcoin and Ethereum as new catalysts emerge. CleanCore Solutions, a publicly traded Dogecoin treasury, has purchased over 500 million DOGE (valued at ~$125 million), and the first U.S.-listed DOGE ETF (Rex‑Osprey, ticker DOJE) is set to begin trading imminently. Read more →

Source: CoinGecko

Fidelity and Canary ETFs for Solana, HBAR, and XRP Appear on DTCC Site

Fidelity’s proposed Solana ETF (FSOL) and Canary Digital’s HBAR (HBR) and XRP (XRPC) ETFs have been listed on the DTCC website, a routine step in the ETF launch process. However, the listings do not imply regulatory approval or completion of other required filings.

Bitcoin Briefly Hits $116K on Cooling Inflation & Rate‑Cut Hopes

Bitcoin jumped to a 19‑day high around $116,300, driven by softer U.S. inflation data and growing expectations that the Federal Reserve will cut interest rates. ETF inflows and reduced selling pressure are helping fuel bullish sentiment among traders. Read more →

Researchers Identify Stealthy Malware Draining Crypto Browser Wallets

Security firm Mosyle revealed “ModStealer,” a cross‑platform malware that dodges antivirus detection and targets browser‑based crypto wallet extensions. Delivered via fake job recruiter ads, ModStealer steals credentials, digital certificates, and wallet data, and installs itself persistently on systems including Windows, macOS, and Linux. Read more →

Ondo Finance Token Rises on Tokenization & ETF‑BlockChain Hype

Ondo Finance’s token advanced this week, climbing ~10% in a day and over 20% across the week, amid broader market enthusiasm for tokenized assets. The gains follow new developments like BlackRock’s moves toward public blockchain ETFs, and Ondo’s Global Markets platform’s growth in value locked and listed tokenized equities. Read more →

Coinbase Accuses SEC of Destroying Gensler’s Texts, Seeks Sanctions

Coinbase filed a court request alleging that the U.S. Securities and Exchange Commission destroyed nearly a year of text messages sent by then‑Chair Gary Gensler, which the agency should have preserved. The deletion has raised questions about the SEC’s record‑keeping, and Coinbase is pushing for sanctions and expedited discovery to recover the communications. Read more →

SBF’s Appeal Arguments Scheduled for Nov. 4 in Federal Court

Nearly two years after being sentenced to 25 years in prison for FTX’s collapse, Sam Bankman‑Fried will have his appeal arguments heard by the U.S. Court of Appeals for the Second Circuit on November 4. His legal team claims he was “never presumed innocent” and that prosecutors mischaracterized FTX user funds as permanently lost. Read more →

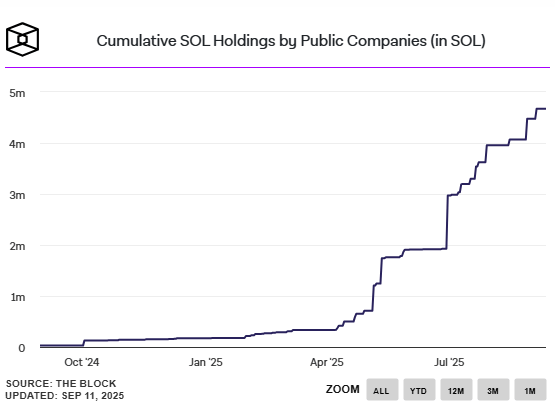

Galaxy Digital Scoops Up $536M in Solana Amid Renewed Interest

Galaxy Digital has acquired roughly $536 million worth of SOL within a 24-hour period, according to on-chain data. The move signals growing institutional interest in Solana as traders speculate on a new bullish phase for the network. Read more →

Chart from The Block Data

Analysts Stay Bullish on Bitcoin Despite Economic Warning Signs

Crypto commentators remain optimistic about Bitcoin’s long-term trajectory, with many pointing to anticipated Fed rate cuts as a bullish driver. However, concerns over stagflation and weakening macroeconomic data continue to cloud the outlook. Read more →

FTX Estate Unstakes $45M in Solana Tokens

The bankrupt FTX estate has unstaked around $45 million in SOL, potentially preparing to liquidate or redistribute the assets. This move follows previous large-scale withdrawals linked to the FTX estate management. Read more →

Christie’s Closes Digital Art Department as NFT Demand Wanes

Christie’s has shut down its digital art division and laid off associated staff amid a continued freeze in the NFT market. The auction house will now integrate digital art into its traditional categories rather than maintain a standalone segment. Read more →

September Fed Rate Cut Seen as Likely, With More to Come

A Reuters poll shows most economists expect the U.S. Federal Reserve to cut interest rates this month, followed by at least one additional cut by year-end. Inflation is still projected to remain above target levels through 2027. Read more →

Bitcoin and Ethereum ETFs Extend Inflow Streaks

Bitcoin spot ETFs brought in $553 million on September 11, marking their fourth straight day of inflows. Ethereum spot ETFs added $113 million, extending their own streak to three days.

Ethena Labs Exits Bid to Issue Hyperliquid’s USDH Stablecoin

Ethena Labs has withdrawn its proposal to issue Hyperliquid’s USDH after community concerns about its non-native status and broader business focus. Founder Guy Young said the team will instead concentrate on building hUSDe, USDe savings and cards, hedging flows on Hyperliquid, and HIP-3 markets.

Albania Appoints AI-Powered Bot “Diella” as Minister of Procurement

Albania has elevated its AI virtual assistant “Diella” — previously used on its e-Albania platform — to the role of minister overseeing government procurement, with the goal of curbing corruption and organized crime in the public sector. The government has not yet clarified how oversight, accountability or risk mitigation (such as manipulation or mistakes by the AI) will be handled. Read more →

The Rise of AI Bots in Crypto: Threats to Your Wallet

AI bots are increasingly used in sophisticated cyberattacks on the crypto sector, automating phishing, exploit scanning, and malware that can adapt and evade detection. These threats include deepfake impersonations, credential stealing, and social-engineering schemes, raising the urgency for stronger wallet security, hardware wallets, multifactor authentication, and vigilance. Read more →

Crypto Companies Raise $869 Million in One Week

Nine crypto startups raised a combined $869 million in one week, led by major rounds in stablecoin issuers and exchanges, bringing total funding in 2025 to nearly $16 billion — well ahead of 2024’s pace. Analysts and investors predict this trend will continue, with projections of fundraising possibly exceeding $25 billion by year end. Read more →

RWA Tokens Soar 11% as On-Chain Value Hits All-Time High

Real-World Asset (RWA) tokens jumped about 11% over the past week, pushing their market cap from ~$67 billion to nearly $76 billion, while the on-chain value of tokenized real-world assets reached a new peak of $29 billion. Over half of that value is in tokenized private credit, with substantial portions also in US Treasurys, commodities, equities, and other forms of non-crypto assets. Read more →

Total Marketcap for RWAs

Source: CoinMarketCap

Strategic Ethereum Reserve Accumulates 4% of Supply

The Strategic Ethereum Reserve has grown to control 4% of the total Ethereum supply, with backing from 72 entities. The reserve refers to the significant accumulation of $ETH by institutions for long-term holding and utility.

First U.S. Memecoin ETF Set to Launch Next Week

Bloomberg ETF analyst Eric Balchunas said the first U.S. memecoin ETF, $DOJE, is now expected to debut in the middle of next week.

AI Giants Face FTC Inquiry Into Chatbot Safety and Child Protections

The U.S. Federal Trade Commission has issued orders to seven major tech companies (including OpenAI, Meta, Google/Alphabet, xAI, Snap, Character.AI, and Instagram) to disclose how their AI chatbots protect minors, how they monetize engagement, and what safety guardrails are in place. The companies have 45 days to respond, amid concerns from studies showing chatbots interacting inappropriately with children. Read more →

THORSwap Offers Bounty Over $1M Exploit of ThorChain-Founder’s Personal Wallet

THORSwap has offered a bounty to the exploiter of a personal wallet (likely owned by the ThorChain founder) that was drained of over $1.2 million in assets. The protocol clarified that the exploit was against a private wallet—not a flaw in its own system—and is encouraging the return of funds with no legal action if done within 72 hours. Read more →

Binance Announces 39th HODLer Airdrop With ZKC Listing

Binance will airdrop 15 million ZKC (1.5% of the token’s initial supply) as part of its 39th HODLer Airdrop, featuring Boundless (ZKC), a universal zero-knowledge protocol built for internet-scale scalability. ZKC is set to begin trading on September 15 at 14:00 UTC with pairs in USDT, USDC, BNB, FDUSD, and TRY. Read more →

UK Lobby Groups Urge Blockchain’s Inclusion in UK-US ‘Tech Bridge’

A coalition of UK finance, tech, and crypto trade groups has called on the government to make blockchain a “core strand” of the planned UK-US Tech Bridge, ahead of President Donald Trump’s state visit. They warned that excluding digital assets from the deal could leave Britain behind regions like Asia and the Middle East in shaping global financial standards, while highlighting stablecoins and tokenization as strategically important sectors. Read more →

Bitcoin Hash Rate & Difficulty Reach New Records as Miner Outflows Slow

Bitcoin’s hash rate surged to 1.12 billion TH/s and mining difficulty hit a record 136.04T, supported by miner behavior showing accumulation rather than selling. Experts believe this could foreshadow a strong price rally—especially with favorable macro conditions and increasing spot-ETF inflows. Read more →

Solana’s Alpenglow Upgrade Cleared First Hurdle — Could Boost Decentralization

Solana validators have approved the first major component of the Alpenglow upgrade, which aims to lower block latency drastically (from ~13 seconds to ~0.1 seconds) and reduce barriers for smaller validators. Proposed changes include lowering inflation and reducing fees, measures designed to spread validator revenue more equitably. Read more →

Experts Question Corporate L1s Like Tempo Over Decentralization Concerns

While corporate Layer-1 blockchains like Stripe & Paradigm’s Tempo and Circle’s Arc promise faster payments and more controlled infrastructure, many crypto natives view them as moving away from permissionless, open models. Critics warn of possible centralization, gatekeeper influence, and regulatory pressure undermining the ethos that traditional blockchains were built on. Read more →

Polymarket Integrates Chainlink Oracles to Improve Market Resolution

Prediction-market platform Polymarket has partnered with Chainlink to provide more reliable, tamper-resistant data feeds for its price-based markets on Polygon, aimed at reducing delays and manipulation. The integration uses Chainlink’s Data Streams and Automation tools for faster, automated settlement of objective markets. Read more →

Binance & Franklin Templeton Partner on Tokenization Projects

Binance has teamed up with Franklin Templeton to explore tokenizing securities and building digital asset products that combine Franklin Templeton’s expertise with Binance’s global trading infrastructure. Key goals include improving settlement efficiency, portfolio construction, and access to institutional-grade tokenized offerings. Read more →

DOJ Seeks to Seize ~$500K in USDT from Iran Drone Supplier

The U.S. Department of Justice has filed a civil forfeiture action to seize roughly $584,741 in USDT from an Iranian company that supplied navigation technology used in Shahed drones. The funds are reportedly stored in an unhosted crypto wallet, which raises questions about how the seizure will be enforced. Read more →

Tether Launches USAT, a U.S.-Regulated Stablecoin, Led by Bo Hines

Tether is creating a U.S.-focused stablecoin called USA₮ (USAT), aiming for full compliance with the newly enacted GENIUS Act; the plan includes issuing via Anchorage Digital and having Cantor Fitzgerald manage its reserves. Bo Hines, former White House crypto advisor, has been appointed CEO of this U.S. venture, with the token expected to launch by year-end. Read more →

Looping Makes Up ~30% of Ethereum DeFi Activity, Says Oracle Co-founder

According to internal data from Redstone, “looping” — borrowing against deposited assets and then re-deploying those borrowed assets — now represents about 30% of all DeFi activity on Ethereum. The strategy, which includes looping yield-bearing stablecoins and staked ETH, boosts exposure but also raises concerns about systemic risk from over-leverage. Read more →

Asia Express: Thai Crypto Hack Rumors & China Developer Turns to RWA Tokens

Thailand’s SEC is investigating unverified reports of a large crypto exchange hack that were shared via the “The BIG Secret” Facebook channel, involving documents of possible internal breaches; affected exchanges have denied that assets are compromised. Meanwhile, Chinese property developer Xinyuan is reviving its blockchain initiatives to explore RWA (Real-World Asset) tokenization, aiming to bring some real estate assets on-chain despite regulatory constraints. Read more →

University of Michigan Survey: Consumer Sentiment Falls Further in September

The latest University of Michigan “Surveys of Consumers” shows consumer sentiment dropped to 55.4 in early September (from 58.2 in August), and is down sharply year-over-year. Expectations about the economy, personal finances, and inflation took a hit, though views on durable goods buying improved slightly. Read more →

Gemini IPO Debut Values Exchange at ~$4.4 Billion

On its Nasdaq debut, Gemini’s stock opened at $37.01 per share—about 32% above its $28 IPO price—giving the firm a valuation of approximately $4.4 billion. The exchange raised $425 million in the IPO, which was significantly oversubscribed, and trades under the ticker symbol $GEMI. Read more →

Rate Today’s Edition

What do you think of today's edition?

Share this newsletter, claim your reward! 🎁

Participate in the On & Off Chain referral program by sharing the newsletter with your friends to claim your reward:

✌️2 referrals: A personal shoutout in On & Off Chain

Must be subscribed